In the fast-moving world of trading, the daily flood of narratives and news stories confronts every participant. Markets swing on countless perspectives, rumors, analyses, and speculative opinions, creating a cacophony that can overwhelm even seasoned traders. This deluge of information, while seemingly informative, often clouds judgment and complicates decision-making as traders strive to align an incessant flow of data with their individual trading theses. Sifting through this torrent to extract actionable insights can feel Herculean, prompting many to question the need to track every twist in the narrative landscape. Yet, amid this relentless information barrage, a fundamental truth remains paramount in trading: price is king. Price action serves as the ultimate arbiter of success or failure because it distills all known information as interpreted by the market’s collective mindset. Grasping this principle can liberate traders from the burden of processing every opinion, allowing them to focus on price movements and trends—the practical, observable reality that directly influences trading decisions.

In this piece, we will explore why price action matters more than the noise, how narratives often mislead, and how a disciplined focus on price can coexist with informed analysis. We’ll delve into the psychology of information overload, examine how to distinguish signal from noise, and present a practical framework built around multi-timeframe analysis. The narrative will also recount real-world experiences that illustrate the pitfall of chasing headlines and the enduring value of trend-based thinking. Finally, we’ll consider how modern tools, including artificial intelligence, can support decision-making without replacing the core discipline of reading price action. The overarching message is simple: actions—specifically price actions—speak louder than words, and the market’s current behavior is the most trustworthy guide a trader can follow.

The Information Deluge and the Primacy of Price Action

In the era of ubiquitous connectivity, traders live in a perpetual information environment. Every moment delivers new headlines, forecasts, charts, and commentary from voices that range from seasoned veterans to self-styled experts. The volume can be intoxicating, and the temptation to over-interpret is real. When confronted with a thousand opinions about why price moved in a particular direction, the instinct to justify a trade through narrative can be powerful. However, this impulse frequently obscures the most important signal: the price itself.

Price action is the market’s language, expressing the aggregated decisions of all market participants. It is not a theory about what should happen; it is a record of what has happened and what the market’s current mood implies about future movements. Recognizing this, traders can reframe their approach: instead of chasing every analysis, they monitor price behavior across time and space, seeking consistency and coherence in the movement. Price action acts as a neutral arbiter, constantly updating the assessment of supply and demand, momentum and conviction, and risk-reward dynamics. This perspective helps traders avoid the trap of hoping news will validate a preconceived thesis and instead aligns decisions with what the market is actually doing in real time.

To operationalize this philosophy, it’s useful to differentiate between information that adds actionable value and information that merely enriches the narrative. Actionable information tends to have a direct bearing on price behavior: changes in momentum, shifts in trend direction, breakout or breakdown patterns, and the emergence of confluence across timeframes. Background noise—speculation about macro events, forecasts that fail to materialize, or sensational headlines—tends to be less predictive of near-term price action and more reflective of fear, greed, or social mood. The task for a disciplined trader is to build routines that foreground price and risk management while maintaining enough awareness of macro context to avoid egregious mispricings but without letting noise drive decision-making.

A practical approach is to establish a systematic habit around price reading. This includes defining what constitutes a trend in a given instrument, recognizing when price is responding to new information, and identifying price action signals with clear rules. For example, a trend may be characterized by higher highs and higher lows in multiple time frames, with momentum measured by tools such as moving averages, chart patterns, or the rate of change. At the same time, risk controls—position sizing, stop placement, and defined re-entry criteria—ensure that actions are anchored in risk management rather than narrative wishful thinking.

In addition to a price-centric mindset, it’s essential to maintain cognitive hygiene. Traders should periodically test their beliefs against current price action, resisting the urge to rationalize a move after the fact. Journaling trades, reviewing outcomes, and acknowledging when a narrative proves incorrect are crucial for long-term improvement. This disciplined stance helps prevent the all-too-common pattern of aligning trades to fit a story rather than the market’s actual behavior. The ultimate objective is to cultivate an internal environment where the simplest, most robust explanation “price moved this way because supply and demand shifted in this pattern” replaces more complicated, and often inaccurate, stories.

Moreover, a robust focus on price action integrates naturally with the reality that uncertainty is inherent in markets. Even the most skilled traders cannot predict every eventuality. The art lies in balancing probabilities: considering multiple scenarios and evaluating which one is most consistent with price action across different contexts. In practice, this means framing trades not on a single forecast, but on how price behaves relative to a defined plan, including entry, exit, and risk management rules. When price action confirms the plan across time horizons, a trader gains conviction; when it contradicts, it prompts disciplined reconsideration or exit.

To illustrate this perspective, consider common questions that traders often find illuminating but are not nearly as intimidating as they seem when anchored to price action. How did the market do relative to yesterday? Where is price on the weekly view? What does the monthly chart suggest about the longer-term trend? What is the trend’s status over the last quarter? How does price behave in the six-month window? And where does price sit relative to the year-to-date performance and the last 52 weeks? These questions emphasize the importance of perspective across multiple timeframes and demonstrate how a price-centric framework can help traders avoid pattern recognition errors that arise from a singular frame of reference.

In other words, the bedrock principle of technical analysis—the idea that a trend is a function of price movement over time—provides a simple yet powerful lens. A trend represents the general direction in which price is developing, and measuring the change from a starting point to the current price reveals the trend’s strength or weakness. A truly strong trend typically shows positive growth across most timeframes, whereas a consistently negative picture across several horizons indicates weakness. The real skill is identifying when multiple timeframes align to reveal a coherent trend and when a discrepancy exists that requires careful judgment about potential counter-trend setups or exits.

Across markets, a straightforward visual can often communicate trend strength more effectively than complex theories. The concept of multi-timeframe analysis—evaluating weekly, monthly, quarterly, semi-annual, year-to-date, and 52-week horizons—offers a practical way to gauge persistence and resilience. When most or all timeframes point in the same direction, the implication is a robust trend with higher probability of continuation. Conversely, mixed signals across horizons suggest caution and narrower risk tolerance. This approach is simple in principle, but its practicality becomes evident when applying it to real-world instruments, from equities to cryptocurrencies.

In practice, many traders underestimate how swiftly price action can reveal structural strengths or weaknesses. A single negative development in one time frame does not automatically negate a positive multi-timeframe picture, but it often serves as a warning sign that risk controls should be adjusted and positions reassessed. By anchoring decisions in price action and cross-checking across timeframes, traders craft a disciplined workflow that reduces susceptibility to news-driven swings and emotional reactions. The emphasis remains on translating observable market behavior into a clear, repeatable decision path rather than chasing explanations that may never be validated by price.

This section has laid out a foundational truth: price action is the indispensable compass in trading. While information and narratives will always exist, effective trading requires a rigorous focus on what price is actually doing now and how that behavior is likely to unfold in the near term. The next sections will explore why narratives are alluring—and often misleading—how to filter them effectively, and how to implement a practical framework that keeps price action at the center of decision-making.

The Allure and Reality of Market Narratives

Narratives are powerful. They shape expectations, influence investor sentiment, and often drive short-term price distortions as crowds react to stories about recessions, rallies, policy shifts, and technological breakthroughs. It’s natural to seek explanations for price moves, especially when markets seem to swing on a crest of news or rumor. But there is a crucial distinction between understanding a story and understanding price action. The former is a qualitative account of why the market could move in a certain direction; the latter is the empirical record of what the market actually did in the face of that story. The two do not always align, and in practice, narratives can deviate from price action for extended periods, leading to mispricing, whipsaws, and frustrated traders who believed the narrative would validate their position.

One of the stark realities of the financial media landscape is that much of the daily information has limited, if any, direct relevance to profitability. Analysts pour over data, forecasts, and macro themes, but a sizeable portion of the content often reflects opinions or expectations rather than verifiable outcomes. Even when forecasts prove informative in hindsight, the market’s reaction to new information can be unpredictable or delayed. This is not to dismiss the value of informed analysis, but to acknowledge that news and opinion are not guarantees of future price behavior. The market’s reaction can be conditioned by multiple factors beyond the immediate narrative, including liquidity, risk appetite, macro surprises, and the sequencing of information.

A useful exercise is to reflect on historical media coverage and compare it with actual price outcomes. When one surveys archives of financial publications, the divergence between narrative emphasis and realized price action can be striking. Were traders who acted on prevailing opinions consistently rewarded? More often than not, the answer is nuanced: in some cases, the story captured a meaningful shift in fundamentals that eventually materialized in price, but in many others, the market discounted or ignored the narrative entirely, continuing on its established path or following a different trajectory. If a trader relies heavily on widely disseminated opinions without validating them against price structure and risk, the probability of encountering a detrimental surprise increases.

The internet, with its vast digital archives, amplifies this dynamic. Platforms that host opinions, forecasts, and sensational content offer a constant stream of narratives that compete for attention. The phenomenon is not unique to any one platform—YouTube, blogs, forums, and social media all host prominent voices whose forecasts attract large audiences. In many cases, hindsight reveals that these popular forecasts missed the mark, sometimes by wide margins. The danger is not the existence of occasional accurate calls but the sheer volume of content that can mislead through repetition, amplification, and momentum of crowd behavior. Traders who confuse popularity with reliability risk aligning with volatility rather than genuine trend following.

This is not merely a caution; it is a practical constraint on decision-making. The more a trader consumes news and opinion without testing its compatibility with price action, the higher the chance that decisions are colored by cognitive biases rather than empirical evidence. Confirmation bias—seeing what one expects to see in price movements—can be particularly pernicious. A trader who is convinced of a given macro narrative may selectively interpret price signals to fit that narrative, rather than letting price lead. The antidote is systematic skepticism coupled with price-driven validation: every analytical claim should be tested against price action across multiple timeframes, with objective criteria for entry and exit that are independent of a story’s appeal.

In reviewing the landscape of narratives, we can recognize a broad spectrum of themes that repeatedly appear and influence sentiment. The following list constitutes a representative set of narratives that the trading mind often encounters. Each item embodies a common emotional driver—fear, greed, hope, or a blend of these—and each has the potential to sway decisions if it is not carefully anchored to price:

- The Impending Recession: Predictions about imminent contractions used to induce fear and prompt changes in spending and investment behavior.

- The Bull Market Rally: Stories of unending upward movement that spur greed and fear of missing out, encouraging additional investments.

- The Housing Bubble Burst: Warnings about past market crashes that stoke fear of a repeat event and influence housing market activity.

- Quantitative Easing (QE) and Its Effects: Debates about monetary stimulus generating optimism or dread about long-term consequences.

- Cryptocurrency Boom and Bust: Narratives about overnight wealth from crypto investments evoking greed, while dramatic losses invoke fear.

- Unprecedented Economic Growth: Forecasts of extraordinary growth sparking hope for a stronger economy.

- Sovereign Debt Crisis: Warnings about defaults that raise fear about global economic stability.

- The Rise of Artificial Intelligence and Automation: Predictions of job displacement fueling fear about future employment.

- Climate Change and Economic Impact: Discussions on costs and green investments generating both fear and hope.

- Global Trade Wars: Tariffs and tensions creating fear about ramifications for economies.

- Emerging Markets Growth: Stories of rapid expansion inspiring hope and greed for high returns.

- Tech Industry Dominance: Narratives about tech behemoths driving gains spurring technology stock investments.

- Interest Rate Hikes or Cuts: Central bank policy anxieties about inflation or recession, or optimism about growth.

- The Wealth Gap: Debates about inequality fostering fear and calls for policy responses.

- Corporate Earnings Surprises: Earnings results beating or missing expectations driving volatility and sentiment shifts.

- Bank Failures and Bailouts: Distress in financial institutions provoking concerns about systemic stability.

- Inflation Fears: Ongoing inflation concerns affecting purchasing power and financial planning.

- Technological Breakthroughs: Announcements of major advances offering hope for growth and investment opportunities.

- Political Instability and Economic Impact: Events that trigger uncertainty, sometimes fear, sometimes hope.

- Demographic Shifts and Economic Futures: Aging populations and workforce changes prompting concern or opportunity.

- Financial Regulation and Deregulation: Policy discussions that spark hope or fear for growth and risk.

- Cybersecurity Threats and Economic Vulnerability: Rising risk awareness of cyberattacks prompting caution.

- Globalization and Its Discontents: Debates about integration versus dislocation, prompting both hope and fear.

- Universal Basic Income (UBI): Debates about safety nets in the automation era, offering hope but also concerns about feasibility.

- Healthcare Costs and Economic Impact: Rising expenses affecting personal finances and national economies.

- Retirement Security and Aging Populations: Anxiety about savings adequacy amid longer lifespans and shifting responsibilities.

- Foreign Investment Flows and Economic Influence: Narratives about dependence or revitalization through foreign capital.

These narratives are potent tools for shaping public perception and behavior toward the economy and the stock market, each carrying weight to influence investment decisions, consumer spending, and policy debates. They reflect a complex interplay of economic theory, policy, social trends, and technological progress that colors public sentiment. But the critical question remains: are these narratives genuinely helpful to you as a trader?

From extensive experience, the answer is often no. While these stories can be tantalizing and informative in a broader sense, they frequently have little to do with trading success. Many traders approach the day convinced that following the latest narrative is essential to profits. Yet when price action moves contrary to the established storyline, they become overwhelmed or unsettled. In contrast, the most successful traders I’ve interacted with consistently emphasize trend and price action rather than the ongoing narrative. They understand that price action transcends the noise of everyday headlines and provides a more stable foundation for decision-making.

A useful analogy is the story of Amazon in its early days—an instructive case study in the tension between news narratives and actual price movement. In the nascent years of the internet, Amazon was a focal point of intense media scrutiny, repeatedly spotlighted for not turning a profit while maintaining a high-profile public profile. The market’s price action during these periods did not always align with the sensational coverage. After its 1997 IPO at $18, the stock faced widespread skepticism and frequent media “pot shots” that highlighted losses and questioned durability. The dot-com era amplified these dynamics: the stock’s price rose to $131 after the IPO, only to crash to around $5 during the subsequent bust in 2000. The media narrative at the time tended to focus on the company’s ongoing losses and the precariousness of internet startups, which seemed to contradict the eventual performance that would propel Amazon to a dominant e-commerce position.

The point in this narrative is clear: early stories about Amazon frequently diverged from the price action that would eventually validate the business model’s long-term viability. This divergence underscores a broader lesson for traders: the news cycle often defies realistic price implications in the short term, and price action remains the more reliable gauge of market sentiment and supply-demand dynamics. The media’s job is to attract readership and shape perception, sometimes at odds with what price reveals about relative strength or weakness.

If you are truly obsessed with a trend whenever you trade, you can quickly test your understanding with a few straightforward questions that reveal whether you are letting price action guide you or being sidetracked by news. How did the market perform compared with yesterday? Where is price on the weekly horizon? On the monthly? On the quarterly? What does the six-month picture show? And where does price sit over the year and within the last 52 weeks? These are simple inquiries, yet they illuminate a fundamental truth: price action trumps everything else. If you are in a long position and a news story proposes a potentially negative outcome, you must understand your place in the multi-timeframe trend before deciding how to respond. Without alignment across timeframes, you risk making a hasty, emotionally driven decision that deviates from the market’s actual signal.

There are countless tools available to help identify prevailing trends, from technical indicators to chart patterns. Yet a reliable starting point can be nothing more than good old common sense grounded in price behavior. The bedrock assumption of technical analysis is that what everybody knows is already reflected in current price. A trend, at its most fundamental level, is the general direction in which price is developing over time. To characterize a trend, you measure the change from a defined starting point to the current price, a simple exercise that yields a clear view of movement over a period. This approach helps traders identify what is genuinely strong and what is genuinely weak.

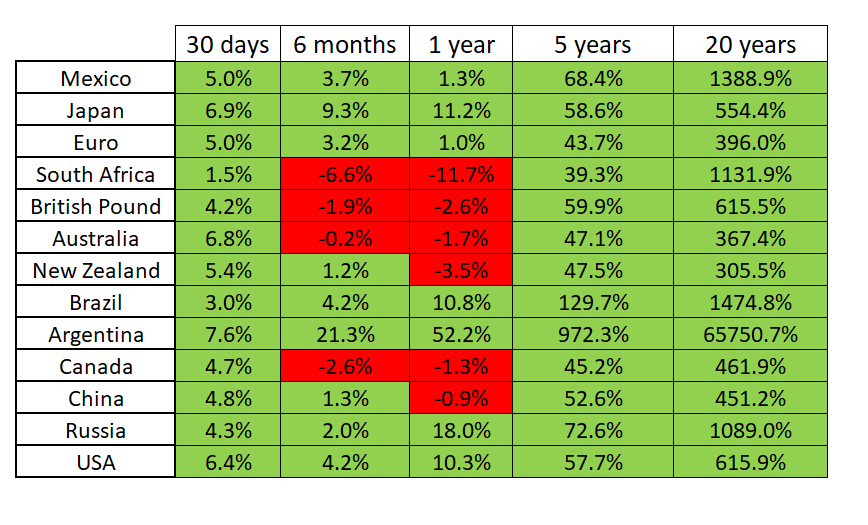

A simple, practical framework for trend assessment uses a multi-timeframe lens to capture the ebbs and flows of price action. Visualizing a basic framework for identifying a strong trend across six timeframes can be instructive. If every timeframe shows positive movement—color-coded as green—you have a market where price action is broadly rising. Conversely, if every timeframe moves negative—color-coded red—you are observing a market in decline. Most markets do not present such pristine alignment; more often, you will encounter a scenario where one timeframe shows a negative change while others remain positive. In such cases, traders scrutinize the price level anchoring the negative change to determine the best course of action.

To determine trend strength, it is advantageous to analyze behavior across multiple timeframes simultaneously. Weekly, monthly, quarterly, semi-annual, year-to-date, and 52-week periods provide panels for cross-referencing. Observing a predominance of positive results across these horizons signals a robust trend, while a preponderance of negative signals indicates weakness. This multi-timeframe approach does not merely define strength; it enhances forecasting precision by offering a more nuanced read of the market’s momentum and persistence. It also reduces the risk of being misled by a single-frame observation that could be an aberration or a temporary anomaly.

In the realm of practical application, many traders leverage this approach by incorporating it into their regular stock studies and broader market observations. Consider Bitcoin as a real-world illustration. The multi-timeframe analysis shows a 15% decline from a recent peak, yet other timeframes remain positive, suggesting the overarching trend remains constructive unless the monthly view turns negative. If the monthly timeframe flips negative, that could be the hint of a longer-term trend shift; until then, the shorter horizons still reflect resilience. This simple framework provides a transparent, actionable lens that prioritizes price action as a guide to decision-making rather than chasing speculative forecasts.

To illustrate how this method translates to different assets, consider a snapshot of a marquee stock and a market index. NVIDIA, for instance, presents a scenario where all timeframes are deeply positive, creating a bearish case despite outwardly favorable headlines. Such a contradiction underscores the point that headlines do not determine what the price will do next; price action does. The same approach applied to Tesla reveals how a company can be in a downtrend across multiple horizons, guiding traders to reallocate capital to more favorable opportunities while highlighting the limitations of relying on broad optimism when price action signals caution.

The purpose of sharing these visuals and analyses is to demonstrate that multi-timeframe analysis is a simple, practical, and enormously useful starting point for any trade or investment decision. It remains, in many traders’ experience, more informative than the most widely read financial news article. The emphasis is not on dismissing news entirely but on ensuring that price action remains the primary compass. The overarching message is to implement this straightforward approach into daily decision-making, using price action as the anchor for all entries, exits, and risk checks. Rather than attempting to forecast the start or end of a trend based on a single narrative, focus on what the market is telling you in the present moment and respond accordingly.

As a complement to price-driven decision-making, consider the potential role of artificial intelligence as a tool within your framework. AI can enhance the analytical process by processing large data sets, recognizing patterns, and generating insights that can inform risk-aware decisions. However, AI is not a substitute for disciplined price reading and risk management. The two can be integrated so that AI offers a supplementary lens—highlighting areas of momentum or anomalies that may require closer inspection—while the trader remains grounded in the reality of price action and probability-based decision-making. The aim is to use technology to refine, not replace, the core craft of reading price and managing risk.

In the broader arc of trading wisdom, a recurring theme is the tension between certainty and uncertainty. The truth is that certainty is unattainable in markets. The more important objective is to balance the probabilities: maximize the chances of a favorable outcome while acknowledging and controlling the risk of an unfavorable one. The most successful traders I have encountered understand this balance intimately. They do not rely on a single source of truth; instead, they rely on a coherent framework that integrates price action, multi-timeframe analysis, and prudent risk controls. The result is a trading approach that withstands random noise and capitalizes on persistent, price-driven trends.

The multi-timeframe method described here is not a relic of the past; it remains a practical, scalable, and adaptable tool for today’s markets. It serves as a reliable starting point for any trade and provides a robust counterbalance to the allure of sensational headlines. For those seeking to refine their process further, integrating artificial intelligence trading software can be a valuable enhancement—but only if used to augment human judgment, not to supplant it. In this sense, the true art of trading lies in harmonizing a disciplined, price-first mindset with the strategic use of technology to sharpen decision-making and risk management.

In subsequent sections, you will see how these principles apply to real-world market examples, including a step-by-step approach to applying multi-timeframe analysis, and a practical demonstration of how to interpret price action in the context of evolving narratives. The overarching objective remains constant: focus on what price is telling you now, and respond with discipline, adaptability, and an awareness of risk.

The Amazon Narrative Revisited: Price Action as the Benchmark

The central message of price action as the arbiter of market reality is reinforced when we examine long-running stories about high-profile companies and their stock prices. The Amazon saga—one of the most instructive case studies in the intersection of media narratives and price behavior—offers a vivid illustration of why price action should anchor trading decisions. In the early years, Amazon faced relentless media scrutiny. The dot-com era was characterized by extraordinary volatility, speculative fervor, and a perpetual stream of headlines about the company’s profitability and business model viability. The stock price mirrored a roller-coaster ride: a public offering that raised expectations, followed by periods of skepticism, losses reported quarter after quarter, and a relentless media focus on the company’s lack of immediate profitability.

From a price action perspective, the story was not linear. The price chart revealed a different story than the one told by commentators and editors. While the narrative questioned the company’s prospects, the price movement demonstrated resilience, with substantial drawdowns punctuated by moments of breakout and expansion. The market’s behavior told its own truth: despite ongoing losses and a skeptical press, Amazon continued to attract capital, refine its business model, and create a pathway to profitability. The eventual realization of these profits—much later in the company’s history—highlighted a critical principle for traders: the narrative can lag or diverge from price action, and the market’s immediate reaction to a story may be inconsistent with long-term outcomes.

This dichotomy has practical implications for traders. If one subscribes to the prevailing narrative without validating it against price action, there is a risk of entering trades that eventually prove misaligned with the market’s actual momentum. Conversely, a price-first approach allows traders to stay with the trend as long as price action confirms strength and to exit or avoid exposure when the trend weakens or proves incongruent with other timeframes. The Amazon example emphasizes that news coverage can be entertaining and influential in shaping public discourse, but it does not guarantee price movement in the direction predicted by sensational headlines. The market’s own logic—the aggregation of all participants’ decisions—ultimately governs price.

This distinction is not a rejection of all news or macro insight; it is a call for disciplined integration. News can inform context and risk assessment, but it should not, in isolation, drive entry or exit decisions. A trader who relies on external explanations alone risks becoming a spectator to price action rather than a participant with an executable plan grounded in market structure. The Amazon narrative demonstrates that the most enduring winners in markets are those who can endure uncertainty, maintain flexibility, and let price action guide the decision-making process. The broader takeaway is simple: the news on a company or the market can rise and fall, but the chart—the actual history of price movements—offers the most reliable compass for trading.

To translate this into practical steps, begin with a straightforward framework for validating price moves against the prevailing trend. When a new development or headline emerges, test how price is behaving in relation to the multi-timeframe trend. If price action remains aligned with the broader trend across weekly, monthly, and quarterly timeframes, the narrative, while important for understanding underlying drivers, should not derail existing positions or steer you into new trades without explicit price-based justification. If price action deteriorates across timeframes, or if a singular horizon shows a weakening signal while others stay strong, exercise caution and reassess exposure. The key is to prevent narrative momentum from displacing price-driven risk management, ensuring that decisions remain anchored to what price is saying in the present moment.

The point here is not to discount the value of macro insights or company-specific developments. Rather, it is to ensure that framing those developments within the context of price action keeps you grounded. Price action is not a servant of the narrative; it is the language through which the market expresses its valuations, risk appetite, and expectations about future returns. The Amazon example serves as a memorable reminder that the date of a headline does not define the market’s response, and the chart’s history holds the answer to whether a trend will persist. For traders, this is an essential discipline: never let a story override a price-based plan, especially when multiple timeframes disagree or when new information introduces volatility that could disrupt a well-founded setup.

A concluding reflection from this narrative is that the news cycle’s glamour can be compelling, but it is not the final arbiter of profitable trading. The chart, interpreted with a disciplined, price-first methodology, provides the most reliable guide to risk and opportunity. The lesson is universal: in markets where uncertainty is the only certainty, price action remains the constant; stories come and go, but the trend endures—or it fades—according to the actual market dynamics that price action reveals.

The Multi-Timeframe Framework: A Practical Roadmap for Price Action

The rich, practical heart of this approach lies in multi-timeframe analysis—the practice of examining price action across several horizons to gauge trend strength, persistence, and potential inflection points. This is not a mystical art; it is a clear, auditable process that helps traders navigate the complexity of markets where noise and information swirl, but price action remains the primary signal. The aim is to provide a framework that is both simple to implement and highly informative when applied consistently. The method I describe here emphasizes clarity, repeatability, and a focus on observable behavior rather than speculation about unseen catalysts.

A working blueprint for multi-timeframe analysis begins with six key horizons: weekly, monthly, quarterly, semi-annually, year-to-date (YTD), and the last 52 weeks. The goal is to observe price action across these horizons to determine whether the trend is gaining strength, maintaining its momentum, or showing early signs of fatigue. The practical steps are straightforward:

- Establish the measurement endpoints for each horizon. For example, in weekly and monthly horizons, you may compare the current price to the opening price of the week or month, respectively. In longer horizons, you compare current closing prices to the relevant historical anchors: the end of the quarter, the end of the six-month period, the start of the year, or the 52-week closing price.

- Interpret the color-coded results. If all horizons show positive movement (green), the market is in a uniformly rising phase, indicating broad-based strength and a higher probability of continued upside. If all horizons show negative movement (red), the market demonstrates a uniform downtrend with a higher probability of continued downside.

- Recognize composite or mixed signals. Many markets do not present clean, uniform signals across all horizons. It is in these cases that traders should drill into the specific price levels at which the divergence occurs. The focus shifts to identifying the price level that corresponds to the weaker horizon (often the quarterly or six-month measurement) to determine whether the market has found support, whether a pullback has occurred, or whether a reversal is developing.

- Cross-reference with price action in transversely related assets or indices. This helps validate whether the observed trend is idiosyncratic to a single instrument or part of a broader market trend. Corroboration across related assets reinforces conviction, while divergence invites caution and further analysis.

This approach offers a practical, visual framework for assessing trend strength. It is a powerful complement to more sophisticated tools, not a replacement. The basic principle remains: a trend is strongest when multiple horizons align in the same directional bias and weakest when the majority of horizons indicate opposing movement. In practice, this method helps traders avoid overreacting to short-term noise while ensuring that longer-term momentum and structure are considered in decision-making.

To illustrate the real-world application of multi-timeframe analysis, let’s consider a few concrete examples drawn from contemporary markets. Bitcoin, for instance, may exhibit a 15% decline from a recent peak on the weekly horizon, while the monthly and quarterly horizons remain positive. Here, the trader would interpret this as a temporary pullback within a broader uptrend, with the caveat that the monthly horizon would need to turn negative to begin weakening the longer-term picture. The interpretation is not a single verdict but a nuanced reading of where price stands within the broader trend spectrum. This practical analysis emphasizes that price action across multiple horizons provides a more stable sense of risk and opportunity than any single timeframe alone.

NVIDIA presents another instructive case: if every horizon indicates a strong positive trend, the strength of the uptrend supports a bullish stance, barring an obvious price action breakdown or a clear reversal signal. In such a scenario, the trend’s persistence across horizons bolsters the case for continuing exposure or seeking higher-probability entries on pullbacks within the prevailing uptrend. A contrary example is Tesla, where a majority of horizons illustrate a downtrend, suggesting caution and the potential for shifting capital toward stronger opportunities. The multi-timeframe framework thus acts as a compass to navigate uncertainty and align trades with the prevailing market structure.

The S&P 500 Index offers a further test case. Across multiple horizons, prices may paint a picture of resilience, climbing despite a wide range of opinions about imminent market corrections. In such instances, the trader’s job is to interpret the price action as the primary signal, with the understanding that external narratives may diverge from the chart’s truth. The inclusion of these examples is not to imply a perfect forecast but to demonstrate a practical process for evaluating trend strength and potential momentum within a structured, repeatable system.

A practical note on execution: the precise numbers used in the multi-timeframe analysis—percent changes, anchor points, and the timing of measurement—are not the core victory. The strength lies in the discipline to measure across horizons and interpret the combined message the price action conveys. This discipline should be part of every trader’s routine, especially when confronted with headlines that could tempt them to abandon their plan in search of a story. The goal is not to predict the future with perfect accuracy but to align decisions with the market’s current logic and to manage risk accordingly.

In addition to such practical steps, it is valuable to consider how these insights can be enhanced with modern technology. Artificial intelligence can assist in data processing, pattern recognition, and scenario generation, offering a complementary tool to human judgment. The appropriate use of AI is to augment the trader’s capacity to observe price action across horizons, identify subtle shifts in momentum, and flag potential risk scenarios for closer scrutiny. However, AI should not supplant the trader’s responsibility to read price, manage risk, and adapt to changing market conditions. The optimal approach blends human discipline with the efficiency and breadth of AI-enhanced analysis, ensuring that decisions remain anchored in price behavior while benefiting from computational insights.

Moreover, the overarching insight from multi-timeframe analysis extends beyond individual trades. It supports a systematic framework for portfolio management and risk budgeting. By understanding how trends behave across horizons, traders can shape allocation strategies that reflect the prevailing market structure, avoid overexposure to short-term noise, and protect capital during periods of cross-c horizon discord. The method is adaptable to different asset classes and markets, from equities to commodities to digital assets, making it a versatile cornerstone of price-action-based trading.

Practically speaking, to implement this framework, begin by establishing objective measurement points for each horizon, standardize the interpretation rules, and create a repeatable routine that you can execute daily. Document the readings, compare them across horizons, and translate the composite view into a concise, rules-based trading plan. The plan should specify entry criteria consistent with the observed multi-timeframe trend, risk controls such as stop placement and position sizing, and clear exit rules for both winners and losers. With practice, this framework yields a transparent, monitorable approach to price action—one that remains stable amid the volatility and noise of the broader narrative environment.

In closing this section, remember that price action remains the core of trading success. The multi-timeframe framework is a practical mechanism to reveal the market’s structure and momentum, providing a coherent, data-driven basis for decision-making. It is not a crystal ball, but it is a robust tool for understanding how price moves within a larger context. When integrated with prudent risk management and a disciplined mindset, it helps traders stay aligned with the market’s actual behavior and makes it easier to navigate the surge of information that characterizes modern financial markets.

Integrating AI into a Price-Action-Driven Strategy

Artificial intelligence represents a frontier of opportunity for traders seeking to augment their decision-making processes. AI has demonstrated prowess in domains requiring pattern recognition, large-scale data processing, and rapid hypothesis testing. In trading, AI can assist with scouting across markets, identifying subtle patterns in price action, and generating probabilistic assessments of future price moves. Yet the application is not about ceding control to machines; rather, it is about leveraging sophisticated tools to sharpen judgment, reduce cognitive load, and improve consistency in how price signals are interpreted and acted upon.

The strongest, most robust approach is to view AI as a supplementary partner rather than a replacement for a well-established price-action framework. Here are several ways AI can complement a price-first trading method:

- Enhanced pattern recognition: AI can scan vast historical price data to identify recurring patterns or multi-timeframe clusters that a human analyst might overlook. It can highlight the presence or absence of strong trend signals across horizons, supporting more confident decision-making.

- Probabilistic risk assessment: AI can compute conditional probabilities of different price scenarios given current market conditions. This helps traders understand potential outcomes and calibrate risk accordingly, rather than relying on single-point forecasts.

- Anomaly detection: AI can flag unusual price actions or breakouts that warrant closer inspection, enabling traders to scrutinize events that may indicate meaningful shifts in market dynamics.

- Scenario analysis: AI can generate multiple plausible trajectories under different assumptions, aiding traders in stress-testing their plans and preparing for contingencies.

- Objective backtesting: AI can support robust backtesting of price-action rules across diverse markets and periods, enhancing confidence in the strategy’s robustness.

The strategic use of AI should follow a disciplined workflow aligned with price action. Begin by defining the exact price-action signals that your model will evaluate, such as price breakouts, continuation patterns, or cross-timeframe momentum shifts. Then, design the AI system to examine these signals in the context of a trader-defined risk framework, ensuring that AI recommendations are always filtered through the trader’s own risk tolerance and capital allocation rules. It is essential to preserve human oversight: AI outputs should inform rather than dictate, and final trading decisions should rest with the trader who has the ultimate responsibility for risk controls and capital preservation.

A common pitfall is to perceive AI as a silver bullet that will automatically deliver profits. In reality, AI is a tool that can improve efficiency, pattern discovery, and decision support, but it does not guarantee success in markets dominated by uncertainty and the possibility of regime shifts. The human ability to adapt to changing conditions, assess risk, and apply context remains indispensable. Traders who combine the strengths of AI with a steadfast commitment to price action and risk management are best positioned to navigate a landscape where information is abundant and market dynamics are complex.

Despite the potential benefits, there are important caveats and best practices to observe when integrating AI into trading:

- Ensure data quality and relevance: AI models are only as good as the data they digest. Use reliable price data and avoid contamination from errors or inconsistent timeframes that could distort analysis.

- Avoid overfitting: Over-optimizing an AI model to historical data may erode performance in live markets. Favor robustness and simplicity, with an emphasis on price-action signals that generalize beyond past conditions.

- Maintain interpretability: Where possible, implement AI in a way that preserves clarity about why a particular signal is being generated. Clear explanations help maintain discipline and trust in the system.

- Align with risk management: All AI-generated insights should be integrated within the trader’s risk framework, including position sizing, stop placement, and predefined exit conditions.

- Monitor, update, and adapt: Markets evolve; what works in one regime may underperform in another. Regularly review AI outputs, recalibrate models, and adjust parameterization to reflect changing dynamics.

In the broader context, AI’s role in trading is part of a larger shift toward data-driven decision-making. It complements—rather than replaces—the core discipline of reading price action and managing risk. The most effective approach treats AI as a powerful tool that can highlight opportunities and illuminate patterns, while the trader remains responsible for validating signals, executing trades, and maintaining a strategic risk posture. This balanced integration enables traders to harness the advantages of both human judgment and machine-assisted analysis, ultimately improving decision quality and consistency.

Important to note is the overarching risk of trading itself. The following standard risk disclosures remind readers of the caution required when engaging in these activities:

THERE IS A SUBSTANTIAL RISK OF LOSS ASSOCIATED WITH TRADING. ONLY RISK CAPITAL SHOULD BE USED TO TRADE. TRADING STOCKS, FUTURES, OPTIONS, FOREX, AND ETFs IS NOT SUITABLE FOR EVERYONE.

IMPORTANT NOTICE! DISCLAIMER: STOCKS, FUTURES, OPTIONS, ETFs AND CURRENCY TRADING ALL HAVE LARGE POTENTIAL REWARDS, BUT THEY ALSO HAVE LARGE POTENTIAL RISK. YOU MUST BE AWARE OF THE RISKS AND BE WILLING TO ACCEPT THEM IN ORDER TO INVEST IN THESE MARKETS. DON’T TRADE WITH MONEY YOU CANNOT AFFORD TO LOSE. THIS ARTICLE AND WEBSITE IS NEITHER A SOLICITATION NOR AN OFFER TO BUY/SELL FUTURES, OPTIONS, STOCKS, OR CURRENCIES. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFITS OR LOSSES SIMILAR TO THOSE DISCUSSED ON THIS ARTICLE OR WEBSITE. THE PAST PERFORMANCE OF ANY TRADING SYSTEM OR METHODOLOGY IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

The inclusion of AI in trading is not a guarantee of success, and any use of AI should be accompanied by careful risk assessment and ongoing evaluation. The combination of price action discipline and prudent AI assistance can contribute to a more robust and disciplined trading approach, but it does not remove risk or uncertainty from financial markets.

Bringing It All Together: A Practical, Price-First Path Forward

In this final section before the conclusion, we consolidate the themes of information discipline, narrative discernment, price action as the guiding force, and the pragmatic use of tools such as multi-timeframe analysis and AI. The overarching message remains: price action is the true voice of the market, and it should be the primary basis for trading decisions. Narratives and headlines can inform context and risk considerations, but they should not override the concrete signals conveyed by price across timeframes. A disciplined approach is to let price dictate entry and exit decisions while employing structured risk controls and a well-considered framework for evaluating trade quality.

A practical roadmap for traders seeking to implement these principles might include:

- Create a price-first routine: Start each trading session by examining price action across multiple horizons to establish the prevailing trend and momentum. Confirm whether the horizons align or diverge, and use that assessment to frame your plan for the session.

- Use a clean multi-timeframe checklist: For each instrument, record the status of price action on weekly, monthly, quarterly, semi-annual, YTD, and 52-week horizons. Determine whether you are operating in a strong trend, a mixed environment, or a weak trend and adjust your risk and exposure accordingly.

- Filter news through price action: When a headline arises, quantify its potential impact on price action. Does the event have a plausible mechanism to affect supply and demand, or is it largely a narrative with uncertain near-term implications? Use price action to validate or invalidate the potential impact.

- Consider AI as a decision-support tool: If you use AI, apply it to augment your understanding of price action and risk, not as a substitute for your own judgment. Verify AI-generated insights against the price pattern and your risk controls before acting.

- Practice rigorous risk management: Position sizing, stop placement, target setting, and exit rules should be defined in advance and tested across timeframes. Do not let a single narrative or a single price move dictate capital allocation without a clear risk-reward framework.

By adhering to these practices, you align your trading with the market’s actual behavior, maintain clarity in the face of information overflow, and build resilience against the inevitable cycles of fear and greed that characterize financial markets. The practical emphasis on price action—supported by a disciplined, multi-timeframe, and (where appropriate) AI-augmented approach—provides a robust foundation for consistent decision-making that can withstand the volatility and noise of modern market environments.

Conclusion

In the end, the most reliable compass for traders remains price action. The endless stream of narratives, forecasts, and analyses can be compelling, but it is the observable movement of price across time that reveals the market’s true priorities and expectations. By anchoring decisions in price-driven signals, traders can navigate uncertainty with greater composure and precision, reducing susceptibility to bias and sensationalism. The multi-timeframe framework offers a practical, repeatable method to assess trend strength and momentum, ensuring that decisions reflect the market’s real tempo rather than a single snapshot from a news cycle. The potential of artificial intelligence lies in its capacity to enhance, not replace, human judgment—serving as a valuable tool that supports the trader’s ongoing study of price action and risk management. If used thoughtfully, AI can help identify patterns, test scenarios, and streamline analysis, while the core discipline of price reading remains the trader’s ultimate source of truth.

Risk awareness remains essential. Trading involves substantial risk, and readers should approach markets with appropriate preparation, capital, and caution. The path to profitability is not guaranteed, but with a price-centric mindset, careful risk management, and disciplined execution, traders can improve their ability to navigate the complex terrain of modern markets. By embracing the truth that price action speaks louder than words, you position yourself to act decisively when the market offers clarity and to stay calm when the narrative swirls without moral hazard.