Traders have long understood that price action is a reflection of how value is exchanged across currencies, not just the numeric figure in a single monetary unit. Before personal computers, analysis was a manual, labor-intensive process that required traders to continually update and revise charts as prices moved. Today’s tools allow for near-instantaneous charting with the click of a few buttons, transforming a once-daily task into a dynamic, real-time exercise. Yet despite this computational leap, one enduring challenge for every trader remains: how to interpret markets beyond the familiar lens of the U.S. dollar. The fundamental factors of monetary policy, currency issuance, and macroeconomic shifts can all impact asset prices in ways that are not immediately evident when viewed solely in dollars. In this article, we explore how pricing assets in diverse currencies can reveal underlying dynamics that are otherwise obscured, with a specific focus on gold. We will analyze whether price trends persist across a dozen international currencies and what these trends imply for investors seeking to protect purchasing power in a world of evolving monetary regimes. Through a comprehensive approach that combines long-term chart analysis, multi-currency performance, and visually intuitive heat maps, we aim to provide clarity on how gold behaves when priced in currencies beyond the U.S. dollar, and how modern tools—infused with artificial intelligence and machine learning—can guide smarter decision-making in volatile markets.

Global Currency-Based View of Gold Pricing

The central premise guiding this exploration is that price is a ratio of exchange. By examining gold priced in currencies other than the dollar, we can uncover how global monetary factors manifest in the asset’s value and how currency debasement or strength influences gold’s purchasing power. The twelve currencies chosen for this analysis provide a broad cross-section of economic conditions and monetary policies:

- Mexico (Mexican Peso)

- Japan (Japanese Yen)

- Eurozone (Euro)

- South Africa (South African Rand)

- United Kingdom (British Pound)

- Australia (Australian Dollar)

- New Zealand (New Zealand Dollar)

- Brazil (Brazilian Real)

- Argentina (Argentinian Peso)

- Canada (Canadian Dollar)

- China (Chinese Yuan)

- Russia (Russian Ruble)

This selection is deliberate: it encompasses major developed and emerging markets, each with distinct inflation trajectories, central bank mandates, and fiscal environments. By pricing gold in these currencies, we illuminate how different macroeconomic backdrops shape the asset’s trajectory and whether gold trends exhibit resilience or vulnerability under varying currency regimes. Across the currencies listed, we can observe how the same underlying asset responds to distinct monetary signals—how monetary expansion, interest rate expectations, and currency flows interact to mold gold’s path in international markets.

Each currency offers a unique lens on gold’s price behavior. For instance, a country grappling with high inflation and rapid money supply growth may experience more pronounced currency depreciation, which can, in turn, accentuate the domestic price of gold when measured in that currency. Conversely, currencies backed by tighter monetary policy or stronger external balances may exhibit more tempered movements, even when gold is rising against the dollar. In this broader framework, investors can ask important, policy-relevant questions: Is gold’s long-term upward trajectory a universal phenomenon across currencies, or does it exhibit currency-specific rhythms? Do currency debasement signals align with shifts in gold’s relative strength across different monetary regimes? And crucially, how should this understanding inform portfolio construction and risk management in a world where central banks pursue divergent paths?

To operationalize this inquiry, the analysis begins with long-term charts across each currency. The goal is to identify whether, independent of the U.S. dollar, gold demonstrates a robust upward trend over extended horizons. We then extend the inquiry to five distinct time frames—30 days, 6 months, 1 year, 5 years, and 20 years—to capture both short- and long-run dynamics. This multi-horizon approach helps reveal whether a consistent directional bias exists or whether cycles and regime shifts periodically override longer-term patterns. The expectation, grounded in historical behavior, is that the longer-term trend for gold remains upward across currencies, reflecting its role as a store of value and a hedge against currency debasement. However, the rate and tempo of that ascent can vary based on the currency’s own micro- and macroeconomic context, the trajectories of domestic inflation, and the interplay of global capital flows.

The practical objective of pricing gold in multiple currencies is twofold. First, it provides a more nuanced gauge of gold’s performance by exposing the relative strength or weakness of each currency. Second, it offers a framework for assessing risk across different market environments. If a currency is weakening due to structural issues—such as deteriorating fiscal positions, capital outflows, or worsening inflation—it can cast a longer horizon influence on gold priced in that currency, potentially altering the perceived risk-reward profile of gold within a diversified portfolio. In turn, investors can use these insights to calibrate currency exposure, hedging strategies, and timing considerations, thereby strengthening the resilience of their investment theses in the face of shifting monetary landscapes.

The six primary questions that guide this currency-based evaluation are simple in principle but powerful in implication: Do all currency-denominated views of gold exhibit a lasting uptrend over the long horizon, or do some currencies show divergence? For time frames of five years and longer, does the positive momentum of gold strengthen, weaken, or remain reversed when priced in different currencies? If the dollar’s value experiences a pronounced decline or inflationary surge, how quickly and to what extent does gold respond when priced in the affected currencies? Can any currency’s price chart reveal a counterintuitive signal—where gold declines in that currency even as it rises in another, implying selective demand or currency-driven shifts in gold’s perceived value? By addressing these questions with careful data and clear visualization, we can derive actionable insights for strategy development and risk management.

The analysis relies on the principle that long-run trends provide a baseline against which shorter-term deviations can be understood. If, across 12 currencies, gold maintains an upward path over the longest horizons, this reinforces the fundamental case for gold’s enduring value proposition in diversified portfolios. Yet, if certain currencies display flatter or more volatile trajectories, it highlights the importance of currency context in decision-making and reinforces the need to consider currency hedging or alternative exposure methods. While the external macro environment—domestic inflation, central bank policy shifts, geopolitical risk—inevitably influences each currency’s behavior, the overarching narrative remains consistent: gold, as a monetary metal with intrinsic properties, tends to preserve or enhance purchasing power relative to fiat currencies over extended periods. The multi-currency lens helps separate idiosyncratic currency risk from the asset’s core value proposition.

In the sections that follow, we will first present long-term charts for gold priced in each of the twelve currencies, offering a comprehensive visual basis for assessment. Then we will compute performance metrics across five time horizons to quantify relative strength and momentum. Finally, we will assemble the findings into a heat map that translates complex currency-adjusted performance into an intuitive, visual summary. The aim is not only to confirm or challenge common narratives about gold but also to provide a robust framework for interpreting price action in a global, multi-currency context. In doing so, we hope to equip readers with clearer insights into how currency dynamics shape gold’s trajectory and how to apply this understanding to more informed investment and trading decisions.

Gold priced in Mexican Pesos

Gold priced in Mexican pesos serves as a case study in how domestic monetary conditions can influence cross-border asset valuation. Mexico’s peso has experienced periods of depreciation and strength driven by shifts in U.S. dollar funding, domestic inflation expectations, and the country’s fiscal stance. When we examine gold priced in MXN, the chart tends to reflect both global gold demand and local macroeconomic factors that push the peso higher or lower. A sustained decline in the peso often coincides with a higher domestic price of gold in MXN terms, reflecting the currency’s weakened buying power and investors’ desire to preserve value through a tangible asset. Conversely, if the peso strengthens in response to favorable inflation metrics or improving fiscal outlook, the MXN price of gold may pause its ascent or even ease modestly, even as gold prices in other currencies rise.

From a long-run perspective, the MXN-denominated gold chart tends to align with broader global tendencies: an overarching upward drift over multi-decade horizons, punctuated by episodes of correction that align with risk-on or risk-off cycles, shifts in commodity pricing, and changes in capital flows. The 30-day window often captures the most immediate reactions to U.S. monetary policy signals, domestic economic data releases, and geopolitical headlines that influence risk sentiment. The 6-month and 1-year horizons reveal whether the price movement translates into persistent momentum or simply reflects short-term volatility. The 5-year and 20-year frames provide a more stable view, illustrating whether the long-run trend remains consistently positive and whether any currency-specific drag emerges. In MXN terms, currency depreciation tends to push gold prices higher, while peso strength can temper gains, though the global foundation of gold’s value usually supports a constructive trajectory over extended periods.

Gold priced in Japanese Yen

The Japanese yen, often influenced by the Bank of Japan’s policy stance, global risk appetites, and the pace of energy and goods inflation, offers another lens for interpreting gold’s relative strength. The yen’s movements can amplify or dampen the domestic price of gold when expressed in JPY, depending on whether the currency is weakening or strengthening against major counterparts. Historically, yen dynamics have been shaped by factors such as yields spreads, the BOJ’s guidance, and broader shifts in the Asian and global currency landscape. When we plot gold in yen terms, periods of yen depreciation typically push the yen price of gold higher, as the currency loses value and investors seek to hedge with a tangible store of wealth. Conversely, a stronger yen tends to restrain the yen-denominated price of gold, even if dollar-based gold is rising, because the local currency gains purchasing power and reduces the required yen price to hold the same dollar value.

Over the long horizon, the yen-denominated gold chart tends to show resilience, with long-term uptrends aligning with the concept of gold as a hedge against currency depreciation and inflation. The multi-timeframe analysis—30 days to 20 years—allows us to observe how short-term risk-based moves interact with longer-term monetary themes. In the 5-year view, the direction and slope of the gold-in-USD trend often translate into corresponding movements in JPY terms, albeit with currency-specific lag and amplitude. The 20-year view highlights deeper structural shifts, such as Japan’s demographic aging, persistent deflationary or low-inflation environment, and the impact of global commodity cycles. By tracking gold priced in yen, readers gain insight into how a major Asian economy, with a currency that frequently serves as a funding currency, participates in the global gold narrative and how that participation differs from dollar-centered analysis.

Gold priced in Euro

Pricing gold in euros reveals how the single-currency zone’s monetary framework and cross-border financial integration influence gold’s international valuation. The euro area’s price of gold is shaped by the European Central Bank’s policies, euro area inflation dynamics, and the diverse economic conditions of member states. Because the euro functions as a common currency across multiple economies, euro-denominated gold often reflects a broader, aggregate assessment of currency strength and monetary credibility. When the euro strengthens, the euro price of gold can soften, assuming dollar-based gold remains steady or rises, while a weaker euro tends to support higher euro-denominated gold prices, all else equal.

From a long-run standpoint, euro-denominated gold tends to align with a global upward bias associated with gold’s role as a currency hedge and store of wealth. However, the euro itself experiences periodic fluctuations driven by macroeconomic stress tests, sovereign debt concerns, and policy responses from the ECB. Across the 30-day and 6-month frames, the euro’s volatility can contribute to short-term deviations in gold’s euro price, even as the longer-term trend remains positive. The 5-year and 20-year horizons capture how structural euro-area developments—such as inflation Persistence, balance sheet normalization, and cross-country economic divergence—shape the pace and magnitude of euro-priced gold movements. Examining gold in euros helps separate currency-structure effects from the global demand for gold, clarifying how Europe’s monetary path interacts with gold’s intrinsic appeal as a depreciating-currency hedge.

Gold priced in South African Rand

South Africa’s rand has a reputation for sensitivity to global commodity cycles, domestic political and fiscal developments, and shifts in risk sentiment. When gold is priced in ZAR, the local currency’s performance can accentuate or dampen gold’s price fluctuations in the domestic market. A weakness in the rand often translates into higher rand-denominated gold prices, as the currency’s depreciation raises the local cost of imported goods and adds a premium for precious metals. Conversely, rand strength tends to moderate the rand price of gold, potentially softening gains if the currency remains firm even as dollar gold rises.

In the long run, rand-denominated gold tends to reflect South Africa’s currency-specific dynamics while still generally following the global upward trend in gold over extended horizons. The 30-day period frequently captures reactions to global risk sentiment and commodity-sector moves, while the 6-month and 1-year views can reveal how currency-specific shocks—such as changes in commodity prices, mining-sector news, or domestic macro data—modulate gold’s price path. The 5-year and 20-year charts emphasize how structural factors within South Africa—like inflation trends, fiscal policy, and currency reserves—interact with gold’s global demand to shape the dwelling price across time. Analyzing gold in rand terms therefore highlights how currency exposure within a commodity-rich economy can influence investment outcomes and risk management considerations.

Gold priced in British Pounds

The British pound responds to a wide array of macro forces, including domestic policy trajectories, energy prices, and the stance of the Bank of England. When investors look at gold priced in pounds, they observe how sterling’s strength or weakness translates into the domestic cost of gold for UK savers and institutions. A stronger pound may temper the pound price of gold even if global demand is rising, while a weaker pound can amplify gilded gains. The pound’s sensitivity to Brexit-era dynamics, post-Brexit policy shifts, and international currency flows adds a distinctive texture to the UK’s gold pricing narrative.

In long-term terms, pounds-denominated gold often tracks the global upward trend, albeit with currency-specific volatility that reflects UK macro conditions. The 30-day and 6-month horizons can reveal more pronounced reactions to central bank commentary, energy price shocks, and geopolitical developments that influence risk appetite within currency markets. Across 5-year and 20-year spans, the interaction between sterling’s monetary stance and gold’s binding role as a store of value tends to generate meaningful divergence or convergence patterns relative to other currencies. By comparing pound-priced gold with other currency baselines, investors can assess relative performance and identify potential hedging or diversification opportunities that align with their strategic objectives.

Gold priced in Australian Dollars

Australia’s dollar is closely tied to commodity cycles, China’s demand for resources, and local inflation dynamics. Gold priced in Australian dollars therefore provides a lens on how an economy that is itself a major commodity producer interacts with gold as a hedge and as a financial asset. When the AUD strengthens, it can compress the AUD price of gold, and when AUD weakens, it can push the price higher, all else equal. The AUD’s sensitivity to global growth expectations, especially in Asia, can create distinctive short- to mid-term patterns in the price of gold in AUD terms.

Over longer horizons, AUD-denominated gold often follows the global uptrend, but the rate of appreciation and the duration of pullbacks can diverge from other currencies due to local demand-supply dynamics and mining-sector considerations. The 30-day window tends to capture immediate reactions to shifts in risk sentiment and commodity prices, while the 6-month and 1-year periods reveal whether AUD-priced gold maintains momentum or experiences pullbacks triggered by domestic policy signals or international trade developments. The 5-year and 20-year charts provide insight into structural factors—such as population growth, housing demand, and the persistence of inflation—that can shape gold’s price path in Australia’s currency environment. Analyzing gold priced in AUD adds an additional layer to understanding global gold dynamics and the role of resource-rich economies in global hedging strategies.

Gold priced in New Zealand Dollars

New Zealand’s dollar shares similarities with the Australian dollar in its exposure to commodity markets and global risk sentiment, but its currency dynamics are also influenced by domestic policy, dairy and agricultural sectors, and relative monetary stance. Gold priced in NZD reflects how these domestic influences interact with gold’s status as a hedge and store of value. A stronger NZD can soften the NZD price of gold, while a weaker NZD can amplify gains, especially during episodes of global monetary tightening or inflation surprises that affect currency valuations.

The long-run trajectory of NZD-denominated gold often mirrors the broader upward trend, but the pace and volatility can be shaped by New Zealand’s own macro policy framework and external demand conditions. The 30-day and 6-month periods are particularly sensitive to global risk-on/risk-off shifts and commodity price swings, whereas the 5-year and 20-year horizons provide a more stable picture of how currency-specific factors interact with gold’s fundamental appeal. By examining NZD-priced gold, readers gain further insight into how small, open economies influence the global narrative around precious metals and how currency exposure can alter investment outcomes in diversified portfolios.

Gold priced in Brazilian Real

The Brazilian Real embodies a currency with a history of pronounced volatility, driven by commodity dependence, fiscal policy considerations, and shifting risk appetites in emerging markets. When gold is priced in BRL, the domestic price is particularly responsive to capital flows and risk sentiment in Latin America, as well as changes in Brazil’s inflation trajectory and interest rate expectations. A depreciation of the real tends to push the BRL price of gold higher, signaling a hedge against currency erosion. Conversely, a stronger real can temper gold’s BRL price, even if global gold remains firm.

Over extended horizons, BRL-denominated gold often reveals episodes where currency instability and inflation expectations amplify gold’s appeal as a store of value. The 30-day window captures the immediate response to domestic policy and external shocks, while the 6-month and 1-year horizons illustrate how currency cycles and commodity cycles interact with gold’s global trend. The 5-year and 20-year analyses emphasize how Brazil’s macroeconomic trajectory—fiscal discipline, monetary policy, and external debt dynamics—interact with global demand for gold to shape long-run outcomes. Analyzing gold in BRL terms helps illustrate how currency risk in a large emerging market can influence hedging strategies and portfolio diversification.

Gold priced in Argentinian Pesos

Argentinian peso-denominated gold offers a particularly instructive look at how hyperinflationary or high-inflation environments influence the domestic valuation of gold. Argentina’s currency has undergone dramatic fluctuations, and gold priced in ARS reflects how investors use tangible assets to preserve purchasing power amid monetary instability. The ARS price of gold tends to be highly reactive to local inflation metrics, policy announcements, and investor sentiment toward safe-haven assets.

In the long term, ARS-priced gold may show pronounced volatility, but historical patterns suggest that gold remains a meaningful hedge, particularly when inflation accelerates or currency confidence weakens. The 30-day and 6-month periods can display sharp shifts tied to policy surprises or macro news, while the 1-year, 5-year, and 20-year horizons illuminate whether the domestic currency’s volatility translates into a durable upward path for gold in ARS terms. Understanding gold’s behavior in Argentinian pesos provides a stark example of how currency instability can magnify the perceived value of gold as a store of wealth and a risk mitigation tool.

Gold priced in Canadian Dollars

Canada’s dollar, backed by a solid fiscal position and a resource-intensive economy, presents another dimension for gold’s domestic valuation. When priced in CAD, gold’s movement reflects not only global demand for the metal but also Canada’s own inflation trajectory, energy prices, and the monetary policy stance of the Bank of Canada. A stronger CAD can restrain the CAD price of gold, while a weaker CAD tends to push the CAD price higher, particularly during periods of global monetary easing or inflationary pressures that erode currency value.

Across the long run, CAD-denominated gold typically aligns with the global upward trend in gold, but currency-specific cycles can introduce varying degrees of amplitude and timing. The 30-day horizon is often sensitive to market expectations about the BoC’s policy path and the near-term currency moves, while the 6-month and 1-year horizons reveal whether domestic economic momentum reinforces or diverges from the broader gold narrative. The 5-year and 20-year analyses highlight structural elements—such as Canada’s commodity exposure and monetary normalization—that influence gold’s price behavior in Canadian dollars. Studying CAD-priced gold enriches understanding of how stable, resource-rich economies contribute to the global mosaic of gold investment and hedging.

Gold priced in Chinese Yuan

The Chinese yuan, given China’s central role in global production, trade, and capital flows, offers a critical perspective on gold pricing in a currency with unique policy influences and structural controls. Gold priced in CNY captures the interaction between domestic monetary policy, foreign exchange interventions, and the evolving role of gold within China’s financial system. When the yuan is strong or relatively stable, the yuan price of gold may show tempered gains, but if currency policy shifts or inflationary pressures mount, the CNY price of gold can accelerate as investors seek safety and diversification.

Over extended horizons, yuan-denominated gold tends to corroborate the overarching global trend while reflecting China’s domestic policy stance and its impact on currency value. The 30-day period often reacts to official communications or data that signal the direction of the yuan’s path, whereas the 6-month to 20-year horizons reveal deeper structural influences—such as China’s monetary reforms, exchange rate regime changes, and shifts in domestic demand for gold and jewelry. Analyzing gold priced in yuan underscores how one of the world’s largest economies influences the global demand for precious metals and how currency considerations shape investment choices.

Gold priced in Russian Ruble

The Russian ruble, shaped by sanctions, commodity cycles, and energy dynamics, provides a vivid illustration of how geopolitical risk intersects with currency valuation and precious metals. Gold priced in rubles tends to reflect not only global gold demand but also the currency’s response to external shocks and domestic policy. A ruble depreciation typically raises the ruble price of gold, consistent with the hedging appeal of gold in times of currency stress, while a ruble appreciation can moderate domestic gold prices even if dollar-denominated gold remains robust.

In long-run terms, ruble-denominated gold can display resilience, but currency volatility and external policy developments can create more pronounced short- and medium-term swings relative to other currencies. The 30-day and 6-month windows are particularly sensitive to geopolitical news and shifts in energy markets, while the 1-year, 5-year, and 20-year horizons reveal how Russia’s macroeconomic trajectory interacts with global gold dynamics. The ruble’s role within the broader currency mosaic highlights how political and structural factors can influence currency-adjusted gold performance and investor behavior in regional markets.

Across these twelve currencies, several consistent observations emerge. First, over the long term, the overarching trend for gold remains upward, regardless of whether it is priced in dollars or in a broad set of international currencies. Second, for five-year or longer holding periods, the trend generally remains positive across most currencies, underscoring gold’s potential as a long-horizon hedge against monetary debasement and currency risk. Third, even if gold is purchased at a moment of currency peak strength, historical patterns suggest that, typically within five to eight years, the uptrend resumes, though the pace and timing can vary by currency. As the analysis progressed, these observations led to a broader conclusion: regardless of how you price gold, each chart reveals a slightly different rhythm of currency debasement, offering a nuanced view of value preservation across the global monetary landscape.

A qualitative note on the broader narrative: gold is often criticized as a barbarous relic or a non-interest-bearing asset. Yet, the charts demonstrate that its primary function has long been to maintain purchasing power. If you trace price history, gold’s drift from a modest $35 per ounce in the 1970s to around $1,900 per ounce today captures a dramatic differential, illustrating why physical gold and financial representations of gold have persisted as hedges against currency erosion. The data and the accompanying visualizations, including cross-currency price charts and the heat map described later, make this argument tangible and accessible. They show that even amidst currency headwinds, the green areas in a heat map—signaling favorable performance—often outnumber the red, underscoring gold’s resilience as a universal store of value.

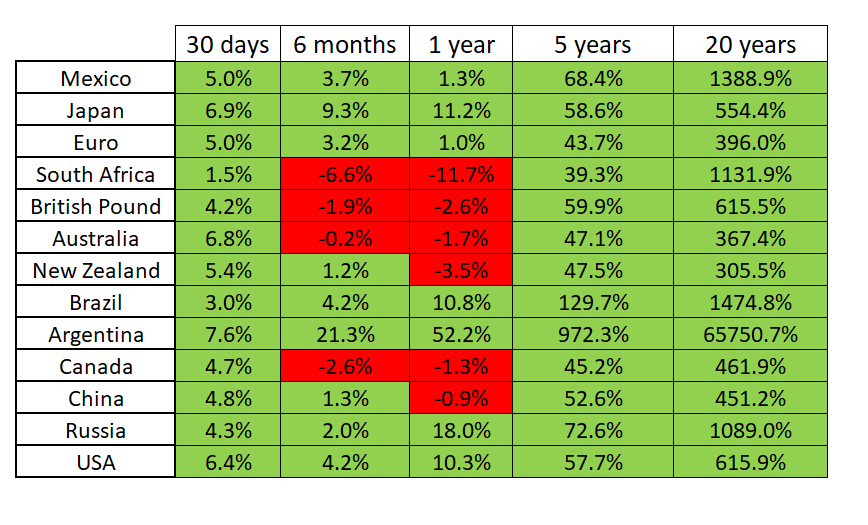

The heat map and its meaning

From the currency-based charts, a heat map emerges as a powerful distilled representation of multi-currency performance. A heat map translates complex, multi-dimensional data into a compact, visually digestible format. It allows traders and analysts to isolate trends quickly and identify problem areas that warrant deeper research. In this analysis, the heat map aggregates the performance of gold across the twelve currencies and across time horizons, providing a snapshot of where gold stands relative to currency-driven demand and supply dynamics. The heat map serves as a practical tool for spotting relative strength and weakness across currencies, helping to prioritize where to focus due diligence, risk assessment, and strategy development.

When interpreting the heat map, the color coding typically highlights green as positive performance and red as weaker performance. The distribution of colors—particularly the balance between green and red—offers an immediate sense of whether gold pricing is consistently robust across currencies or whether certain currencies exhibit stronger pullbacks. In the presented data, the largest negative returns tend to be small in magnitude when compared with overall positive performance, suggesting a predominance of favorable momentum for gold when observed across a diversified currency basket. While individual quadrants can vary by period and currency, the visual trend often emphasizes the resilience of gold and its role in preserving value in the face of currency debasement pressures.

Macro analysts frequently apply this type of currency-aware analysis to asset classes beyond precious metals, including commodities, real estate, equities, cryptocurrencies, and fixed income. The challenge, of course, lies in the time and resources required to gather, harmonize, and present such data in a way that is both accurate and actionable. Heat maps excel in fulfilling this need by reducing cognitive load while preserving essential information about cross-currency performance. They enable portfolio managers, traders, and researchers to communicate insights efficiently and to articulate strategic implications with greater clarity. In today’s environment of expansive government spending and rapid policy shifts, this approach to analysis becomes especially valuable for protecting portfolios and guiding risk management decisions.

What comes next: turning data into decisions

The practical takeaway from currency-based gold analysis is twofold. First, the approach equips investors with a more nuanced understanding of how gold behaves across a spectrum of monetary contexts, supporting more informed hedging and diversification strategies. Second, it highlights the importance of robust data processing capabilities and visualization tools that turn raw numbers into actionable intelligence. The effort to harvest, organize, and present cross-currency data is non-trivial; it requires careful consideration of data quality, time alignment, currency conversion conventions, and methodological transparency. Yet the payoff is substantial: traders can identify robust opportunities and shield themselves from hidden currency risks that may undermine otherwise sound investment theses.

The heat map and the underlying multi-currency framework also foster a more disciplined approach to portfolio construction. By distinguishing currency-driven effects from asset-driven fundamentals, investors can design strategies that balance exposure to gold with currency hedges, inflation expectations, and macroeconomic scenarios. The approach is not a forecast guarantee but a structured method for understanding and managing risk in a complex, global market environment. As macro conditions evolve and new data emerge, the currency-based perspective on gold provides a flexible analytical lens that complements traditional price-and-volume analysis.

The Role of Artificial Intelligence in Trading Decisions

Beyond visual analytics and multi-currency analysis, another transformative element in modern trading is the application of artificial intelligence (AI), machine learning, and neural networks to forecast price movements and guide actionable decisions. The central idea behind AI-driven trading platforms is to extract subtler patterns from vast, interconnected data streams—patterns that human analysts might overlook due to cognitive limits or information overload. This section delves into how AI, and specifically a predictive indicator known as the blue line, operates within a sophisticated trading framework to help traders identify opportunities and manage risk more effectively.

At the heart of this approach is what we refer to as the predictive blue line. This line is a daily computed indicator that analyzes a combination of key price drivers, their statistical correlations, and the asset’s historical price behavior to forecast a directional trend. The rules of interpretation are straightforward yet powerful. The slope of the predictive blue line signals the medium-term trend. A rising slope suggests an uptrend and potential buying opportunities as momentum builds. A sideways slope indicates a consolidation phase where prices are likely to move within a range and where breakout strategies may be less favorable. A falling slope warns of potential price declines and points to selling or shorting opportunities as momentum shifts downward.

To illustrate how this tool can inform trading decisions, consider a chart of gold priced in U.S. dollars over the past six months. Observing the predictive blue line alongside actual price bars provides a dynamic view of when the market’s momentum was shifting. If the blue line’s slope started moving higher, and price followed suit, that alignment would bolster confidence in a continuing up move and could encourage a trader to long or add to positions. If the slope began to tilt downward, traders might anticipate lower prices and look for exit signals or opportunities to hedge. This framework helps traders identify more objective entry and exit points, reducing reliance on intuition alone and increasing the consistency of decision-making across changing market regimes.

The broader narrative around AI in trading emphasizes the edge that machines can provide in environments characterized by rapid information flow and complex interdependencies. AI can process a vast array of data sources, including cross-asset correlations, macro indicators, and sentiment signals, to detect statistical relationships that may precede price movements. Machine learning, in particular, is designed to learn from historical data, refining its models as new information becomes available. The promise is not that AI will replace human judgment but that it will augment human analysis by delivering more reliable probabilistic assessments of future price directions. In volatile markets, where headlines change by the minute and traditional indicators can lag, AI-powered forecasting can offer traders a greater probability of identifying meaningful opportunities before others.

Advocates of AI-driven trading argue that these systems excel at pattern recognition across high-dimensional data and can adapt to shifting regimes more rapidly than human analysts. The result is a framework in which risk and opportunity are defined through data-driven signals rather than subjective interpretation alone. Early demonstrations of AI’s performance in decision-making—whether in games like poker and chess or in more complex tasks such as real-time market forecasting—have underscored the potential for AI to outperform traditional analytical approaches in specific contexts. The argument is not that AI guarantees profits but that it enhances the analytic toolbox available to professional traders, particularly when combined with robust risk controls, disciplined execution, and transparent methodology.

In practical terms, the use of AI in trading often involves a suite of integrated tools and practices. The predictive blue line is one element in a broader ecosystem that includes historical price data, correlation matrices, volatility measures, and regime detection. Traders may use AI-generated forecasts to inform position sizing, stop placement, and exposure to different assets or currency baskets. They may also combine AI signals with traditional technical analysis to validate ideas and avoid overfitting. The synergy between AI-based insights and human judgment can produce a more resilient approach to navigating markets that are influenced by currency fluctuations, macro shocks, and shifting risk appetites.

The case for adopting AI in trading is strengthened by the reality that modern markets present a level of complexity that exceeds manual analysis. As data volumes grow and interconnections across assets intensify, AI’s capacity to identify subtle correlations becomes increasingly valuable. Yet, with this opportunity comes responsibility. Traders must implement rigorous risk controls, backtest strategies on diverse data, and remain aware of model risk. The goal is to use AI to improve decision quality, not to rely on a single indicator as a substitute for sound judgment or comprehensive risk management.

Practical Application: From Theory to Practice

In applying AI and currency-aware analysis, traders can pursue a practical workflow that integrates long-horizon insights with short-term trading opportunities. Begin by establishing a currency-agnostic view of gold’s long-term trend, incorporating the heat map results to identify currencies that have historically shown more robust performance or greater resilience during market stress. Then, overlay AI-driven forecasts to refine entry and exit points based on predicted momentum shifts. This dual lens—currency context plus machine-learned signals—can help traders calibrate their risk budgets, identify hedging needs, and optimize position sizes to align with their risk tolerance and investment objectives.

A disciplined approach also entails awareness of the limitations and risks associated with AI-based trading. While AI can enhance pattern recognition and decision support, it does not eliminate uncertainty or guarantee profits. Market dynamics may evolve in ways that historical data cannot fully capture, and models can overfit to specific regimes or datasets. As with any trading methodology, AI should be implemented with robust risk controls, transparent governance, and ongoing validation. Traders should also consider the liquidity and transaction costs of their chosen instruments, especially when operating within currency baskets or across multiple asset classes.

Signals, strategy, and risk controls

The predictive blue line and AI-driven insights should be integrated into a comprehensive set of trading rules. These rules might specify the conditions under which a position is opened, the criteria for adding or reducing exposure, and the precise criteria for closing positions. Risk controls are essential to ensure that losses are contained and that leverage remains within reasonable bounds. This includes setting clearly defined stop-loss levels, maximum drawdown thresholds, and position-size limits that reflect the trader’s capital base and risk appetite. In addition, diversification across currencies and asset classes can help mitigate idiosyncratic risk and reduce the impact of any single market shock.

A balanced approach combines the insights from long-term currency analysis with the short-term momentum signals generated by AI. By doing so, traders can navigate the complexities of global markets with greater confidence, prioritizing risk-managed opportunities that align with strategic objectives. This integrated framework supports better decision-making and can contribute to more consistent performance over time, even as macro conditions and currency dynamics evolve.

Risk Management, Disclosures, and Practical Considerations

Trading and investing in gold and related assets carry substantial risk, and past performance is not indicative of future results. The level of risk varies depending on the instruments chosen, market conditions, and individual strategies. It is critical to distinguish between potential rewards and potential losses and to recognize that sophisticated tools such as AI do not guarantee profits. The following points summarize essential risk considerations and best practices for responsible investing and trading in this context:

-

Risk of loss: Trading stocks, futures, options, forex, and exchange-traded funds involves substantial risk and is not suitable for all investors. Only risk capital should be used for trading activities, and investors should be prepared to absorb potential losses.

-

Volatility and leverage: Many markets exhibit high volatility and, when combined with leverage, can amplify gains and losses. Thorough risk management practices, including appropriate position sizing and stop mechanisms, are essential.

-

Model and data risk: AI- and machine-learning-driven approaches rely on historical data and statistical relationships. Models can misinterpret signals, overfit to past performance, or fail to anticipate regime shifts. Ongoing validation and monitoring are necessary.

-

Liquidity and execution risk: Some instruments, particularly those denominated in international currencies or less liquid markets, may experience liquidity constraints, widening spreads, or slippage during periods of stress.

-

Regulatory and market structure risk: Market participants should be aware of evolving regulations, exchange rules, and compliance considerations that could affect trading accessibility and cost structures.

-

Risk disclosure and expectations: All trading strategies, including AI-driven ones, should be evaluated within a robust risk framework. Claims of guaranteed returns or risk-free profits are inappropriate and should be avoided. The ultimate outcomes depend on market behavior, timing, and adherence to disciplined risk management practices.

The overarching message is that even with sophisticated AI tools and comprehensive currency-based analyses, successful trading requires a disciplined approach grounded in risk management, continuous learning, and a clear understanding of each trader’s objectives and constraints. The goal is to cultivate a transparent, methodical framework for decision-making that can adapt to changing conditions while maintaining a focus on long-term value preservation and prudent growth.

Important cautionary notes accompany any discussion of predictive technology and market speculation. The article emphasizes that substantial risk of loss exists and that no system can guarantee profits. Readers should take care to avoid overreliance on any single indicator or model, and they should ensure that investment decisions are consistent with their financial situation, risk tolerance, and investment horizon. Historical performance is not a reliable predictor of future results, and past outcomes do not guarantee future success. The spirit of the guidance is to empower readers with knowledge and structured frameworks that support informed decision-making, rather than to promise particular outcomes or to encourage excessive risk-taking.

Implementation considerations for practitioners

For practitioners seeking to apply the currency-based analysis and AI-enhanced decision framework, the following guidance can help translate concept into practice:

-

Data integrity: Use reliable sources for currency exchange rates, gold price histories, and macroeconomic indicators. Ensure time alignment across data series to avoid misinterpretations.

-

Methodological clarity: Document the methodology used to construct series, convert currencies, and compute performance metrics. Transparency in assumptions enhances credibility and enables replication.

-

Visualization discipline: Leverage heat maps and multi-timeframe charts to convey complex information succinctly. Clear visual communication improves comprehension for stakeholders with varying levels of expertise.

-

Risk governance: Establish a risk management plan that includes capital allocation rules, drawdown controls, and scenario analyses to prepare for adverse market environments.

-

Continuous learning: Regularly update models and adjust frameworks to reflect evolving market conditions, regulatory developments, and new data sources.

-

Education and literacy: Build a base of knowledge among team members or readers about currency dynamics, monetary policy, and the basic economics underpinning gold’s role as a hedge. This fosters more informed decision-making and reduces misinterpretation of signals.

Conclusion

In a world where monetary policy, currency issuance, and macroeconomic shifts continually reshape the value landscape, pricing assets in multiple currencies offers a richer, more nuanced lens through which to understand market dynamics. The analysis of gold across twelve currencies—Mexico, Japan, Eurozone, South Africa, United Kingdom, Australia, New Zealand, Brazil, Argentina, Canada, China, and Russia—reveals a consistent, overarching narrative: over the long horizon, gold tends to trend upward, reinforcing its historical role as a store of value and a hedge against currency depreciation. Across five-year and longer horizons, this positive momentum generally holds, even when some currencies experience deeper drawdowns or sharper volatility. Importantly, even in the most challenging currency environments, gold’s uptrend typically resumes within a horizon of five to eight years, underscoring its resilience as a protective asset.

The currency-based approach also uncovers nuanced differences in pace and magnitude of gold’s rise, offering a more granular view of how currency debasement, inflation dynamics, and policy shifts influence price paths in diverse markets. These insights are complemented by a heat map—a graphical, at-a-glance representation that helps isolate trends, highlight strengths, and identify potential research gaps in need of deeper inquiry. The visual tool demonstrates that, while individual quadrants can vary, green sectors often dominate, signaling net-positive performance relative to currency-driven baselines. The heat map thus becomes a practical instrument for practitioners seeking to evaluate risk, identify opportunities, and communicate findings with clarity.

Beyond charting and visualization, the integration of artificial intelligence and machine learning introduces a powerful dimension to market analysis and decision-making. The predictive blue line, a daily-constructed indicator, distills complex price dynamics into a directional forecast. By examining the slope, traders can infer medium-term momentum, anticipate consolidation phases, and set strategic expectations for buying, selling, or hedging. The synergy between currency-aware analysis and AI-driven forecasting creates a compelling framework for navigating today’s markets—one that recognizes the global nature of price formation while providing actionable signals to improve decision quality. AI is presented not as a magic bullet but as a tool that enhances understanding, reduces guesswork, and supports disciplined execution in a landscape characterized by rapid information flow and evolving risk factors.

As with any investment approach, responsible use of AI and currency-based analysis requires a rigorous commitment to risk management, transparency, and ongoing validation. Traders should implement robust controls, diversify exposure, and remain mindful of model risk and data limitations. The ultimate objective is to build a resilient investment approach that protects capital and aims for sustainable growth, leveraging the best of both global currency insight and machine-driven predictive capability. The convergence of macro-currency analysis, heat map visualization, and AI-assisted forecasting offers a comprehensive, forward-looking framework for those seeking to understand gold’s role in a multi-currency world and to execute with greater confidence in an era of rapid market evolution.

In closing, the currency-based examination of gold—and the AI-powered decision framework that accompanies it—highlights a central truth: value in financial markets is best understood through the interactions of currencies, prices, and probabilities. Gold’s historical function as a hedge against currency erosion remains intact, and its performance across diverse currencies reinforces the case for its inclusion in diversified portfolios. The combination of long-term perspective, cross-currency awareness, visual synthesis, and predictive technology provides a robust toolkit for traders and investors aiming to preserve purchasing power, navigate volatility, and pursue prudent, evidence-based opportunities in the global marketplace. The path forward for informed decision-making lies in embracing this integrated approach—grounded in data, clarified by visualization, and strengthened by disciplined risk management—and in applying it with rigor, curiosity, and humility as markets continue to evolve.