Building a disciplined stock watchlist is a foundational habit of successful traders that rarely gets the spotlight it deserves. Far from a casual jotting-down of ticker symbols, a true watchlist is a battle-tested framework designed to keep you laser-focused, in sync with the market’s rhythm, and prepared to act when the moment arrives. This article revisits the core ideas of how to construct and maintain such a list, why this approach matters, and how intelligent tools can transform watchlists from mere collections into strategic weapons. The goal is not to copy any single method but to help you discover a rhythm that fits your temperament and daily routine—one you can commit to every single trading day without hesitation.

The Philosophy Behind a Stock Watchlist

A watchlist, when done correctly, is more than a catalog of stocks. It serves as a mirror that reflects your trading philosophy, your purpose in the market, and, most critically, your intent in real time. If you start with the wrong premise, you’ll find yourself hampered before you place your first trade. That’s why the distinction between investors and traders matters deeply here. Investors often resemble farmers who plant seeds and wait for harvests years later, focusing on long-term metrics like dividends and valuation ratios. They are playing a different game, and that’s perfectly fine. Traders, however, operate in the now business. They hunt for actionable opportunities, and their watchlists must be built around signals of near-term movement, momentum, and turnover.

This difference is essential because a trader’s watchlist is not a passive repository; it is a dynamic instrument designed to identify opportunity quickly and efficiently. A well-constructed list signals where conviction is strongest, where the underlying catalysts are most active, and where risk-reward economics align with current market conditions. If you don’t set this intent from the outset, your process can devolve into indecision, hesitation, and second-guessing. The market’s tempo is unforgiving, and stock rotation happens with speed comparable to today’s social-media currents. In that environment, a current, purpose-driven watchlist helps you avoid guesswork and maintain a steady course.

Think of a trader’s watchlist as a weapon rather than a mere directory. It should be sharp, focused, and ready to deploy when momentum builds. The aim is not to chase every potential idea but to stay attached to a finite, high-probability set of names that you understand inside and out. The contrast with long-horizon investing is striking: where investors may tolerate slower, steadier progress and broader diversification, traders require precision and velocity. A properly tuned watchlist embodies this mindset, acting as a daily briefing that aligns your actions with observable market dynamics rather than speculative narratives.

Momentum and movement become the anchors of this approach. The kinds of metrics that matter shift from fundamentals and long-term projections to price action, volatility, and how stocks behave as they approach and pierce key technical levels. Volatility, far from being a risk to fear, becomes your oxygen—an environment in which skilled traders can extract opportunity if they have a disciplined plan and the right tools. In that sense, a watchlist is a mirror of your own risk tolerance, your time horizon, and your capacity to execute under pressure. When the list reflects a precise understanding of those factors, you gain the confidence to act decisively rather than hesitate at moments when the market is most alive.

A well-tuned watchlist also reveals a crucial truth about market dynamics: the market rarely moves in a random, all-encompassing fashion. Instead, it rotates through sectors, themes, and leadership cohorts that outperform the broader index. The watchlist then becomes a map that highlights where the money is flowing, where leadership is consolidating, and where the crowd’s attention is likely to coalesce next. For the discerning trader, that map is invaluable because it guides where to seek entries, how to measure risk, and when to scale in or out. In short, the watchlist is the trader’s strategic compass—an instrument that translates raw market data into actionable, repeatable decisions.

Tools, Edge, and the Predictive Advantage

Stock screeners are a familiar technology in every trader’s toolkit. They act as the pan and sieve that separate the obvious from the noise by filtering stocks through a set of criteria such as volume, float, RSI, sector heat, and other quantitative signals. This mechanism helps you move past “where should I look?” to “which stocks deserve closer attention right now?” By itself, a filter-driven approach provides a solid foundation, but it often leaves traders reacting to yesterday’s data rather than anticipating tomorrow’s momentum.

The real edge arises when screeners are paired with predictive analytics that look ahead, not just backward. Traditional screens tell you what happened; advanced systems attempt to forecast what is likely to happen next. That forward-looking capability is the essence of the advantage many professional traders seek. When the market is moving in a discernible pattern, a predictive engine helps you align your watchlist with the trajectory that is most likely to persist.

Within this space, a family of AI-powered tools has emerged to redefine how watchlists are built and used. For some traders, this means a specialized engine that processes thousands of permutations across technical indicators, intermarket relationships, and seasonal tendencies. The result is not a single “buy signal” but a curated sense of direction—the sort of guidance that helps you separate probable breakouts from false starts. In practice, this approach translates into a watchlist that not only contains names with rising momentum but also clearly signals which stocks are most likely to move in the near term.

This is where predictive neural networks come into play. Rather than simply reporting what happened, these systems emphasize what is likely to happen next. The aim is to illuminate the path of least resistance in the market, helping traders to anticipate shifts in leadership and to position themselves ahead of the crowd. The promise—when it works—is a measurable improvement in the speed and quality of decision-making. Traders who rely on such tools report that they can move from a reactive stance to a proactive one, allowing them to lock in gains earlier and reduce the impact of unexpected drawdowns.

Importantly, the edge that AI can provide in this context is not about removing human judgment. It’s about augmenting human decision-making with data-driven foresight. The best users combine their market experience with the AI’s directional read on sectors, stocks, and timing. They still perform due diligence, verify headline catalysts, and apply their own risk controls. The AI serves as a high-powered accelerator, compressing the time between recognizing an opportunity and acting on it, while also helping to avoid common cognitive biases that creep into quick judgments.

In practical terms, many traders engage with this technology through a system that includes an AI-driven screening layer, a curated set of leading securities within the top-performing sectors, and a process for updating the watchlist on a daily basis. The watchlist becomes not only a set of names to watch but a dynamic workflow that aligns your daily routine with the market’s most probable moves. This fusion of human strategy and machine-assisted forecasting is the core reason why some traders report clearer thinking, faster execution, and a more consistent approach to capturing momentum.

From Hoarding to Focus: Building a Lean, Actionable List

A common pitfall is a watchlist that grows like a garage full of unlabeled boxes: ticker after ticker piled high with little capacity to process or act on them. Such breadth without focus creates cognitive load, invites paralysis, and ultimately erodes edge. The antidote is a lean, highly curated list that concentrates on a handful of sectors and a handful of leading names within each sector. This disciplined approach yields a structure that’s easier to internalize, easier to monitor, and easier to execute against with confidence.

The first principle is to define the battlefield clearly. Rather than scattering attention across all corners of the market, you identify a few sectors where leadership is strongest and where momentum is robust. Within those sectors, you drill down to the top performers—stocks that are actively leading the charge and showing sustained, directional strength. By anchoring your watchlist in sector leadership and stock-level momentum, you position yourself to ride the waves where the money is already moving.

A lean watchlist also improves your ability to time entries and manage risk. When you are staring at a concise roster, you can drill into the chart patterns, price levels, and volatility characteristics of each name with greater depth. You can track how each stock responds to intraday moves, how it volatilizes during broader market shifts, and how it interacts with sector catalysts. This level of granular observation is far more practical for decision-making than a sprawling, unfocused list.

Another essential practice is to keep the watchlist updated with purpose. Market leadership can change quickly, and old leaders can fade into the background. The best traders routinely prune their lists, removing names that have deteriorated in momentum or that no longer fit the current market regime. They replace them with new contenders that meet the same stringent criteria for performance, liquidity, and responsiveness to catalysts. The result is a watchlist that remains both nimble and relevant, reflecting the market’s evolving leadership.

There is a strong psychological dimension to this discipline as well. A focused watchlist reduces cognitive friction, curtails overanalysis, and minimizes the temptation to chase “hot tips” or headlines that diverge from the list’s core logic. When every name on the list has a defined reason for inclusion and a clear plan for tracking, you gain a level of mental clarity that translates into faster, more decisive action. That clarity is a critical component of maintaining an edge in a fast-moving market.

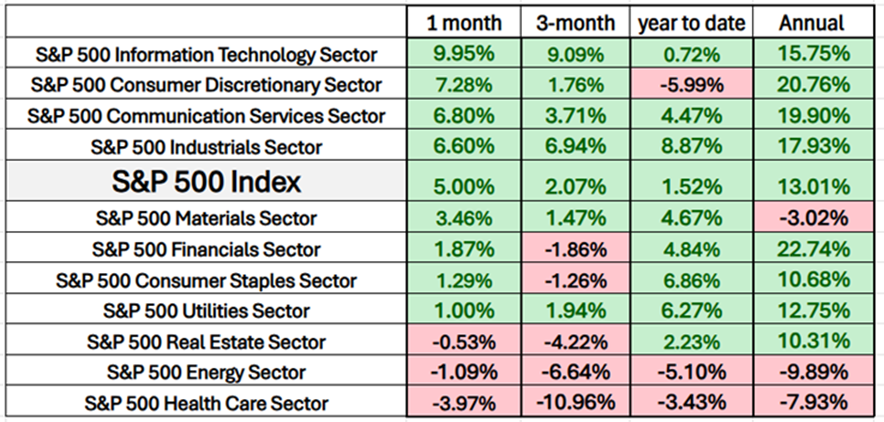

Seasoned traders also leverage sector-specific dynamics to refine their watchlists. By watching how leaders in Information Technology, Communications Services, Industrials, and other impactful sectors perform relative to the broader market, you can identify which stocks are most likely to extend their momentum. The practice of focusing within top-performing sectors helps you avoid dilution, ensuring that your watchlist remains aligned with the strongest underlying drivers of price movement. In other words, you externalize your bias toward momentum into a rigorous, data-backed selection process that can withstand the volatility of market noise.

Finally, a lean watchlist is not a static artifact. It is a living tool, constantly adapted as new data arrives. Each trading day is an opportunity to reassess, refine, and recalibrate. You can, for instance, monitor how newly released earnings, changes in leadership, or macro developments affect the stocks you’ve identified as leaders. The ability to incorporate fresh information without overreacting is a hallmark of a mature, disciplined approach to watchlisting. In this sense, the watchlist becomes a dynamic operating system for your trading decisions—one that preserves speed, accuracy, and adaptability in equal measure.

The Sector-First Approach: Outperformers, Momentum, and Relative Strength

A central theme in a robust watchlist-building process is prioritizing sectors that are already outperforming the broader market. Rather than chasing all corners of the market at once, the strategy focuses on where true money is flowing and where the strongest performers are emerging. This approach hinges on the insight that sector leadership often precursors broader market moves, and that relative strength within a sector provides a reliable signal for stock-specific opportunities.

To operationalize this approach, a trader begins by asking a straightforward question: Which sectors are currently outperforming the S&P 500? This question is not rhetorical; it creates a foundation for the day’s or week’s research. The logic is simple: if a sector is beating the index, stocks within that sector are more likely to experience continued upward momentum than the market at large. The trend is your friend, provided you confirm it with objective data and disciplined risk management.

The next step is to identify the stocks that are leading the charge within those outperforming sectors. By examining sector-based exchange-traded funds (ETFs) and their component stocks, you can assess which names are outperforming their peers and contributing to the sector’s overall strength. This method allows you to filter out weaker constituents and focus on the strongest performers whose price action aligns with the sector’s trajectory. In practice, this means looking for stocks that are not merely rising but doing so in sustained ways, with breakouts, breakout-like patterns, or continued uptrends that persist across multiple timeframes.

The emphasis on outperformers is not about chasing the past; it’s about anticipating future strength. Momentum is a key signal because it indicates buyers remain engaged and supply constraints are being managed by market participants who expect further upside. The relative strength of a stock against its sector and the market serves as a practical proxy for the probability of continued momentum. In a sector-driven environment, leadership clusters tend to shift in waves, so staying anchored to outperformers helps you ride the most probable moves rather than reacting to the noise of a broad market backdrop.

A practical execution pathway follows the sector-outperformance assessment with a stock-level filtration. Within each top-performing sector, you sift through the leading stocks to construct a watchlist that captures the most compelling momentum candidates. This is where the daily discipline comes into play: you track price action across timeframes, watch for how stocks respond to intraday swings, and evaluate whether the momentum is broad-based or reliant on a narrow subset of buyers. The best candidates exhibit a combination of price strength, liquidity, and a willingness to maintain directional momentum through minor pullbacks, which provides the trader with favorable odds for entry and exit.

The overall outcome of this process is a curated blend of sectors and names that align with a single overarching objective: to ride the wave of outperformance with a watchlist that’s perceptive, responsive, and practically actionable. When sectors move in a coherent, sector-wide updraft, it’s often not a coincidence. It’s the reflection of converging catalysts—technological innovation, consumer demand, global growth patterns, or policy shifts—that empower a group of stocks to perform well in tandem. The watchlist, tuned to these conditions, becomes an instrument to harness that collective strength rather than suffer from scattered opportunities.

The rationale for narrowing to the top four performing sectors—and, in most cases, concentrating on the top two—stems from the reality that the strongest ideas usually cluster in a narrow market regime. By focusing energy on these sectors, you avoid dispersing attention across too many ideas, which can dilute your decision-making and reduce the probability of timely entries. This concentrated approach is not about missing opportunities; it’s about ensuring you can depth-dive into the best opportunities, understand their catalysts, and manage risk with precision. The market rewards clarity of purpose and disciplined execution, and this sector-first methodology embodies that ethos in a practical format.

Step-by-step, the process unfolds as follows: Step one, determine which sectors are outperforming the S&P 500 and use that as the battlefield. Step two, within those sectors, identify the leading stocks that are advancing most strongly and add them to your watchlist. Step three, leverage AI-driven insights to gain forward-looking guidance on the most promising moves among the top performers. These steps create a coherent framework that organizes your research around momentum, sector leadership, and predictive signals, culminating in a watchlist that is both actionable and aligned with current market dynamics.

Within this framework, the goal is not to chase mirages or attempt to predict every twist in the market. Instead, it’s about recognizing where the market’s heat is concentrated and positioning yourself to participate in the most robust trends. Momentum in the strongest sectors is a reliable compass for future performance because it signals a broader flow of money and a sustained commitment by institutional players. The watchlist becomes a reflection of that momentum: a focused collection of stocks where price action and sector leadership converge to present high-probability opportunities.

The Process in Practice: Step-by-Step to a Live Watchlist

In practical terms, building a dynamic watchlist begins with a foundational assessment of sector performance. Start by asking a central question: Which sectors are outpacing the S&P 500 in the current environment? The answer to that question becomes the first filter, a filter that narrows the field to the sectors where leadership is strongest. Once you’ve identified these outperformers, the next move is to drill down into the individual stocks within those sectors to locate the ones driving the bulk of the momentum. This two-layer approach—starting with sectors, then moving to the top stocks within those sectors—creates a robust, scalable method for watchlist construction that can adapt as conditions evolve.

Step one, Sector Assessment: By analyzing recent performance data, you can categorize sectors by their relative strength. For example, Information Technology, Communications Services, and Industrials may emerge as leaders in a given period, each demonstrating a different facet of market strength—AI-driven demand, advertising and streaming momentum, and infrastructure-related activity, respectively. The aim is to identify where the heat is highest and where institutional appetite remains focused. This assessment is not a static snapshot; it is a living read on how market leadership shifts with new information and macro developments.

Step two, Stock Selection Within Leaders: After identifying the strongest sectors, you focus on the top-performing stocks within those sectors. A practical method is to examine sector-based ETFs to capture a snapshot of how individual stocks within the sector have performed. You then identify the leader stocks—those showing the clearest and most sustained momentum, liquidity, and price action. The selection criteria should emphasize stocks that are actively moving, breaking through key resistance levels, and demonstrating a willingness to consolidate or trend in the face of broader market fluctuations. The goal is to assemble a watchlist that’s not merely a list of rising prices, but a curated group of stocks whose day-to-day action reliably reflects the sector’s momentum.

Step three, AI-Guided Refinement: With a foundational list in place, the next step is to bring in predictive analytics to fine-tune the selection. This involves letting AI-driven insights point toward the top performers within the sectors and to the moments when entries might align with directional momentum. The process is not about surrendering control to machines; it’s about using data-driven intelligence to confirm and prioritize the best opportunities within the sectors that are already showing leadership. The AI layer helps you avoid late entries and helps you anticipate shifts that might otherwise be missed if you rely solely on conventional indicators.

Step four, Real-Time Review and Adjustment: The watchlist should be reviewed on a daily basis, with the understanding that market leadership can change quickly. A disciplined trader will prune stocks that lose momentum or diverge from the sector’s direction while adding new candidates that meet the same high standards for performance, liquidity, and responsiveness to catalysts. This ongoing review ensures that the list remains current and aligned with the market’s evolving structure rather than becoming a static archive of yesterday’s winners.

Step five, Execution-Ready Readiness: The ultimate aim is to transform the watchlist into an execution-ready briefing. For each name, maintain a concise but comprehensive snapshot that includes the stock’s recent momentum, key price levels, relative strength, and the catalysts expected to drive further movement. A well-structured format allows you to move quickly when a stock meets your predefined entry criteria, increasing the odds that you can ride the trend from the moment momentum compresses in your favor. When the list is clean, precise, and actively maintained, you reduce the friction that often causes hesitation in the heat of the moment.

The integration with AI-driven insights is the bridge between a traditional approach and a modern, predictive framework. By combining sector leadership analysis with machine learning-guided projections, you create a dual-layered confidence in potential trades. This combination helps you validate entries with a forward-looking perspective while grounding your decisions in concrete, observable market behavior. The result is a watchlist that not only lists potential opportunities but also provides a clear rationale for why those opportunities are expected to perform in the near term.

As an illustration of how this approach translates into live results, consider how top-performing sectors and their leading stocks can be organized into a practical watchlist. In the Information Technology sector, stocks such as Palantir Technologies, CrowdStrike Holdings, Seagate Technology, Verisign, and Super Micro Computer may emerge as leaders based on current momentum and technical setups. Within the Communications Services sector, leaders like Meta Platforms, Netflix, and T-Mobile United States often surface due to strong user engagement, monetization momentum, and sector-driven catalysts. In Industrials, leaders may include GE Aerospace and Boeing Co., where aerospace and defense-related momentum can create persistent move dynamics. While the exact roster will shift as markets evolve, the approach remains consistent: identify outperforming sectors, isolate the top performers within those sectors, and apply a forward-looking lens to refine the list.

The discipline behind Step 3—the integration of AI guidance—serves a critical function in maintaining a responsive watchlist. By applying predictive analysis to the trajectories of the top-performing stocks within the leading sectors, you gain an extra layer of confidence about which names are most likely to continue their momentum. The AI layer does not replace the trader’s judgment; it augments it by highlighting patterns and probabilities that might otherwise take longer to detect manually. In this sense, the watchlist becomes a living document that not only captures current momentum but also forecasts potential continuation, giving the trader a meaningful advantage in timing entries and exits.

One practical takeaway is that a watchlist should be treated as a constantly evolving war room rather than a static file. You should regularly reassess your positions, prune underperformers, and introduce new candidates that satisfy the same rigorous criteria. This process ensures you maintain a crisp focus on the strongest opportunities while avoiding the drag of clutter and indecision. The result is a watchlist that remains aligned with the market’s best-performing sectors and the stocks driving their momentum, with AI-enhanced insights supporting clear, confident decision-making.

Real-Time Signals, Top Performers, and AI-Assisted Signals

The practical value of an AI-augmented watchlist becomes evident when you observe it in action. The top-performing sectors paint a clear picture: when Information Technology shows a strong updraft, supported by AI-driven momentum signals, the stocks within that sector tend to outperform, especially when paired with a supportive macro and sentiment backdrop. The data points you monitor—price action, volume, volatility, and intermarket relationships—become the scaffolding for your trading plan, guiding you to the moments when a stock’s momentum is ready to accelerate.

For example, in the Information Technology sector, a set of high-conviction performers might appear as notable leaders: Palantir Technologies (PLTR), CrowdStrike Holdings (CRWD), Seagate Technology (STX), Verisign (VRSN), and Super Micro Computer (SMCI). Each name would be assessed not only on its day-to-day price movement but also on how it contributes to the sector’s broader momentum profile. The AI component would highlight which names are likely to extend their gains, and which might require caution or tighter risk controls. The pattern recognition capability of the AI system helps traders distinguish between durable uptrends and short-lived spikes, a distinction that can mean the difference between a winning trade and a missed opportunity.

In the Communications Services sector, prominent names might include Meta Platforms (META), Netflix (NFLX), and T-Mobile US (TMUS). These stocks often reflect strong user engagement, monetization improvements, and resilience to macro headwinds, making them prime candidates for watchlist inclusion when sector momentum is favorable. In Industrials, names such as GE Aerospace (GEA) and Boeing Co. (BA) may illustrate how defense, aerospace, and related infrastructure activity translate into meaningful price action. The core idea remains the same: identify leaders, confirm their momentum with both price action and AI predictions, and position your watchlist to capitalize on continuing strength rather than waiting for a top or a perfect entry.

The overarching objective is to build a watchlist that is not merely a snapshot of the market but a dynamic framework that integrates real-time momentum signals with forward-looking guidance. The AI-assisted approach aims to create a balance between reactiveness and anticipation, enabling you to act decisively when the edge appears while maintaining a rigorous risk-control discipline. When executed consistently, this combination of sector focus, leadership selection, and predictive insight can transform watchlist-building from a routine task into a strategic advantage.

The Reality of Volatility, Risk, and the Trader’s Edge

A central tenet of this approach is a willingness to embrace volatility as an opportunity rather than a threat. Top-performing stocks often exhibit rapid, high-velocity moves that can deliver substantial profits but also come with heightened risk. The reality is that many traders are drawn to safer, slower plays: “safety” and “boring” can seem appealing, but they rarely produce the kind of outsized gains that aggressive momentum strategies can deliver when managed properly. The seasoned trader understands that risk is inherent in any high-mquality momentum play and that the key to enduring success lies in disciplined risk management, precise entry timing, and the ability to adapt to shifting conditions.

In this context, a watchlist becomes a risk-management tool as much as an opportunities tool. By focusing on a concise set of sector leaders and carefully selected stocks within those sectors, a trader reduces exposure to less-likely winners and concentrates capital on the opportunities with the strongest signal strength and liquidity. The watchlist also serves as a daily reminder to calibrate risk controls—such as position sizing, stop placement, and profit targets—based on the current market regime and the volatility profile of the top candidates. The goal is to maintain an approach that is both aggressive enough to capture meaningful moves and conservative enough to protect capital during drawdowns or sharp market reversals.

The use of AI in this context addresses another common challenge: cognitive bias. Traders frequently fall into the trap of overconfidence in familiar patterns or the adrenaline rush of chasing stories. Predictive analytics can help counteract these tendencies by quantifying the likelihood of continuation moves and by highlighting scenarios that align with historical success patterns. While no system can guarantee profits, the combination of human judgment and AI-driven guidance can reduce the influence of fear, greed, and recency bias—factors that often erode edge.

Of course, it’s essential to acknowledge the important caveat that all trading involves risk. The relationship between watchlists, momentum, and profitability is probabilistic, not deterministic. Market conditions shift, leadership rotates, and even the strongest momentum stocks can encounter pullbacks or abrupt changes in sentiment. A robust watchlist strategy anticipates these realities by including risk-management rules, clear exit criteria, and a framework for evaluating performance over time. The discipline to revise and refine the watchlist, rather than cling to yesterday’s winners, is what ultimately separates sustainable traders from those who rely on luck or superficial storytelling.

In addition, education and continuous improvement remain foundational. Traders should seek to understand the mechanics of price action, how to interpret volume and volatility in different market environments, and how to interpret the signals produced by AI analytics. This ongoing learning helps you interpret AI outputs with greater nuance, refine your own heuristics, and tailor the watchlist to your unique risk tolerance and time horizon. The end result is not a rigid system but a flexible, robust framework that harmonizes human insight with machine-generated foresight.

Real-Time Signals, Training the Edge, and a Path to Mastery

The practical demonstration of this approach comes from watching live signals and studying how top performers respond to evolving conditions. At the onset of a trading session, a trader reviews the sector performance signals and identifies which sectors are currently leading the market. The emphasis is on the direction and acceleration of momentum rather than on any single day’s price action. This daily ritual creates a coherent starting point that anchors the watchlist in the strongest market dynamics.

Then, within those sectors, the trader examines the top performers’ charts. The focus is on stocks that are breaking out or continuing to push beyond established resistance levels, ideally accompanied by growing volume and favorable price action patterns. The AI-guided layer provides a forecast that complements the observed momentum, highlighting candidates with the highest probability of continued strength. The combination of real-time signals and predictive insights helps the trader prioritize entries, manage risk, and avoid chasing spikes that lack a durable foundation.

The watchlist’s exact composition will differ from one trader to another, reflecting individual preferences, risk appetite, and time commitments. However, the underlying principles remain consistent: prioritize sector leadership, select the strongest stocks within those sectors, and apply a forward-looking toolset to refine the list. The end product is a live watchlist that isn’t merely an inventory of names but a structured playbook for participating in the market’s most compelling moves.

In this framework, the top performers in a given period—such as a month—are not treated as sacred idols to be worshiped. Instead, they are evaluated as potential core holdings for future momentum. If a stock’s performance begins to degrade, it is pruned from the list; if a new stock emerges with a compelling momentum profile, it is added. The watchlist thus becomes a dynamic, living document that reflects how the market’s leadership evolves and how the trader’s edge adapts to shifting conditions. The most successful practitioners understand that staying with winners does not mean overinvesting or ignoring risk; rather, it means recognizing durable momentum, managing exposure, and knowing when to take profits or cut losses.

Another element of the approach is the explicit acceptance that not every day will be a victory. The market is a competitive arena where volatility can surge and fade in the blink of an eye. The best traders treat drawdowns as normal, expected parts of a longer journey, and they rely on a rigorous framework to minimize the impact of bad luck or misreads. A well-constructed watchlist supports this philosophy by ensuring that each decision is anchored in data, momentum, and a clear plan for trade management. In this way, the watchlist becomes a catalyst for disciplined execution rather than an impulsive reaction to headlines.

Finally, for readers who want to see this approach in action, there is an opportunity to deepen the understanding of AI-driven trading by attending a free online master class that demonstrates how predictive technology is used to spot tomorrow’s top stocks. The session showcases practical applications of AI in market analysis and provides a curated list of tickers that the AI actively monitors—high-probability trades drawn from the strongest sectors, assembled in a manner consistent with professional edge-building. The experience is designed to translate the theory of watchlists and AI-driven forecasting into a tangible, repeatable practice that traders can adopt to improve clarity, precision, and confidence in their daily trading routine.

Think of the master class as a doorway to a more systematic, data-informed approach to trading. It’s not about magic or hype; it’s about leveraging the same kind of machine learning and predictive analytics that large teams use, but in a way that individual traders can implement within their own workflows. The promise is straightforward: gain a clearer sense of where the smart money is flowing, understand why a particular stock is likely to move next, and build a watchlist that supports consistent, disciplined trading rather than haphazard speculation. The result is not merely improved performance but a more resilient and thoughtful trading practice that can adapt as markets evolve.

Conclusion

In the fast-moving world of trading, a well-crafted watchlist is not optional—it is essential. It represents the intersection of your trading philosophy, your risk discipline, and your ability to act decisively in the face of volatility. By focusing on sector leadership, honing a lean set of top performers, and leveraging AI-backed insights to anticipate momentum, you build a structured path to consistent edge. The watchlist becomes more than a list of names; it becomes a disciplined operating system for your trading day, guiding you through the noise toward clarity and execution.

The approach outlined here is not a one-size-fits-all blueprint. It is a framework that invites you to experiment, adapt, and refine until it fits your personal style and objectives. The key is to uphold the core principles: prioritize momentum and relative strength, maintain a lean and highly actionable roster, and use predictive analytics to sharpen decision-making without surrendering control to machines. In doing so, you empower yourself to ride the market’s strongest trends with confidence, rather than chasing every rumor or headline.

As you adopt this watchlist-centric approach, remember that the market’s edge is rarely found in grand theories alone. It resides in disciplined execution, continuous learning, and the humility to update your beliefs as real-world data unfolds. With a sharp watchlist, a clear process, and the assist of predictive analytics, you can transform your trading routine from reactive to proactive—standing ready to seize opportunities as they appear and to navigate volatility with assurance. The result is not merely the potential for better performance; it is the development of a practical, repeatable system that can sustain you through the market’s inevitable cycles.