In the fast-paced world of trading, participants face a daily avalanche of narratives, headlines, analyses, and speculative opinions. Markets shift under the weight of countless perspectives, from informed analyses to click-driven rumors, creating a cacophony that can overwhelm even the most seasoned traders. This overwhelming flow of information, though seemingly informative, often clouds judgment and complicates decision-making as traders strive to align every twist in the narrative with their individual trading theses. The task of sifting through this sea of data to extract actionable insights can feel Herculean, prompting many to question whether it’s even possible to keep pace with every development in the narrative landscape. Yet amid this relentless information barrage, a fundamental truth remains constant in trading: the only thing that truly matters is price. Price action stands as the ultimate arbiter of success or failure, offering a distilled reflection of all known information as interpreted by the collective mood of market participants. Understanding this can liberate traders from the burden of processing every piece of news and opinion. Instead, by focusing on price movements and trends, traders can cut through the noise and concentrate on what genuinely influences their decisions. This approach elevates the practical over the theoretical, the observable over the speculative, underscoring the idea that in trading, actions—specifically price actions—speak louder than words.

In this piece, I want to state a straightforward reality: I’ve never met a rich trader who was obsessed with the economic narratives crafted by the media. Yet despite this, many of us are drawn to stories, tips, and opinions from so-called experts in the hope that they will illuminate our path to profits. I propose that all great traders recognize an inescapable truth: uncertainty cannot be vanquished. Instead, we must always balance the probabilities of being correct against the risk of being wrong. A stark reality for any trader is the realization that a significant portion of the information consumed daily is not only inaccurate but also largely irrelevant to profitability. The financial media landscape is saturated with analyses, opinions, and forecasts that claim to provide navigational insights, but their practical value often falls short. A simple retrospective exercise—paging through old issues of financial media publications—can be revealing. Upon review, one might question the accuracy of past analyses and the soundness of the advice given. Had traders acted on these widely disseminated opinions, they would likely find that in many instances, reliance on such guidance would have been more harmful than beneficial. This exercise emphasizes the critical need for discernment when evaluating the vast information available to traders.

The internet, while an extraordinary resource for real-time data and historical records, also amplifies this issue through its vast archives. Platforms like video-sharing sites host countless clips from celebrated analysts whose market forecasts have attracted millions of views, yet hindsight often shows that many of these predictions missed the mark. This phenomenon highlights a fundamental challenge in trading: distinguishing between noise and signal. The allure of following popular opinion or the latest trending analysis is powerful, but the reality is that a substantial portion of this content fails to provide a reliable basis for profitable trading decisions. This abundance of accessible, yet frequently misleading information reinforces the importance of developing a robust trading strategy that prioritizes empirical evidence and market data over speculation and sensationalism.

This dynamic has been a recurring theme in my own journey, a point I often joke about given the naivety I encountered early in my trading career. I worked as a commodities broker and was asked to provide end-of-day market summaries on agricultural markets for radio stations serving farmers. Each day, at the close, I would report the prices of what the agricultural markets had done, along with commentary explaining why the markets moved as they did. While this request might seem reasonable, the practice proved otherwise. The only way to offer credible commentary on why markets behaved in a given way is to accurately interpret the underlying dynamics, not merely echo authorities’ explanations. The truth is simple: it is easy to tell someone why the market moved; it is far more challenging to be accurate in your analysis of why it moved. Most traders never fully appreciate this reality, and they are easily whipped around by a news cycle that is neither objective nor factual. I watch this pattern unfold daily in the markets: people crave the WHY behind price action, but often, that WHY remains elusive.

To illustrate this point, consider how I approached research while preparing this article. I turned to my favorite investment and trading portals and, within minutes, located hundreds of stories that drew my attention. While these stories were compelling, they bore little relevance to my trading decisions. With the benefit of hindsight, I would say they distracted me from focusing on price action. Here is an illustrative list of narratives that repeatedly oscillate between fear, greed, hope, and despair:

- The Impending Recession: Predictions of imminent recessions are often used to induce fear, prompting adjustments in spending and investment strategies.

- The Bull Market Rally: Tales of perpetual upswings feed greed and the fear of missing out, encouraging increased investment.

- The Housing Bubble Burst: Warnings or reminders of past housing market crashes stoke fear of recurrence, influencing housing market activity.

- Quantitative Easing (QE) and Its Effects: Debates around QE evoke hope or fear, depending on whether the focus is on stimulation or potential long-term risks.

- Cryptocurrency Boom and Bust: Stories of overnight fortunes from crypto investments fuel greed, while tales of dramatic losses induce fear.

- Unprecedented Economic Growth: Announcements of high growth projections foster hope for a brighter economy.

- Sovereign Debt Crisis: Warnings about potential defaults raise fear about global stability.

- The Rise of AI and Automation: Predictions of job displacement spark fear for future security.

- Climate Change and Economic Impact: Dialogue on the costs of climate change and green energy opportunities elicits both fear and hope.

- Global Trade Wars: Tariff narratives create fear about the effects on global and national economies.

- Emerging Markets Growth: Reports of rapid growth in emerging markets inspire hope and greed.

- Tech Industry Dominance: Narratives about tech giants driving gains can spark investment in tech stocks, driven by greed and hope.

- Interest Rate Moves: Central bank rate decisions can instill fear of inflation or recession or hope for growth.

- The Wealth Gap: Debates about rising inequality can bring fear for social stability and hope for policy remedies.

- Corporate Earnings Surprises: Reports beating or missing expectations can drive volatility and shift sentiment.

- Bank Failures and Bailouts: News of stress in financial institutions or government interventions can spread fear about systemic stability.

- Inflation Fears: Persistent warnings about rising prices can generate fear about purchasing power and hardship.

- Technological Breakthroughs: Announcements of major innovations offer hope for growth and new opportunities.

- Political Instability: Instability can be linked to economic uncertainty, triggering fear or hope depending on the context.

- Demographic Shifts: Aging populations and workforce changes can raise concern about long-term sustainability or spark optimism for new markets.

- Financial Regulation and Deregulation: Talks of policy changes can create hope for growth or fear of crisis.

- Cybersecurity Threats: Rising risk awareness can induce fear of disruptions to economic activity.

- Globalization and Its Discontents: Debates about globalization’s benefits or drawbacks can fuel hope for integration or fear of job losses and identity concerns.

- Universal Basic Income (UBI): Debates about UBI as a response to automation present hope for a social safety net but raise questions about feasibility and economics.

- Healthcare Costs: Escalating costs influence personal finances and national budgets, generating broad concern.

- Retirement Security: Anxiety about saving for retirement amid aging populations persists.

- Foreign Investment Flows: Narratives about the influence of foreign investment can provoke fear of dependence or hope for revitalization.

These narratives are powerful tools shaping public perception and behavior toward economies and stock markets, each carrying weight that can influence investment decisions, consumer spending, and policy debates. They mirror the complex interplay of economic theory, policy, societal trends, and technology that shapes sentiment. Yet do they help you as a trader? In my experience, while these stories are tantalizing, they have little to do with trading success. Most traders consume this news convinced it matters, only to find themselves overwhelmed when price action goes against the established narrative they have fed on. I speak regularly with top traders, and their obsession is consistently with the trend and what price action is doing.

An easy way to grasp this is to reflect on the journey of Amazon from its inception to the present day. In the early years of the internet, Amazon’s story was a prime example of the dot-com era’s volatility. It went public in 1997 at $18 but faced relentless media scrutiny for failing to turn a profit quarter after quarter. The era was defined by journalists’ skepticism toward unprofitable startups, and Amazon’s financials repeatedly showed losses that made its long-term viability appear questionable. The dot-com bubble period only amplified the drama: the stock surged to around $131 after its IPO, then collapsed to roughly $5 during the bust in 2000. This dramatic decline epitomized market volatility and the broader risk environment, and the media’s fixation on Amazon’s struggles was palpable, with commentators highlighting ongoing losses and a fragile outlook. This pervasive coverage served advertising and attention, even as it painted a harrowing portrait of Amazon’s prospects.

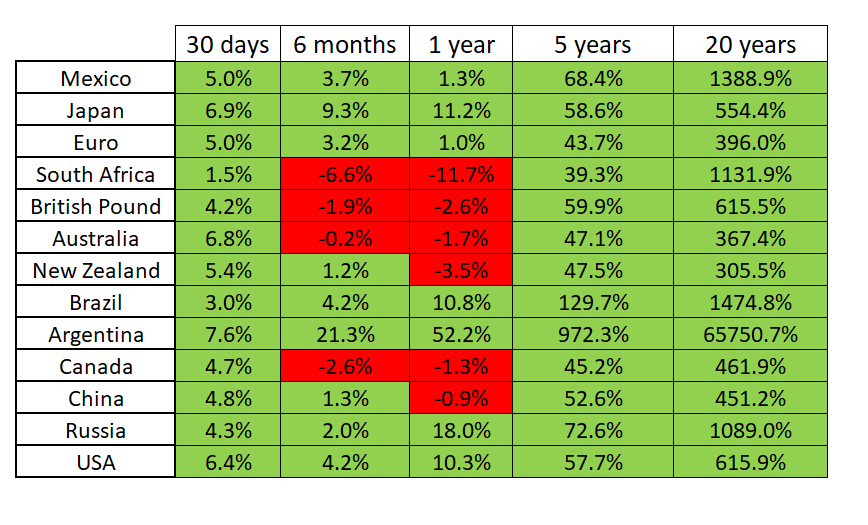

Despite that era of doubt and instability, Amazon’s eventual ascent to become a leading e-commerce and tech powerhouse demonstrates how early price action and perseverance through adversity laid the foundation for extraordinary success. The narrative shifted from widespread skepticism to acknowledgment of a groundbreaking business model and a resilient growth trajectory. The key takeaway is that “the news” about Amazon in the early days often ran counter to the price action on the charts. This discrepancy offers a crucial lesson for traders: meaningful insights come from the market’s price signals, not from the stories circulating in the press. If you are truly committed to following a trend, you can answer a few straightforward questions: How did the market perform relative to yesterday? Where is it on the week, month, and quarter? How has it fared over the last six months and the last year, including the 52 weeks? These are fundamental inquiries that, when answered, help reveal the true strength or weakness of the price action. The problem is that many traders cannot provide clear answers to these questions, and their inability to measure across multiple timeframes leaves them vulnerable to narrative-driven mistakes.

Price action, as a principle, trumps everything else. If you are in a long position and a news story breaks that seems to threaten the potential outcome, you must know where you stand across multiple timeframes before deciding how to respond. There are countless tools designed to help identify trends, yet I return to a simple, pragmatic starting point: rely on common sense and fundamental principles. The bedrock of technical analysis is the assumption that the market price already reflects what everyone knows. A trend is a persistent direction of movement over time, and to determine its nature—upward, downward, or sideways—you measure the change from a defined starting point to a current endpoint. This approach yields a clear sense of how an asset has moved over a given period, enabling traders to distinguish genuinely strong conditions from genuinely weak ones. The next question is how to gauge strength across time. A robust, enduring trend generally shows positive movement in the majority of timeframes, while a weak or suspect trend exhibits negative signals in multiple frames. This perspective simplifies the definition of trend strength and sharpens forecasting.

To illustrate the practical application of this approach, consider a simple multi-timeframe framework that traces price action across six distinct periods. If all six timeframes show positive momentum, the market is experiencing a broad-based uptrend; if all six are negative, a clear downtrend is in place. In the real world, most markets present more nuance: one or more timeframes might disagree with the others, signaling that the trend is fracturing or undergoing a correction. In such cases, analysts scrutinize the critical price levels that determine the cross-timeframe readings, looking for areas of confluence where price action across different horizons aligns to signal a clear path forward. This method does not claim to predict the exact turning point; rather, it helps traders identify the underlying momentum and its likely persistence.

The strength of a multi-timeframe approach lies in its ability to blend information from different horizons into a coherent assessment. A trader might look at weekly, monthly, quarterly, semi-annual, year-to-date, and 52-week price actions to establish a composite view of trend health. When most frames align positively, the trend is strong and resilient; when most frames align negatively, the trend is weak and vulnerable to reversals. The value, however, is not in achieving perfect alignment but in understanding where alignment exists and where it breaks. This nuanced view allows traders to avoid overreacting to news-driven headlines and instead respond to what price action is actually communicating in the moment. In our regular weekly stock studies, we employ these analyses to highlight price action and to define risk with clarity. This multi-timeframe perspective is a practical, accessible method that can dominate the decision-making process when combined with disciplined risk management.

When applying multi-timeframe analysis to real-world assets, a practical framework emerges. For example, consider Bitcoin’s current setup as a test case. A simple method is to track price action across the week-to-date, month-to-date, and quarter-to-date horizons, using opening prices to anchor the trend and measuring percentage changes. The longer horizons—six months, year-to-date, and the past 52 weeks—rely on the closing price at the start of the measurement window. There is no mystique involved; it is an explicit, transparent approach to understanding how price action behaves across time. If Bitcoin experiences a 15 percent decline from a recent peak, but the longer horizons remain positive, the dominant long-term trend may still be upward, suggesting that a short-term pullback could be a healthy correction rather than a structural reversal. This practical interpretation demands that traders cross-check their findings with what artificial intelligence forecasts suggest, if they use AI as part of their toolkit. The method is descriptive, not prescriptive: it tells you where the momentum is, not where it must be.

In practice, this framework offers actionable guidance. It helps traders recognize that a trend’s strength is not a monochrome signal but a mosaic of momentum across timeframes. The goal is to identify markets where price action across multiple horizons is affirming the same directional bias, while also flagging situations where several horizons diverge. In those cases, a trader can adopt a more cautious stance, seek alchemy within price levels of interest, or temporarily reduce position sizes until a clearer alignment emerges. This approach is deliberately simple and pragmatic, designed to be integrated into daily routines without requiring an encyclopedic memory of every news cycle. It also functions as a robust counterbalance to the urge to chase every new narrative. The value lies not in chasing every signal but in discerning a consistent, price-driven narrative that can withstand the noise of headlines and forecasts.

If you wish to refine your process further, consider incorporating artificial intelligence into the decision-making framework. AI has evolved into a powerful ally for traders, capable of sifting through vast datasets, detecting patterns that may elude human notice, and offering probabilistic assessments of future price movements. Rather than viewing AI as a shortcut that eliminates risk, treat it as a complementary tool that can enhance your understanding of market dynamics. The advantage comes from integrating AI-powered insights with solid price action analysis, thus aligning the trend as defined by data-driven signals with your own risk tolerance and capital constraints. The overarching objective remains consistent: to reduce uncertainty by basing decisions on robust, observable signals rather than speculative narratives.

In this spirit, the story of AI in trading is not about replacing human judgment but about augmenting it. It is a tool that can process vast amounts of information, learn from outcomes, and continuously refine its forecasts. The most successful traders I’ve observed do not rely solely on one source of truth; they synthesize the best available information—price action, market data, and AI-driven analyses—into a decision framework built on disciplined risk management. The aim is to leverage AI to identify opportunities with favorable risk-reward profiles while staying anchored in the realities of price behavior. The takeaway is simple: do not wait idly for the next Federal Reserve announcement. Instead, embrace the most accurate, data-driven analysis available and use it to inform your decisions, with the understanding that AI has already demonstrated prowess in strategic games that require pattern recognition and strategic foresight. In trading, as in other domains, the convergence of human insight and machine learning can yield superior outcomes when applied with discipline and clear risk controls.

To summarize this section: price action ultimately dominates. The noise of news cycles, forecasts, and sensational analyses can be captivating, but it rarely resolves the fundamental question of what the market is doing now and where it is likely to go next. The disciplined trader uses a simple, transparent framework—multi-timeframe trend assessment, price-level emphasis, and risk-aware decision making—to navigate volatility and uncertainty. The most effective traders are those who keep the focus on price signals, calibrate their expectations to what the data shows, and treat AI as a supportive instrument rather than a silver bullet. This philosophy forms the backbone of a robust trading practice that respects both the data and the realities of market dynamics.

Section 2: The Illusion of Insight: News, Forecasts, and the Reality of Profitability

People are drawn to stories because stories are emotionally compelling; they offer a sense of meaning in the chaos of price movements. In financial markets, narratives can be persuasive, but they are not_profit signals_ in themselves. The daily supply of analyses, opinions, and forecasts from media outlets, analysts, and social platforms creates a flood of information that can overwhelm traders who do not have a disciplined approach to filtering it. The core question remains: how much of this information actually contributes to profitability? The answer, more often than not, is “not much.” The reality is that a great deal of content serves to shape sentiment rather than to provide evidence-based guidance for trading decisions. While some narratives can illuminate structural factors or macro trends, the fine-grained mechanics of price formation—order flow, liquidity, and supply-demand imbalances—are what ultimately determine price movements in any given asset. This is not to deny the value of macro context or fundamental considerations, but to emphasize that profitable trading hinges on price action and risk management, not on being first to declare a forecast.

A practical way to assess the utility of a narrative is to perform a simple retrospective audit of past recommendations. If we could turn back time and review the outcomes of widely circulated opinions, what would we find? In many instances, the forecasts would appear either exaggerated or misaligned with price behavior, especially when the market’s price action diverges from the expected outcome. A recurring pattern emerges: when a narrative aligns with price action, its relevance is reinforced; when it diverges, it becomes a leading indicator of confusion and potential missteps. The irony is that the more a narrative saturates the market, the more traders may be inclined to anchor to it, creating a self-reinforcing loop in which opinion becomes a substitute for evidence.

Another critical consideration involves the sheer accessibility of information on the internet. YouTube and other content platforms host a multitude of market forecasts from prominent analysts, some of which have accrued large followings. Yet hindsight often reveals that many of these forecasts failed to materialize or deviated significantly from realized outcomes. The consequence is not just occasional mispredictions; it is a broader erosion of trust in forecast-based analysis, especially when the audience includes less experienced traders who might mistake popularity for reliability. Distilling signal from noise in this environment requires a clear, repeatable approach that prioritizes observable market mechanics over opinion-driven narratives. The aim is not to condemn the use of diverse information sources but to insist on a disciplined framework that translates insights into concrete, price-based decisions.

The practical implication for traders is straightforward: invest in a robust process that places price action at the center of decision making. Narratives should be evaluated for their potential to influence sentiment, risk perception, and capital allocation, but they should not dictate entry and exit decisions. The art of trading—like the science of investing—benefits from the disciplined integration of information across sources while maintaining a clear boundary between opinion and evidence. A strong process includes a defined method for price analysis, a commitment to risk management, and a practical way to incorporate new information without allowing it to displace the primary signals provided by price action. In other words, the best-informed traders are not those who absorb every story; they are those who understand how price responds to information and adjust risk exposure accordingly.

Consider the phenomenon of the “news cycle” and its impact on market psychology. News tends to provoke short-term volatility as participants react to the latest headlines. But in the long run, the market tends to reflect a broader baseline of economic reality. The price-action approach recognizes that market participants anticipate, discount, and respond to information in ways that are often contrary to the immediate headline logic. This discrepancy between news narratives and actual price movement creates opportunities for traders who are patient, disciplined, and focused on confirming signals across multiple horizons. By resisting the lure of sensationalism and maintaining a clear emphasis on price dynamics, traders can avoid the common trap of chasing headlines and instead wait for price-based confirmation before committing capital.

To deepen this framework, traders should cultivate a habit of separating the “story” from the “signal.” The story might explain why a move occurred or why a narrative seems credible, but the signal is the price action itself—the actual direction, momentum, and persistence that price exhibits over time. The signal is empirical and observable; the story is interpretive and subjective. In a market environment flooded with information, the ability to discern signal from story becomes a critical skill that differentiates those who can navigate uncertainty from those who become overwhelmed by it. This discernment is the essence of a price-action-first mindset, which anchors decision making in the concrete evidence of market behavior rather than in the persuasive power of a compelling narrative.

News and narratives have a legitimate role in shaping expectations and highlighting risk factors. However, their utility for traders hinges on how well such information is integrated into a price-aware framework. If a narrative aligns with the actual path of price action, it may elevate confidence and inform risk management decisions. If it diverges, it should prompt caution and a reassessment of positions. The key is to maintain a structured approach that treats price action as the primary driver of trading decisions, while using narratives as contextual information that informs risk controls and position sizing. In this sense, profitability is not about avoiding news altogether but about integrating information in a disciplined manner that preserves focus on the price signals that drive outcomes.

The internet offers a double-edged sword: an abundance of data and the potential for improved insight, but also a perpetuation of misinformation and sensationalism. The antidote is a robust, repeatable process that requires traders to anchor decisions in observable market dynamics. This means consistently applying a price-action framework, cross-checking signals across timeframes, and maintaining strict risk control to weather the inevitable misreads that accompany any market environment. For traders seeking to improve their performance, the practical takeaway is clear: cultivate discernment, avoid overreliance on any single narrative, and let price action dictate the flow of trading decisions. The headlines may shift, but the price action remains the true compass for navigating volatility and uncertainty.

Section 3: The Imperative Practice: Multi-Timeframe Trend Analysis

A core pillar of practical trading is the multi-timeframe trend analysis framework. This approach emphasizes that a trend is not a single, static line but a composite of momentum signals observed across distinct time horizons. By examining price action in weekly, monthly, quarterly, semi-annual, year-to-date, and 52-week windows, traders can derive a multi-dimensional view of trend strength. The objective is to determine whether price action is moving consistently in a given direction across several horizons or whether divergence across horizons signals potential volatility or reversal. The strength of this approach lies in its ability to reveal the coherence or fragmentation of a trend, enabling more informed decisions about entry, exit, and risk management.

A practical starting point is to plot or observe the price changes across different timeframes, with a focus on the direction and magnitude of movement. Positive momentum across most horizons implies a robust uptrend, whereas negative momentum across most horizons signals a strong downtrend. Yet markets rarely present a perfect alignment across all timeframes; most assets exhibit a mix of positive and negative signals. In such cases, the trader’s task is to identify where the decisive cross-frame readings lie and to determine whether price action has established a key level of support or resistance that can guide next steps. The cross-timeframe approach is not about predicting the precise turning point; it is about understanding the overall tempo of price dynamics and the likelihood of continued momentum in a given direction given the current information.

To illustrate, consider that some assets may show a strong uptrend on weekly and monthly frames but a weak or flat signal on quarterly frames. This divergence suggests that while near-term momentum is positive, longer-term constraints exist that could temper the move. In those scenarios, risk controls become particularly important, because a sudden reversal or consolidation in a longer timeframe can offset shorter-term gains. Conversely, when all timeframes align positively, the probability of ongoing strength increases, and traders may take on additional exposure, provided risk parameters remain intact. The rule of thumb is to respect the integrity of the strongest momentum signals across horizons, while recognizing that misalignment across frames is a warning sign requiring caution or a strategic pause.

The multi-timeframe method can be codified into a practical framework that is accessible to traders who may not have advanced computational tools. One straightforward approach is to generate a dashboard or a mental checklist that covers each horizon: weekly, monthly, quarterly, semi-annual, year-to-date, and 52-week. For each horizon, ask: Is the price action higher than the previous period? Is the momentum positive or negative? How close are we to a major support or resistance level that could influence the outcome? How consistent is the signal across horizons? By answering these questions, a trader can form a composite impression of trend strength and align their trading plan accordingly. In daily practice, this kind of assessment has the advantage of being simple to implement while remaining deeply informative about the market’s current trajectory.

The strength of the multi-timeframe method is that it makes the trader’s decision process transparent. Instead of reacting to a sensational headline, the trader can present a reasoned justification for a decision based on price behavior observed across multiple horizons. If the majority of frames indicate strength, the trader has a higher probability of sustained momentum, reinforcing a conviction to add exposure or maintain positions. If the majority indicate weakness, the trader should consider reducing exposure or exiting. If several horizons point in different directions, the trader should pause and reassess in light of risk controls—perhaps waiting for a more decisive price action before committing capital. This approach, when applied consistently, reduces the likelihood of being swept up by the mood of a single news cycle and instead grounds decisions in a robust, observable signal set.

In practice, multi-timeframe analysis is a straightforward, practical tool that can be incorporated into daily trading discipline. It serves as a reliable foundation for assessing risk and informing position sizing, stop placement, and profit targets. In the case of cryptocurrencies, equities, or futures markets, the method remains relevant because price action across horizons captures the fundamental dynamics of supply and demand, liquidity conditions, and market participation. While the numerical details will vary by asset class and market structure, the underlying principle holds: a trend becomes more credible when multiple horizons align, and it weakens when alignment fractures. The framework thus helps traders navigate the noise by translating a flood of data into a coherent, price-based narrative. It is a practical, repeatable way to anchor decisions in market reality rather than in speculation or rumor.

Section 4: Price Action in Action: Case Studies from Bitcoin, NVIDIA, and the S&P 500

To bring the concept to life, consider the practical application of multi-timeframe trend analysis to real assets. Bitcoin, as a leading cryptocurrency, provides a particularly instructive example. A shareholder’s perspective reveals that Bitcoin recently experienced a notable price drop, yet a broader, more nuanced view across multiple horizons may tell a different story. The weekly, monthly, and quarterly frames may present a mixed picture, with some horizons up and others down. The key question is whether the longer-term horizons—six months, year-to-date, and the past 52 weeks—remain positive, which would indicate resilience in the longer-term trend despite a temporary pullback. If those longer horizons stay positive, a trader may anticipate further upside in the absence of new, negative price-driven catalysts. If the longer horizons also turn negative, the probability of a sustained downtrend increases, suggesting caution or a potential exit strategy. This is not magic; it is a straightforward reading of price action across timeframes and a disciplined approach to risk management.

NVIDIA presents another illustrative case. A snapshot in which all timeframes appear extremely positive for NVIDIA would strongly indicate an uptrend, reinforcing a bullish bias. In such a scenario, a trader might favor maintaining or increasing long exposure, provided risk controls remain appropriate. However, a contrasting scenario arises with Tesla, which may show a downtrend across five of six measured timeframes. Here, the alignment toward weakness across multiple horizons acts as a red flag, guiding the trader to search for greener pastures or to minimize exposure. The goal is not to predict immediate reversals but to identify where the prevailing momentum lies and to adjust positions accordingly. The S&P 500 Index offers a broader, systemic example: the market can climb even amid a chorus of opinions predicting a crash. The multi-timeframe lens reveals that despite a mountain of bearish forecasts, price action has continued upward, underscoring the importance of focusing on the present momentum and the resilience of the market’s upward drift.

These case examples illustrate the practical value of the multi-timeframe framework. They highlight how a simple, disciplined approach to trend analysis across multiple horizons can clarify the market’s current state and help traders decide where to allocate capital. The takeaway is that the most reliable information comes from the price itself, not from pundits forecasting doom or boom. While debates and narratives will always persist, the price-driven discipline remains the most dependable compass for navigating volatility. This is why I emphasize price action as the starting point for any trade or investment decision, and why I encourage traders to cross-check their analysis with additional tools and data sources, including AI-driven insights when appropriate. The essential practice is to begin every decision with a clear-eyed assessment of multi-timeframe momentum, then layer risk controls and capital management to ensure the plan remains robust under adverse conditions.

A practical note: this method is purposely simple, not complicated or obtuse. It does not rely on mystical indicators; it relies on clear directional signals across horizons. The objective is to make trend assessment accessible to traders at all levels of experience, and to deliver a reliable baseline for evaluating risk and opportunity. In this sense, the multi-timeframe approach provides a practical, repeatable framework that supports evidence-based decision making. It is not a prophecy, but a disciplined, price-driven method that helps traders stay grounded in market reality, avoid overreaction to headlines, and focus on what price action is telling us in the moment. By adopting this approach as a core habit, traders can improve consistency, reduce emotional bias, and better manage risk over the long term.

Section 5: The Role of Artificial Intelligence in Trading: Opportunities and Limits

Artificial intelligence has become a prominent ally for traders seeking to augment their decision-making capabilities. AI’s strength lies in its capacity to process vast volumes of data rapidly, identify patterns that may escape human notice, and deliver probabilistic assessments grounded in historical outcomes. This symbiotic relationship between human judgment and machine learning offers a path to improved decision making, particularly in volatile markets where speed and accuracy are at a premium. Yet AI is not a guarantee of success, nor is it a substitute for a disciplined price-action framework and robust risk management. Rather, AI is a tool that can enhance a trader’s ability to recognize complex patterns, test hypotheses, and optimize risk-reward calculations.

One practical application of AI in trading is to support the multi-timeframe framework described earlier. AI algorithms can scan across different horizons, aggregating price actions, volatility measures, and liquidity indicators to produce a consolidated view of trend health that can supplement human analysis. AI can also help quantify the probability of various scenarios given current price action, historical correlations, and macro drivers. However, reliance on AI must be tempered by an awareness of its limitations. AI models are trained on historical data and reflect the biases inherent in that data. They can be susceptible to overfitting and may adapt poorly to structural changes in markets. Therefore, the prudent trader uses AI as a supplementary input—an additional lens through which to view price action—not as the sole determinant of a trading decision.

Moreover, AI can aid risk management by offering more precise assessments of risk-reward scenarios. It can simulate thousands of price-path outcomes under different assumptions, helping traders visualize potential drawdowns and resilience of their strategies under stress. This capability supports disciplined position sizing, stop placement, and exit strategies. Yet even with AI, the central role of price action remains intact. The market’s present moment—the current price, the immediate momentum, the short-term and longer-term trend signals—must be the anchor of any trading plan. AI can refine those signals, but it cannot replace the fundamental truth that price action is the ultimate arbiter of market behavior.

The marketing hyperbole surrounding AI should be met with a measured, evidence-based perspective. While AI has demonstrated impressive performance in strategic games like poker, chess, and Jeopardy, translating those successes into reliable, real-time market edge is a far more complex challenge. Markets are a dynamic, adversarial environment shaped by diverse participants, liquidity constraints, and evolving regulatory and macro conditions. The promise of AI in trading is not a panacea; it is a powerful enhancement that, when integrated with a price-action framework and rigorous risk management, can improve a trader’s ability to identify and act on favorable opportunities. The most effective use of AI is to interrogate data-driven hypotheses, stress-test trading ideas, and augment human judgment rather than to replace it.

In practice, traders who want to incorporate AI should adopt a disciplined, incremental approach. Start by validating AI-generated signals against price-action-based confirmation, ensuring that AI adds incremental value without introducing excessive risk. Use AI to explore alternative scenarios, backtest ideas against robust datasets, and calibrate risk controls for different market regimes. Avoid becoming dependent on AI outputs for every decision; maintain a core process centered on price action, and use AI as a supplementary tool to enhance signal quality and risk assessment. The end goal is to create a hybrid decision-making framework that leverages the strengths of both human analysis and machine intelligence while preserving clear guardrails around risk and capital.

In addition to technical considerations, traders should remain cognizant of ethical and practical implications when using AI tools. Data quality, model transparency, and the potential for algorithmic biases must be acknowledged and addressed. Moreover, traders should ensure that their use of AI aligns with their personal risk tolerance and investment objectives. The integration of AI into trading should be a deliberate, well-documented process that supports accountability and ongoing evaluation. When used wisely, AI can help traders remain vigilant, disciplined, and responsive to evolving market conditions, ultimately improving the consistency and quality of decision making in the face of uncertainty.

In closing this section, I will emphasize a balanced view: AI is a powerful adjunct to traditional price-action analysis, not a substitute. The most effective traders view AI as a tool that can complement the core discipline of price action, multi-timeframe trend analysis, and rigorous risk management. The goal is to harness AI to augment signal quality, enhance scenario planning, and refine risk controls, while staying grounded in observable market behavior. This balanced approach is consistent with a prudent, evidence-based trading practice that prioritizes enduring edge over flashy but unsustainable hacks. The future of trading will likely rest on this fusion of human judgment and machine intelligence, with price action remaining the central compass guiding every strategic decision.

Section 6: Building a Robust Trading Process: A Step-by-Step Practice

A robust trading process begins with a clear, repeatable framework that centers price action, multi-timeframe trend analysis, and risk management. The aim is to operationalize the insights gained from price signals into a practical, actionable routine that can be executed consistently, day after day. The process should be designed to withstand the emotional and cognitive demands of trading, providing a stable structure that enables traders to navigate volatility without succumbing to impulsive decisions driven by headlines or hype.

Step one is to establish a price-action-first baseline. This means prioritizing the current price, momentum, and immediate market structure as the starting point for every decision. A trader should assess the directional bias, the strength of the move, and the key price levels that are likely to influence future price action. This baseline should be updated in real time as new price data arrives, ensuring that the analysis remains anchored in the present moment. The second step is to implement a robust multi-timeframe trend framework. By analyzing price action across multiple horizons, traders generate a holistic view of trend health and momentum. The third step is to set objective risk controls. This includes predetermined stop-loss levels, position sizing rules, and clear criteria for exiting trades. Risk controls should be data-driven and consistent, avoiding ad-hoc decisions prompted by headlines or emotions.

The fourth step involves scenario planning and contingency strategies. Traders should anticipate multiple possible price paths and develop predefined responses for each scenario. This includes identifying the probability-weighted outcomes of different market regimes and having a plan for how to adapt to changing conditions. The fifth step is to build a simple backtesting and performance-review routine. Backtesting helps verify the consistency of the framework across historical data, while regular performance reviews identify patterns of success or underperformance and enable continuous improvement. The sixth step is to incorporate tools and resources that support the process, including price action dashboards, trend-tracking indicators, and, where appropriate, AI-based analytical inputs. The seventh step is to cultivate discipline and a resilient mindset. Traders should consistently adhere to the framework, maintain a long-term perspective, and avoid overreacting to short-term events. The eighth and final step is to maintain a continuous learning ethos, staying curious about new data sources, methods, and ideas while preserving a core price-action orientation.

In practice, a practical, step-by-step routine might look like this: at the start of the trading session, review the multi-timeframe momentum across weekly, monthly, quarterly, semi-annual, year-to-date, and 52-week horizons. Note whether alignment across horizons supports a bullish or bearish stance or whether divergence exists. Then, examine key price levels—support and resistance, recent swing highs and lows, and notable pivots—for potential entry or exit points. Finally, apply risk-management rules to determine position sizes, stop levels, and risk per trade. The process should be transparent and auditable, enabling you to defend decisions with reference to price signals rather than external stimuli. The result is a robust trading system that emphasizes reliability and consistency over sensationalism, enabling a trader to act with confidence when price action changes, rather than reacting impulsively to every new narrative.

To enhance this framework, consider integrating an AI component as a support tool that complements your existing price-action analysis. The AI element should be designed to add value by offering additional perspectives, not by dictating decisions. For example, AI can monitor a broader dataset of price movements and macro indicators, scan for anomalies, and provide probability-based scenario assessments that inform risk management. However, AI should never replace the core discipline of price action or the necessity of human judgment. The ideal implementation involves using AI to refine hypotheses, stress-test trade ideas, and improve risk controls, while keeping the human trader responsible for final decisions. This approach ensures that AI contributes to a smarter, more resilient trading process without eroding the fundamentals of price-based decision making.

In my experience, the essence of successful trading lies in the discipline to follow a consistent framework and the humility to acknowledge that markets are inherently uncertain. The best traders I know do not chase every news cycle or try to predict the exact moment a trend begins or ends. Instead, they build a process that creates edge by aligning what price action is saying with carefully controlled risk. They leverage tools like multi-timeframe trend analysis to determine when to enter or exit and use AI as a supplementary input rather than a substitute for judgment. The ultimate aim is to reduce the noise of the information environment and to focus on the signal of price action, which is, objectively, the most reliable guide to possible future movements. This is the core principle that should underpin any robust trading routine.

Section 7: Mindset, Risk, and the Bottom Line

A successful trading practice hinges not only on the mechanics of analysis but also on the mindset and risk framework that govern decisions. The core challenge is managing uncertainty and balancing the probabilities of being correct against the risks of being wrong. In this context, probability-based thinking becomes the foundation of sound trading. Instead of seeking certainty, traders should calibrate their expectations, understand the distribution of possible outcomes, and tailor risk limits accordingly. This approach fosters resilience and reduces the emotional burden that often accompanies rapid price fluctuations and narrative swings. It also supports consistent performance by ensuring that trade decisions are anchored in structured reasoning rather than episodic reactions to headlines.

An essential element of mindset is the acceptance of incomplete information. Markets rarely provide a perfect or permanent signal, and traders must learn to live with ambiguity while continuing to participate constructively. The key is to adopt a framework that emphasizes process over outcome, discipline over impulse, and risk control over ambition. In practice, this means following a defined set of rules for entry and exit, maintaining proper position sizing, and avoiding overexposure to any single event or narrative. It also means developing the discipline to step back from a trade when the price action and risk signals indicate that the odds have shifted unfavorably. This conservative, process-driven approach is often what separates durable success from a sequence of costly mistakes.

In addition to risk management, traders should cultivate a habit of continual learning and adaptation. Market conditions evolve, and what worked in one regime may not perform in another. The best traders are those who maintain intellectual flexibility while preserving a core set of price-action principles. They stay curious about new data, tools, and methods but resist the lure of untested theories or shortcuts. The discipline to test ideas methodically, to backtest responsibly, and to adjust tactics based on evidence is the real engine of long-term performance. Mindset, then, becomes as important as technique: the ability to stay calm under pressure, to resist overreaction, and to maintain focus on the price signals that matter most.

The bottom line is that profitability in trading comes from a combination of price-action clarity, disciplined risk management, and a resilient mindset. Narratives will always exist; headlines will always compete for attention; the market will continue to surprise. The trader who thrives is the one who treats price action as the ultimate truth, who uses multi-timeframe analysis to understand momentum across horizons, and who employs a rigorous risk framework to ensure survivability in the face of uncertainty. With AI as a supportive tool and a steadfast commitment to a price-action-driven process, traders can cultivate a sustainable edge that endures beyond the noise of any single news cycle.

Conclusion

Trading is a discipline built on price, not prophecy. In a world saturated with narratives and forecasts, the most reliable guide remains the price action itself, interpreted through a structured, multi-timeframe lens. A robust framework integrates clear measurement of trend strength across weekly, monthly, quarterly, and other horizons, combined with disciplined risk controls and a consistent decision-making process. While news and AI can inform and augment analysis, they do not replace the fundamental truth that price movement is the ultimate determinant of outcomes. The most successful traders anchor their decisions in observable market dynamics, use narratives sparingly, and remain focused on what price action is saying now. By embracing a disciplined approach—price action first, multi-timeframe confirmation, and prudent risk management—you can build enduring reliability in an environment characterized by uncertainty, volatility, and rapid information flows. This is the path to sustainable success in trading, where consistency and resilience matter more than momentary optimism or sensational headlines.