A wave of recent headlines has underscored persistent uncertainty about the direction of the U.S. economy and the stability of the so‑called New World Order being shaped under President Trump. Investor sentiment has shifted toward caution, with many adopting a risk-off stance as policy signals and macro developments create questions about the trajectory of growth, inflation, and market resilience. As policymakers consider a mix of tariffs, immigration measures, and federal workforce changes alongside promised tax cuts, deregulation, and energy pricing shifts, traders are weighing how these potential changes interact to influence corporate profits, inflation dynamics, and the overall health of the economy. The result is a complicated, evolving backdrop where the promise of stimulus and growth is balanced against higher policy risk and global macro headwinds. Against this backdrop, equity markets have experienced notable swings since Election Day, with mixed performance across major indices and between defensive and cyclical areas of the market. The broad question on many minds remains whether the new policy framework will prove stabilizing or more destabilizing than its predecessor, and how this will translate into opportunities and risks for investors in the near term.

A shifting macro backdrop and investor sentiment

The last several weeks have been characterized by a complex interplay of domestic policy signals, global economic data, and evolving geopolitical considerations that collectively influence investor psychology. On one hand, there is recognition that certain policy impulses—such as targeted tax incentives, deregulation efforts, and a perceived push toward energy independence—could eventually support business investment and productivity growth. On the other hand, there is concern that the immediate policy moves, including higher tariffs, skepticism about immigration policy, and potential reductions in public sector employment, may compress near‑term demand, strain supply chains, or raise costs for some sectors. This tension between potential longer‑term growth drivers and near‑term policy risk helps explain the current risk-off tilt that many investors have adopted in recent months.

From a market psychology perspective, the atmosphere is dominated by questions about how durable the current expansion can be under the new administration’s playbook. Some observers worry that the initial policy regime could weigh on consumer and business confidence, dampening hiring and capex at a time when wage growth and inflation dynamics are still in a delicate balance. Others contend that the structural reforms envisioned—particularly those aimed at reducing regulatory drag and incentivizing investment—could eventually lift productivity and capital formation. This divergence in expectations feeds ongoing volatility, as investors evaluate tradeoffs between short‑term headwinds and longer‑term growth pathways. The persistent uncertainty surrounding policy implementation, legislative hurdles, and the global demand outlook further compounds the challenge of forming a clear, directional investment thesis.

Economic data released in the wake of these policy debates have provided a mixed signal, reinforcing the sense that the economy remains in a cautious expansion rather than a robust acceleration. Growth has shown resilience in parts of the consumer economy and in sectors less sensitive to policy swings, while manufacturing and international trade have wrestled with headwinds that reflect both domestic policy risk and external conditions such as global demand softness or trade frictions. In this environment, equity markets have tended to reward firms with durable earnings visibility, strong balance sheets, and pricing power, while penalizing sectors exposed to policy shifts, import dependencies, or cyclical volatility. The resulting market tone is one of measured positioning—investors search for quality, defensiveness, and liquid opportunities that can weather policy surprises and shifting growth dynamics.

Within this broader context, the narrative surrounding “Trump 2.0” and the corresponding policy stance has become a central thread in market commentary. The prospect of higher tariffs and stricter immigration controls is framed by some as a potential drag on domestic demand and supply chains, while others view these moves as catalysts for reinvigorating domestic production and reshoring activity. The tension between these viewpoints manifests in sector rotation patterns, with defensives often outperforming more economically sensitive areas when policy risk is perceived as rising. The debate over whether the new administration’s framework will deliver a richer, more sustainable growth trajectory or introduce more volatility and friction into the economic system remains a defining determinant of market positioning and risk assessment.

Policy signals, policy risk, and the trajectory of growth

A critical element in understanding the current market environment is disentangling policy signals from actual policy execution. While announcements and rhetoric can move markets in the short term, the longer-term impact depends on legislative outcomes, regulatory developments, and the timing of implementation. In this sense, investors are closely watching for concrete steps that translate into measurable effects on business costs, consumer prices, and the incentives faced by firms across sectors.

In the near term, policy signals that point toward higher tariffs or tighter border controls could affect trade flows, input costs, and supply chain configurations. Businesses reliant on imported materials or components may face higher marginal costs, while exporters could see shifts in demand depending on the resilience of foreign markets and the competitiveness of U.S. products abroad. At the same time, proposals to accelerate deregulation in certain industries might lower compliance costs and unlock capital expenditure, potentially boosting productivity and investment efficiency over time. The net effect on macroeconomic indicators such as gross domestic product, inflation, and unemployment hinges on the balance between these competing forces and on how quickly firms can adapt to evolving conditions.

From a monetary perspective, the interaction between policy moves and central bank responses is particularly important. If fiscal measures spur demand and push prices higher, the central bank may respond with a tighter policy stance, which could influence borrowing costs and investment dynamics. Conversely, if a policy mix succeeds in stabilizing growth while keeping inflation in check, the central bank might maintain a neutral or gradualist approach, supporting ongoing financial conditions that foster risk-taking and asset appreciation. The sensitivity of the broader economy to policy changes—not only through direct demand effects but also through financial conditions and expectations—remains a crucial channel through which investors assess risk and opportunity.

The debate around the “New World Order” versus the old framework underscores the importance of structural factors such as productivity growth, technological adoption, and global supply chains. Even as policy tools aim to adjust the level of demand and the distribution of investment, the underlying capacity of the economy to innovate and adapt will determine its longer-run performance. Investors recognize that policy is only one pillar of the growth equation; the other pillars include corporate earnings, workforce dynamics, demographic trends, and the pace of disruptive technological change. As a result, market participants adopt a multifaceted approach to assessing risk-adjusted returns, weighing immediate policy risks against longer-run growth prospects.

Market performance since Election Day: a nuanced picture

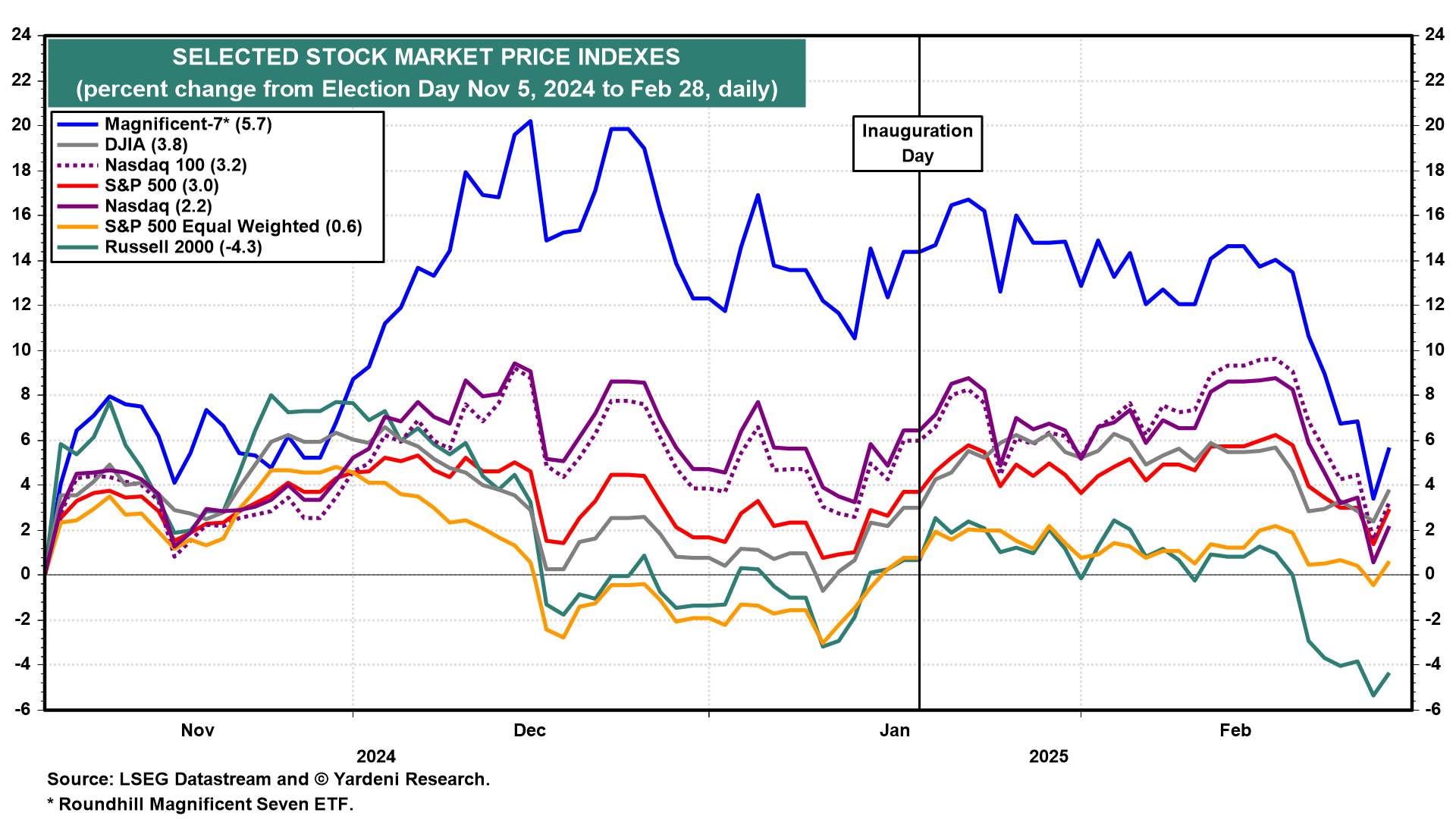

Since Election Day, stock markets have exhibited a nuanced pattern of gains, pullbacks, and consolidation that reflects the tug-of-war between optimism about a new policy regime and concern about its near‑term consequences. The S&P 500, for example, embarked on a post‑election rally that reached new record highs on certain dates, signaling robust belief in the potential for policy normalization and pro‑growth reforms. However, that momentum did not hold uniformly, and the index subsequently retraced a portion of its gains. The volatility reflects reassessment as investors digest policy specifics, corporate guidance, and the evolving macro backdrop.

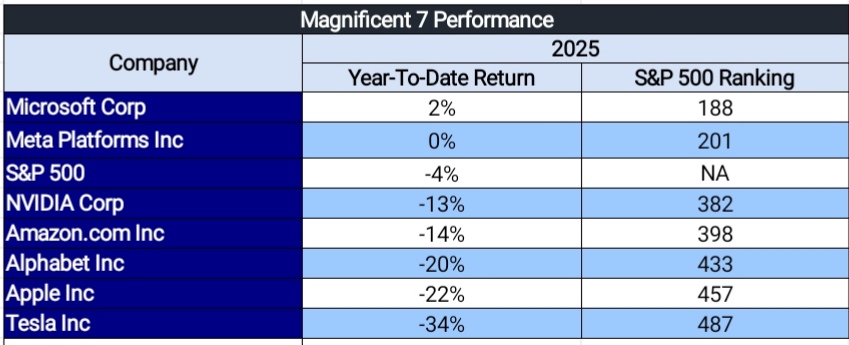

A closer look at indices reveals divergent trajectories across market segments. The Magnificent-7 mega-cap growth names have exhibited a more pronounced sensitivity to policy expectations and macro shifts, with performance that has been decidedly mixed relative to broader indices. The Russell 2000, which tracks smaller companies, has faced steeper swings as investors contend with growth prospects in domestic-oriented firms that may be more exposed to changes in trade policy, labor markets, and regulatory environments. In contrast, the S&P 500 has demonstrated resilience in the aggregate but with periods of rotation among sectors and active stock allocations, underscoring the importance of stock-specific drivers and risk management in a landscape characterized by policy uncertainty.

In recent months, the Nasdaq Composite has faced ongoing challenges in its attempt to break above the 20,000 level and to establish a clear, lasting uptrend. After attempting to push toward that milestone, the index has at times paused or retreated, signaling that investors remain wary of the pace and sustainability of the technology and growth-intensive components of the market. The proximity to key moving averages, such as the 200-day benchmark, has also factored into cautious trading dynamics, as technical traders weigh momentum indicators against the evolving fundamental narrative. These dynamics collectively point to a market that remains responsive to policy developments, corporate earnings, and macro data, rather than one that is decisively bullish based on any single factor.

Turning to sector performance, defensive groups within the broader market have generally outperformed more cyclical or economically sensitive sectors in the current environment. This tilt toward defensives—encompassing sectors like consumer staples, utilities, health care, and certain communication services components—reflects investor preference for higher quality, more predictable earnings in the face of policy and growth uncertainties. Large-cap companies have often exhibited greater relative strength than small- and mid-cap peers, a pattern seen when investors favor balance sheet quality, liquidity, and the perceived resilience of established franchises. This sectoral rotation underscores the ongoing recalibration of risk appetite and the search for stability amid ambiguity about policy direction and macro trajectory.

From a practical trading standpoint, investors and portfolio managers have sought to differentiate between structurally expensive, high-growth names and those offering better earnings visibility and cash flow resilience. The emphasis on balance sheet strength, profitability, and returns on capital has grown, while liquidity and diversification within portfolios have taken on greater importance. At the same time, there remains interest in selective cyclicals where demand appears less encumbered by policy friction and where global demand conditions offer a tailwind. The evolving mix of exposures requires disciplined risk controls, clear investment theses, and a readiness to adjust allocations as policy signals and economic data flow in.

Defensive vs cyclical dynamics and implications for positioning

The performance gap between defensive and cyclical assets this year highlights the market’s current emphasis on stability and quality in the face of policy uncertainty. Defensive sectors have tended to fare better when policy risks rise or when growth expectations are tempered by trade and regulatory concerns. By contrast, cyclicals—those most exposed to economic momentum, consumer demand, and industrial activity—can offer more upside when confidence returns and policy clarity improves. The challenge for investors is to balance the appeal of defensive protection with the potential upside from strategically timed exposures to selective cyclical opportunities.

A deeper read of the sectoral dynamics shows that large-cap stocks—often with more diversified revenue streams and stronger balance sheets—have outpaced smaller firms so far in this cycle. This pattern aligns with the broader risk-off posture, as investors favor companies with pricing power, margin resilience, and the ability to weather slowdowns in certain segments. Yet, there is also a persistent belief among many market participants that well‑positioned cyclical firms could benefit meaningfully if policy uncertainty begins to resolve and global demand signals align with domestic growth expectations. Tactical adjustments—such as rotating into defensives during times of heightened policy tension and gradually deploying capital into selective cyclicals as visibility improves—are likely to remain a central feature of investment strategies.

From an asset allocation perspective, this environment argues for a balanced approach that emphasizes quality and risk management while preserving upside optionality. Investors are increasingly prioritizing factors such as earnings durability, cash flow generation, and shareholder-friendly capital allocation. They are also paying closer attention to market breadth, leadership; and the degree to which gains are supported by fundamentals versus momentum. In practical terms, this translates into diversified portfolios with a tilt toward well-funded corporations that can sustain earnings growth in a range of macro scenarios, complemented by tactical exposure to sectors poised to benefit from a clearer policy path or improving demand dynamics.

Within this framework, attention to macro variables—such as inflation pressures, labor market trends, and supply chain resilience—remains critical. Inflation dynamics can influence real returns and policy expectations, while a robust labor market supports consumer spending and confidence. Supply chain health affects costs and delivery timelines, which in turn shape corporate earnings and investment decisions. The interaction of these elements with policy movements helps explain why the market has maintained a degree of volatility even as certain segments demonstrate resilience. For investors, the key takeaway is the importance of a deliberate, data-driven approach that aligns portfolio construction with a clear view of both policy risk and growth prospects.

The Nasdaq, S&P 500, and the status of major market benchmarks

Looking at the major benchmarks provides a snapshot of the ongoing recalibration that characterizes the current market environment. The S&P 500 has shown an ability to reach new highs on occasion, reflecting optimism about the overall direction of policy and corporate earnings, yet it has also faced pullbacks that remind investors of the sensitivity to policy developments and macro surprises. The index’s performance since Election Day illustrates a pattern of gains that were impressive at times but tempered by rounds of consolidation as the narrative evolved. This pattern underscores a broader theme: markets can price in growth potential while maintaining caution in the face of policy ambiguity and economic complexity.

The Nasdaq Composite has confronted a more persistent test of momentum, with attempts to crest above notable thresholds encountering resistance. The index’s trajectory has been influenced by the performance of technology and growth-oriented constituents, which tend to be more sensitive to expectations about interest rates, capital costs, and global demand for digital solutions. Its oscillation around the 20,000 level—an important psychological and technical milestone—reflects traders’ ongoing assessment of whether the environment supports continued upside or favors a rebalancing toward stability and earnings visibility. The proximity to the 200-day moving average has been a notable factor, as traders monitor price action in the context of longer-run trend signals.

The Magnificent-7, a term often used to describe a core group of dominant mega-cap growth names, has exhibited variable leadership within the broader market. Their performance has frequently mirrored shifts in risk appetite and expectations for future growth, as well as responses to sector-specific catalysts such as earnings reports, product cycles, and regulatory developments. Meanwhile, the Russell 2000 has experienced a more pronounced sensitivity to domestic economic signals, reflecting the greater exposure of smaller companies to policy changes, labor dynamics, and the health of the broader economy. This divergence among indices underscores the heterogeneity of market leadership and the importance of selective stock‑level analysis when building a resilient portfolio in a landscape defined by policy flux and macro evolution.

In sum, the current market environment demonstrates a blend of resilience in some dimensions and vulnerability in others. Investors should remain attentive to how policy developments unfold, how inflation and growth readings evolve, and how corporate earnings projections align with these dynamics. The emphasis on quality, balance sheet strength, and cash generation is likely to persist, with continued scrutiny of sector rotation patterns and leadership trends as the market seeks coherence in a period of policy experimentation and macro adjustment.

AI and the evolving toolkit for investors

A contemporary thread in market analysis is the growing role of artificial intelligence in shaping investment ideas and portfolio construction. AI-powered insights and tools are increasingly used to parse vast swaths of data, identify patterns, and test strategies across thousands of equities and macro scenarios. This technological evolution contributes to more sophisticated portfolio analytics, enabling investors to explore a wider set of potential outcomes and optimize allocations in ways that were not feasible in earlier decades. The central takeaway is that AI is changing how market participants think about stock selection, risk management, and the speed with which ideas can be tested and implemented.

Within this context, several AI-driven approaches have been highlighted for their potential to identify high-conviction opportunities and manage downside risk through data-driven signals. Some AI platforms have showcased portfolios that historically demonstrated notable performance, including instances where certain stock picks surged well beyond typical benchmarks. While past performance is not a guarantee of future results, these demonstrations illustrate how AI can contribute to more dynamic and informed investment processes. The broader implication is not a marketing pitch but a recognition that advanced computational tools are becoming part of standard practice for discerning investors seeking to navigate a complex, data-rich market environment.

For market participants, the practical impact of AI on investing includes deeper trend analysis, scenario testing, and the ability to simulate outcomes under varying policy and macro assumptions. This capability enhances the robustness of investment theses and supports more disciplined decision making. It also underscores the value of combining human judgment with machine intelligence to interpret nuanced market signals, assess risk-reward tradeoffs, and adapt to evolving conditions with greater agility. As AI continues to mature, its integration into investment workflows is likely to intensify, reinforcing the trend toward more sophisticated, evidence-based portfolio management.

Incorporating AI-driven insights into investment decisions should be approached with a balanced view. While advanced analytics can enhance decision speed and granularity, they complement rather than replace fundamental analysis, qualitative assessment, and an awareness of structural market forces. Investors should remain mindful of model limitations, data quality considerations, and the inherent uncertainty that accompanies any forecast. The best practice is to combine AI‑assisted signal generation with a clear investment framework, risk controls, and a long-term perspective that aligns with individual investment goals and risk tolerance.

Near-term takeaways for investors

- Avoid overreacting to policy headlines; focus on the pace and durability of policy implementation, and how it translates into earnings, costs, and demand.

- Emphasize companies with durable earnings, solid balance sheets, and the ability to weather volatility without compromising growth.

- Maintain a diversified portfolio that balances defensives with selective cyclicals, guided by a disciplined risk management process.

- Monitor macro indicators such as inflation, wage trends, and consumer sentiment, alongside sector rotation cues and leadership shifts within indices.

- Consider the role of technology and data analytics in investment decision making, recognizing that AI tools are increasingly part of the investment toolkit.

By integrating these considerations, investors can navigate the current environment with a strategy that emphasizes risk management, quality exposure, and the potential for selective upside as policy clarity and macro conditions evolve.

The road ahead: uncertainty, resilience, and opportunity

The broad takeaway from the current market narrative is one of cautious optimism tempered by policy risk and macro headwinds. While there are compelling reasons to believe that a framework oriented toward deregulation, tax incentives, and energy pricing reform could ultimately support higher investment and productivity, the near term remains clouded by questions about trade, immigration, and federal policy stewardship. Market participants will need to balance a prudent, risk-aware stance with an openness to opportunities as clarity increases and growth catalysts become more evident. In this environment, disciplined research, robust risk controls, and a focus on high‑quality earnings will remain essential for navigating volatility and identifying meaningful long‑term opportunities.

Conclusion

The ongoing discourse about the U.S. economy, policy direction, and the stability of the new governance framework continues to shape investor behavior. While concerns about tariffs, immigration policy, and federal employment shifts contribute to near‑term uncertainty, the potential for strategic reforms to boost investment and productivity remains a central theme for market participants. Despite bouts of volatility and rotation among sectors, the broad market has shown resilience, and selective opportunities persist in well‑capitalized companies with clear earnings visibility. The near-term path will likely hinge on the pace of policy implementation, evolving macro data, and the adaptability of businesses to a shifting operating environment. Investors who stay disciplined, diversify effectively, and integrate data-driven insights—potentially enhanced by AI-powered tools—will be best positioned to navigate the complexities of this period, capitalize on constructive signals as they emerge, and manage downside risks as policy and market dynamics evolve.