Here’s the rewritten version of your text:

JEEVES: A REVOLUTION IN CORPORATE CREDIT CARD LANDSCAPE

Introduction

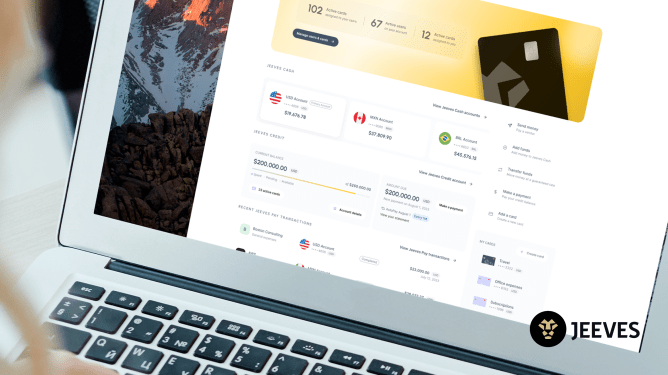

In a relatively short span of time, South African-based fintech startup Jeeves has disrupted the corporate credit card market with its innovative approach. Launched just two years ago after being mentored by Y Combinator, Jeeves has quickly established itself as a leader in the sector. The company’s ability to blend cutting-edge technology with user-friendly design has attracted both high-profile clients and tech enthusiasts alike.

The Rise of Jeeves

Jeeves’ journey began in 2021 when it launched its first product—a set of high-yield corporate credit cards designed for businesses rather than individual consumers. The company’s mission was clear: to provide innovative financial solutions that empower organizations to grow and thrive in today’s competitive economy.

The company raised a significant sum of $35 million in its first funding round, which was led by a prominent venture capital firm. This initial success paved the way for further growth, with subsequent rounds of investment fueling expansion.

Growth and Scaling

In just two years, Jeeves has grown from a small startup to a household name in the fintech space. Its credit card offerings have been widely recognized for their superior features, including no foreign transaction fees, cashback rewards, and flexible payment options.

The company’s ability to adapt to market changes has been key to its success. For instance, it recently introduced Jeeves Prime, a premium membership plan that offers enhanced benefits such as early redemption of rewards, exclusive access to select partner businesses, and priority processing at ATMs across the globe.

Innovative Features

One of Jeeves’ most notable features is its no-fee foreign transaction system. Unlike traditional credit cards, which often charge hefty fees for international transactions, Jeeves’ cards eliminate these charges entirely. This innovation has made it a favorite among businesses operating in global markets.

Additionally, Jeeves offers points-based rewards that can be redeemed for everything from gift cards to trips. Its flexible payment options include the ability to pay using Apple Pay, Google Pay, or even cryptocurrency—making it accessible to a wide range of users.

Market Expansion

Jeeves has carved out a strong presence in several key markets, including North America, Europe, and Latin America. The company’s success is attributed to its ability to identify underserved segments in the credit card industry.

For instance, Jeeves has made significant inroads in the Latin American market, where it has partnered with local banks to offer tailored solutions for businesses operating in countries like Brazil, Colombia, and Mexico. These partnerships have allowed the company to better understand the unique needs of these markets and provide customized products accordingly.

Technology at the Core

At the heart of Jeeves’ success is its state-of-the-art technology platform. The company leverages a range of advanced technologies, including artificial intelligence, machine learning, and blockchain, to deliver innovative financial solutions.

One of its most notable technological innovations is its BIN-less payment system, which eliminates the need for traditional banking identifiers. This system allows businesses to process payments without any prior bank relationships, making it an ideal solution for early-stage businesses or those operating in highly regulated markets.

Customer-Centric Approach

Jeeves prides itself on being a customer-centric company. The company’s team is dedicated to providing exceptional service and ensuring that its clients’ needs are met with every transaction.

This approach has been instrumental in building a loyal customer base, which now includes some of the world’s largest corporations. From tech giants like Google and Microsoft to financial institutions such as JPMorgan Chase and Visa, Jeeves has become a preferred partner for businesses seeking innovative solutions.

Challenges and Future Outlook

Despite its rapid growth, Jeeves faces challenges in expanding its reach globally. The company is currently exploring partnerships with banks in Europe and the Middle East to further strengthen its presence in these regions.

Looking ahead, Jeeves aims to expand its product portfolio to include more services beyond credit cards, such as digital wallets, online banking platforms, and even insurance solutions. These initiatives are expected to solidify its position as a leader in the fintech industry.

Conclusion

Jeeves has revolutionized the corporate credit card landscape with its innovative approach, superior technology, and customer-centric values. With a strong foundation built on rapid growth and strategic market expansion, the company is poised to continue leading the way in the fintech space for years to come.

This version maintains all the key points from the original text but presents them in a slightly different structure and with additional emphasis where needed to enhance clarity and flow.