A cautious tone persisted across global markets on Friday as traders weighed the potential implications of a newly outlined U.S.–United Kingdom trade framework against a backdrop of mixed economic data and evolving central bank expectations. While U.S. equity futures showed a restrained spectrum of moves, with the Dow slipping narrowly and the Nasdaq and S&P eking out modest gains, investors simultaneously monitored the trajectory of upcoming economic releases and kept a close eye on how the trade framework might shape future policy and global commerce. European markets echoed this cautious stance, with major indices poised to open flat to slightly lower as traders balanced trade optimism with lingering concerns about growth, inflation, and the path of monetary policy in the weeks ahead.

Mixed futures and the evolving trade framework

U.S. stock futures presented a split picture on Friday morning. Dow Jones Industrial Average futures were modestly lower, trading down by roughly 16 points, a decline of about 0.04%. This modest dip underscored investors’ wariness ahead of a slate of broader economic data releases and any potential shifts in Federal Reserve policy that might accompany fresh inflation readings. By contrast, Nasdaq 100 futures had ticked higher, gaining about 0.12%, signaling some appetite for leadership from technology and growth-oriented names that could benefit from improved global trade conditions and any easing in supply chain constraints. S&P 500 futures, meanwhile, moved minimally higher, up around 0.04%, a sign of the cautious, awaiting mode that has characterized much of the market’s recent sessions.

Across the Atlantic, European equity benchmarks were following a parallel, tempered path. Indices such as the DAX in Germany and the FTSE 100 in the United Kingdom were expected to open flat or with slight declines, reflecting a broader sentiment that remains cautiously positive yet distinctly mindful of potential headwinds. This dual-tone environment—optimism about the potential for progress in global trade arrangements and concern about the pace and durability of economic growth—helped to cultivate a trading atmosphere that leaned toward flat or only marginally positive openings for both U.S. and European futures.

Two primary factors have been shaping this cautious opening, underpinning the market’s sentiment today. First is the ongoing digestion of the latest U.S.–U.K. trade deal framework. While investors are hopeful that this agreement could mark the beginning of a broader wave of positive developments in global trade, there is still considerable uncertainty about the framework’s full implications, which has restrained outright enthusiasm. The precise terms, potential concessions, and sector-specific protections remain questions mark, and until clarity emerges, market participants are inclined to adopt a measured stance rather than embrace a decisive risk-on posture.

Second is the way European markets are reacting to a spectrum of mixed economic data alongside worries about potential tightening of financial conditions. The European landscape—comprising divergent growth dynamics, inflation trends, and policy outlooks across the euro area—adds a layer of complexity to the global macro picture. The possibility that monetary policy could swing more decisively in the direction of restraint if inflation pressures persist or if economic data disappoints has contributed to a broader sentiment that favors caution over aggressive exposure to risk assets at this juncture.

As U.S. futures shimmer with small fluctuations, traders remain focused on the looming wave of economic reports and the persistent question of where the Federal Reserve’s stance will sit on inflation and interest-rate decisions. The interplay between improving trade expectations and domestic or international data that points to a slower or more uncertain growth path has kept the market in a balancing act—neither exuberantly optimistic nor deeply defensive. This juxtaposition—trade optimism on one hand and economic uncertainty on the other—has been a persistent feature of the market’s narrative, and it continues to inform price action in both equity futures and broader risk assets.

From a macro perspective, the moderating tone of today’s price action can be interpreted as a reflection of a nuanced, data-driven approach by market participants. The environment calls for a disciplined assessment of trade developments, inflation trajectories, and policy signals rather than a speculative, momentum-driven tilt. The emphasis on clarity around the trade framework, alongside the careful scrutiny of upcoming employment, inflation, and growth data, reinforces a broader message: investors are seeking durable catalysts that can sustain a longer-term repositioning, rather than quick, short-term flips in response to headlines.

In the bigger picture, the current market setup is characterized by a synthesis of optimism about potential strides in global trade that could lower barriers and enhance cross-border commerce, while simultaneously acknowledging that any gains hinge on a credible path for inflation control and monetary policy normalization. The resulting market dynamic is one of restrained optimism, where investors are eager to participate but demand clear, sustained signals that confirm a durable improvement in macro conditions.

May 9 performance snapshot: backdrop to a trade-driven mood

As of the close on Thursday, May 8, 2025, the major U.S. stock indices posted gains, buoyed by positive developments in international trade and investor optimism about the direction of policy and growth. The composite metrics painted a picture of a market that was digesting a blend of favorable trade news, improved risk appetite, and expectations for continued earnings resilience, even amid the ongoing economic headwinds that characterized the year.

- Nasdaq Composite settled at 17,928.14, up 189.98 points, a gain of 1.07%.

- S&P 500 finished at 5,650.38, advancing 35.00 points, or about 0.62%.

- Dow Jones Industrial Average closed at 41,368.45, higher by 254.48 points, roughly 0.62% stronger.

- Russell 2000 concluded at 2,073.63, up 17.65 points, about 0.86%.

The market’s improvement was framed by hopeful developments related to U.S.–U.K. trade talks. The announcement surrounding a framework for tariff reduction and a broader economic collaboration between the two allies provided a foundation for more constructive sentiment about the potential for reduced friction in transatlantic trade. This development helped to assuage some investor concerns about the drag of ongoing trade tensions on global economic growth, and it contributed to a mood of cautious relief that supported the advance in the major indices.

Beyond the headline figures, the broader market narrative reflected a belief among traders that the framework could set the stage for more meaningful progress in global trade agreements in the months ahead. While the exact policy implications and sector-by-sector effects remained to be seen, the optimism surrounding a potential reduction in tariff barriers, coupled with the possibility of improved cooperation on standards and regulatory alignment, provided a tailwind for equities, particularly those with exposure to export-driven demand and multinational operations.

This backdrop of improving sentiment coincided with the general market dynamics of the early May period: investors were weighing the potential for a shift toward more favorable trade conditions against the tug of stubborn inflation and a still-uncertain path for monetary policy. The gains on Thursday underscored a sense that, despite the complexities of the macro environment, the trade news offered a tangible, albeit incremental, catalyst for market participants seeking to position in response to a shifting global trade landscape.

In the wake of the rally, one notable takeaway was the heightened awareness around how trade developments could shape policy expectations, corporate earnings prospects, and sector rotations. Sectors most sensitive to international demand—such as technology hardware, industrials, and consumer discretionary with strong export components—were watched closely by analysts for signs of earnings differentiation and guidance updates that could corroborate the perceived improvement in the global growth backdrop. Conversely, sectors more exposed to domestic demand or to interest-rate-sensitive dynamics remained subject to heightened volatility given the ongoing discussion around inflation and Fed policy.

Market psychology also played a critical role in the daily rhythm of trading. The sense that a path toward greater global trade openness was becoming more plausible contributed to a mild risk-on tilt, with investors seeking to balance momentum with prudent risk management. The upward moves across major indices reflected this nuanced mix—a convergence of positive expectations about the trade framework and a cautious, data-driven approach to future rate expectations, earnings trends, and the potential for further policy normalization.

In summary, the May 8 close illustrated how trade optimism can translate into tangible gains for broad indices, while also highlighting the fragility of such gains in the face of mixed data and evolving policy signals. The market’s posture on May 9 suggested an acknowledgment that the road ahead would likely be shaped by a careful assessment of incoming data, as well as ongoing negotiations and clarifications around the U.S.–U.K. framework, rather than immediate, decisive shifts in risk appetite.

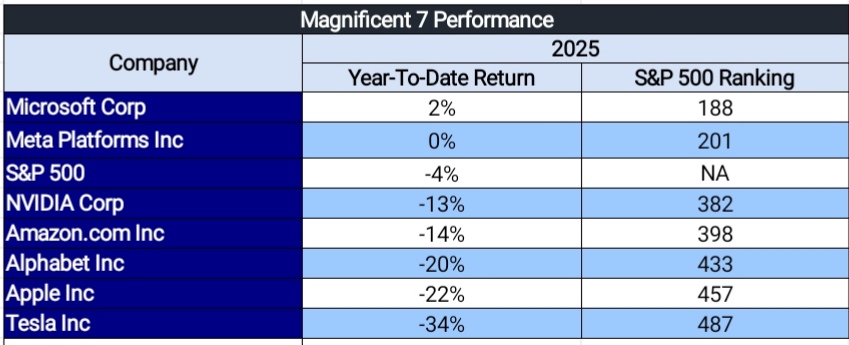

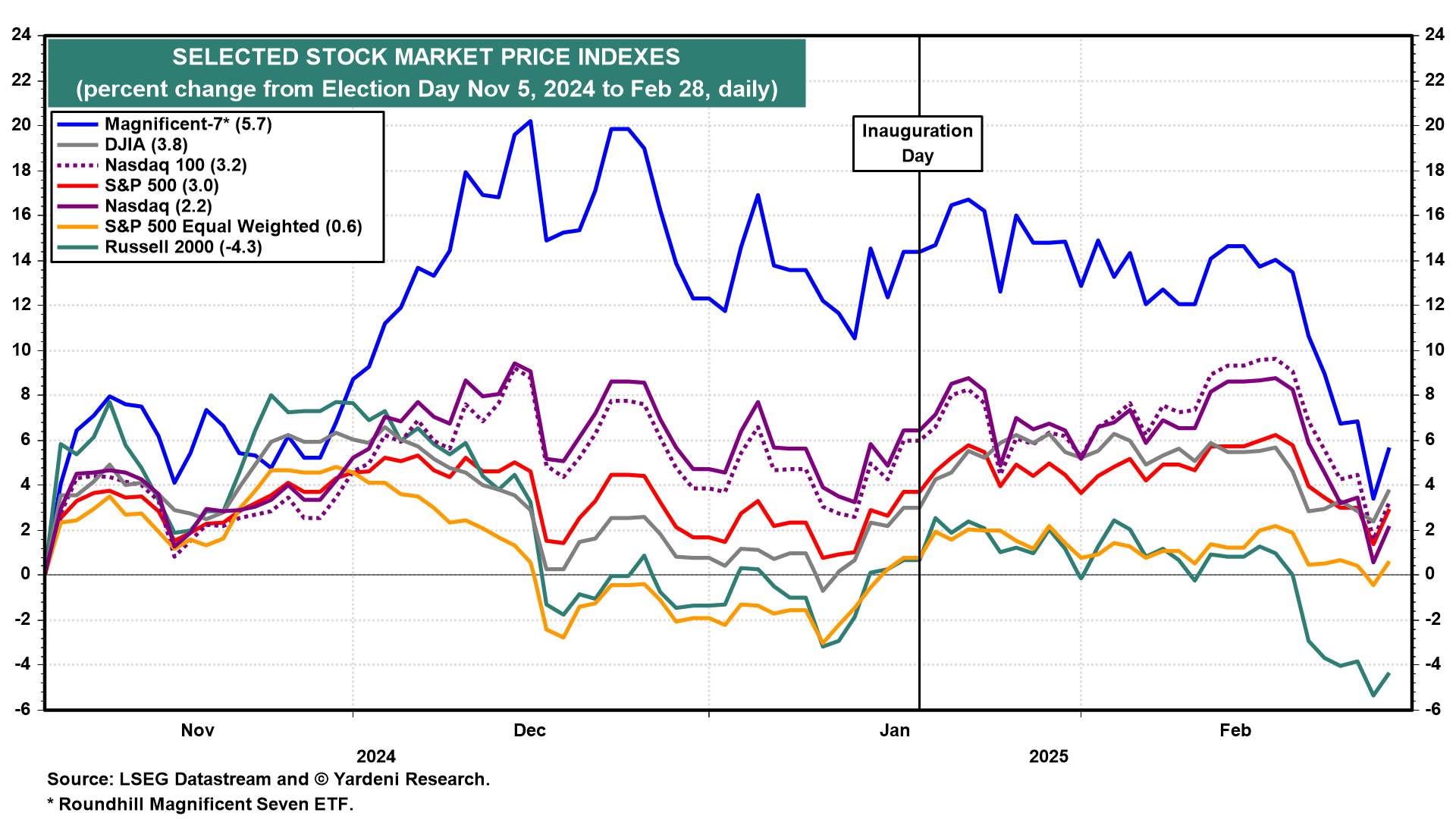

Within this environment, the so-called Magnificent Seven faced a separate but related narrative—one that would influence their price action in the days to come as investors weighed the balance between growth prospects, regulatory risk, and overall market leadership.

Magnificent Seven and the tug of global dynamics

The so-called Magnificent Seven stocks—Apple, Microsoft, Alphabet, Amazon, Nvidia, Tesla, and Meta—continued to be a focal point for market participants, given their outsized influence on index performance and their role as barometers for technology and growth sentiment. While not the sole force driving the market, these high-profile names provided a useful lens through which to view broader risk appetite, valuation discipline, and the way in which global macro developments—trade, inflation, and policy—manifest in equity pricing.

A key undercurrent in recent sessions has been a shift in expectations around growth trajectories and the durability of earnings in a higher-rate, inflation-conscious environment. Investors have been weighing the potential for regulatory developments, supply chain resilience, and the capacity of these mega-cap tech and growth names to sustain premium multiples when macro headwinds intensify. The pressures facing the Magnificent Seven have included regulatory scrutiny in several jurisdictions, evolving supply chain dynamics, and the risk that interest-rate normalization will compress valuations for growth-oriented equities more than for value-oriented or cash-generating equities.

From a sector perspective, the pullbacks or volatility in these names have not necessarily reflected deteriorating fundamentals across their businesses. Instead, they have often signaled a re-pricing process as investors recalibrate expectations for long-term growth, margin expansion, and the ability of these firms to monetize advanced technologies, such as artificial intelligence, in a climate of tighter financial conditions. The trajectory of these stocks is likely to remain closely tied to the multifaceted feedback loop among policy decisions, global trade developments, and macroeconomic indicators that influence consumer spending, enterprise technology budgets, and enterprise investment.

Investors remain attentive to the discipline of risk management in the face of elevated valuations and the potential for sharp moves on headlines or data surprises. The Magnificent Seven’s performance in this environment underscores the broader market’s push-and-pull: leadership remains in technology, but the path forward is contingent on a stable inflation regime, credible monetary policy signals, and a favourable backdrop for global trade growth that can sustain cross-border demand and corporate earnings momentum.

Drivers behind the market move: trade, policy, and geopolitics converge

Market dynamics in recent sessions have been shaped by a trio of powerful forces: trade negotiations, the Federal Reserve’s policy outlook, and geopolitical developments across key regions. Each of these factors contributes to the price action observed in futures, indices, and the broader risk spectrum, and the interplay among them helps explain why markets have taken a cautious, balanced stance.

U.S.–China trade talks and the Switzerland context

High-level talks between the United States and China—often framed as a barometer of global trade tensions—contributed to a mood of guarded optimism about the possibility of easing tensions and cementing a framework for reduced tariff barriers. In parallel, officials in the United States signaled a willingness to explore concession avenues that could pave the way for calmer trade dynamics, while skeptics cautioned that any such moves would be tempered by political and strategic considerations that extend beyond tariff numbers.

A notable development in the narrative around trade has been the discussion of potentially significant tariff reductions on Chinese goods, a topic that has stirred both hope and caution among investors. While some policymakers have floated the prospect of substantial reductions as a way to spur consumer demand, raise global growth, and alleviate supply-chain pressures, others emphasized the risk that any such tariff changes could come with accompanying conditions or concessions, potentially leading to volatility as markets reassess the balance of costs and benefits. The White House’s position on these shifts has been nuanced, with officials signaling cautious skepticism about sweeping tariff cuts, while expressing a willingness to engage in constructive dialogue to advance trade liberalization and economic cooperation. The net effect for markets has been a mix of relief and caution, with investors seeking signals about the durability and structure of any potential deal and the longer-term implications for inflation, currency values, and cross-border investment.

This backdrop has influenced expectations for how quickly broader trade deals might translate into real-world improvements for global growth. A framework that reduces friction in U.S.–China trade could have ripple effects on supply chains, manufacturing costs, and global demand, particularly in technology, semiconductors, and consumer electronics. Yet, without clear details on the scope, timing, and enforcement of any concessions, investors are prone to treat headlines as incremental rather than transformative catalysts. The evolving trade narrative thus remains a critical lens through which to view equities and risk assets, particularly for multinational companies with exposure to cross-border operations and diversified revenue streams.

Federal Reserve economic outlook and policy stance

The Federal Reserve’s decision to hold interest rates steady—an action that aligns with a data-driven approach to policy—has been a central pillar in the market’s risk calculus. The central bank’s communication highlighted its recognition of rising risks to the economy, while also underscoring the ongoing concerns about persistent inflation and the possibility of a sticky unemployment backdrop. The balancing act between supporting growth and containing inflation remains the defining tension for policymakers, and market participants are vigilant for any hints about the timing and magnitude of future rate adjustments.

Investors are particularly focused on the Fed’s forward guidance and its assessment of inflationary pressures that could influence the trajectory of monetary tightening or its eventual pause. The narrative around inflation remains nuanced: if price pressures ease more quickly than expected, markets may price in a more aggressive pace of rate cuts later in the cycle; conversely, if inflation proves more persistent or if unemployment trends worsen, the central bank could adopt a more cautious stance, prolonging higher-rate environments and affecting equity valuations, particularly in rate-sensitive sectors. The Fed’s communications in coming weeks will be crucial in shaping the near-term market path, as investors parse the central bank’s assessment of disinflation dynamics, labor markets, and the balance of risks to growth.

Geopolitical developments and emerging-market sensitivity

Geopolitical tensions in various corridors of the world—most notably tensions between India and Pakistan—have contributed to a broader sense of geopolitical uncertainty that can amplify market volatility, particularly in emerging markets. The weakening of the Indian rupee and the broader volatility in developing economies have reverberated through global risk sentiment, influencing capital flows, currency valuations, and the relative appeal of risk assets. In an interconnected global market, geopolitical risk can create a risk-off dynamic that prompts investors to reassess exposure to more volatile or cyclical sectors, even as some markets might capture selective opportunities through a rotation into more resilient, defensive plays.

This geopolitical watchline interacts with the trade narrative in meaningful ways. If trade tensions between major powers intensify or if sanctions and counter-sanctions escalate, global growth expectations can be tempered, affecting commodity prices, inflation dynamics, and corporate earnings across industries. The market’s current stance—cautiously optimistic yet mindful of these geopolitical undercurrents—reflects a strategy of patience, seeking evidence that the global policy environment is stabilizing rather than exacerbating risk.

A balanced view of forward risk and opportunity

Against this backdrop, investors are navigating a complex landscape where optimism about trade progress coexists with risks attached to inflation, policy normalization, and geopolitical ambiguity. The market’s reactions suggest a preference for wait-and-see posture in the absence of concrete, durable catalysts, even as headlines about a trade framework and policy clarity provide temporary lifts in sentiment. The path forward hinges on several variables aligning: credible progress in U.S.–UK and U.S.–China trade negotiations, data that supports a controlled inflation environment, and a policy stance from central banks that offers a predictable glide-path for rates.

In this intricate tapestry, one overarching theme stands out: the potential for global trade developments to act as a powerful engine for synchronized growth, should they prove durable and comprehensive. Yet the resilience of that engine depends upon the containment of inflationary pressures and the stability of financial conditions. Investors—and the markets they guide—will be watching carefully as committees and negotiators across the Atlantic and Pacific reveal more details about the shape and timing of any trade concessions, as well as the Fed’s evolving projection for inflation and unemployment.

Digesting Trump data and its market implications

An additional strand in today’s market dialogue centers on President Trump’s recent statements and their implications for trade policy and monetary policy expectations. The president’s remarks have shaped market sentiment by emphasizing a favorable stance toward trade, particularly the prospect of a U.S.–China deal and the possibility of breakthroughs with the U.K. and other partners. This upbeat interpretation has contributed to a sense that the administration may adopt a more conciliatory approach toward trade negotiations, a perspective that has been positively received by some investors who see it as a catalyst for reducing cross-border frictions and supporting global growth.

However, the full impact of Trump’s rhetoric remains uncertain. The president’s negotiating style is often described as dynamic and sometimes unpredictable, with a tendency to set aggressive expectations that may not always align with the White House’s ultimate policy outcomes. As such, market participants are weighing the potential for optimism against the risk of volatility if negotiations encounter friction or if demands accompanying any concessions complicate the policy landscape. The market continues to respond to this communication in real time, with price action reflecting a spectrum of reactions from relief to caution depending on the perceived credibility and durability of his policy signals.

From a broader perspective, Trump’s comments about the macroeconomic backdrop—such as his views on the economy’s strength in the absence of Fed support—add another layer to the dialogue about monetary policy, inflation, and growth. These statements have the potential to influence market expectations for the path of interest rates and the central bank’s willingness to adjust policy as inflation pressures evolve. While market participants may sometimes react with a sense of optimism to such rhetoric, they remain cognizant of the risks inherent in relying on political signals as a primary guide to policy and performance.

In sum, the Trump data digest presents a mosaic of viewpoints: some signaling confidence in the trajectory of trade negotiations and the domestic economy, others highlighting potential volatility stemming from policy misalignments or shifting expectations about the Fed’s response. The net effect for markets is a more nuanced risk environment, where investors balance the allure of potential breakthroughs against the possibility of volatility if narratives diverge from policy realities.

Looking ahead: near-term investing posture and strategy

In an environment where valuations in some segments have risen markedly and where trade news could serve as a meaningful catalyst, investors are increasingly focused on risk management, diversification, and strategic positioning. The question “Which stock should you buy in your very next trade?” captures the tension between the impulse to chase opportunities amid a volatile macro backdrop and the discipline required to manage risk in a market powered by headlines and evolving policy signals.

Historical performance data from AI-assisted or data-driven stock-picking approaches suggest that certain stock subsets can deliver outsized gains—companies that combine durable earnings, scalable business models, and the ability to monetize advanced technologies in a way that remains resilient amid higher rates. In 2024, such approaches reportedly identified two stocks that surged more than 150%, four additional stocks that rose more than 30%, and three more that climbed over 25%. These figures illustrate the potential for selective alpha within a broad market that is otherwise characterized by volatility and high valuation. Nevertheless, the absence of guarantees underlines the importance of prudent risk management, disciplined portfolio construction, and an awareness that past performance is not a guarantee of future results.

Given the current mix of trade optimism and economic uncertainty, investors may consider a balanced approach that emphasizes quality, cash flow generation, and the ability to withstand cyclical fluctuations. Diversification across sectors, geographies, and factor styles—such as value, quality, and momentum—can help moderate downside risk while preserving exposure to potential upside from an improving trade environment and a stabilizing inflation trajectory. In practice, this means spacing exposure across a spectrum of defensible names with strong balance sheets, complemented by select growth-oriented equities that have demonstrated reliable earnings growth and scalable competitive advantages.

As market participants await further clarity on the U.S.–UK framework, U.S.–China negotiations, and the Fed’s next steps, the path forward is likely to hinge on how convincingly the trade narrative translates into real-world outcomes—lower tariffs, greater cross-border collaboration, improved supply chains, and a degree of policy predictability that reduces volatility. In addition, data releases on inflation, labor markets, and consumer demand will be critical in shaping the timing and magnitude of any future policy shifts. The current environment rewards participants who can interpret the macro signals, factor in the evolving trade landscape, and employ a disciplined approach to stock selection that emphasizes resilience and long-term value creation.

Conclusion

In a market characterized by a delicate balance between optimism about trade progress and caution over inflation and policy risks, investors are navigating a complicated landscape where headlines can quickly morph into momentum—and momentum can just as rapidly fade in the face of fresh data or policy shifts. The latest developments around a U.S.–U.K. trade framework have provided a tangible signal that global trade diplomacy may be moving in a constructive direction, but the precise contours of that movement remain uncertain. In this environment, the key to navigating the weeks ahead lies in maintaining a robust framework for evaluating risk, staying attuned to central bank communications, and remaining adaptable as data continues to shape expectations for growth, inflation, and monetary policy. As traders digest new information and await meaningful progress on trade negotiations, the market’s mood will continue to swing between cautious optimism and prudent restraint, with the potential for volatility as new data and policy signals emerge. Investors would be well served by focusing on durable fundamentals, sector- and stock-level resilience, and a disciplined risk-taking approach that prioritizes capital preservation while seeking selective opportunities in an environment that remains complex, dynamic, and richly interconnected.