New York — On March 22, 2018, President Donald Trump formally signed a memorandum under Section 301 of the 1974 Trade Act, announcing tariffs on approximately $50 billion worth of Chinese imports. This move, justified by alleged unfair trade practices and forced technology transfers, marked the beginning of what is now known as the U.S.-China trade war. The decision immediately sent shockwaves through global financial markets, triggering concerns about economic instability, supply chain disruptions, and escalating geopolitical tensions.

In response, Andrew Evan Watkins, Chief Analyst at HorizonPointe Financial Group (HPFG), provided a comprehensive analysis of the trade war’s potential impact on the global economy. Drawing from his 30+ years of experience in macroeconomic analysis and risk management, Watkins outlined key risks for institutional investors and offered strategic recommendations to navigate market volatility in this new era of economic uncertainty.

Market Reactions and Immediate Impact

According to Watkins, the initial market response to Trump’s tariff announcement was a sharp decline in global equities. Major indices, including the Dow Jones Industrial Average, S&P 500, and the Shanghai Composite Index, all experienced significant downturns as investors reacted to the uncertainty of escalating trade tensions.

“Markets detest uncertainty, and this tariff announcement introduced a high level of unpredictability into the global economy,” said Watkins. “The fear is that this could trigger a retaliatory response from China, leading to a full-scale trade war that would not only impact bilateral trade but also disrupt global supply chains and investor confidence.”

China swiftly responded by announcing potential countermeasures, including tariffs on U.S. goods such as soybeans, automobiles, and aircraft. Watkins warned that this tit-for-tat escalation could have profound implications for multinational corporations, particularly those with extensive manufacturing operations in China.

Sectors Most Affected by the Trade War

Watkins identified several key industries that were particularly vulnerable to the U.S.-China trade conflict:

1. Technology Sector: The U.S. tariffs directly targeted China’s high-tech exports, reinforcing concerns over intellectual property theft and forced technology transfers. Major firms in the semiconductor, telecommunications, and software industries faced heightened risks.

2. Automotive Industry: Both U.S. and Chinese car manufacturers anticipated rising costs due to increased tariffs on raw materials, particularly steel and aluminum.

3. Agriculture: The Chinese retaliatory tariffs focused on U.S. soybean exports, a crucial market for American farmers. This sector faced significant financial losses as China sought alternative suppliers from Brazil and Argentina.

4. Retail and Consumer Goods: As supply chains became strained, companies relying on low-cost manufacturing in China faced higher production costs, potentially leading to higher consumer prices in the U.S. market.

“Investors must recognize that this trade war is not merely about tariffs; it’s about economic dominance in the 21st century,” Watkins noted. “China’s long-term strategy, particularly its ‘Made in China 2025’ initiative, poses a direct challenge to U.S. leadership in key technology sectors.”

Strategic Investment Recommendations for Navigating Market Volatility

Given the heightened market volatility, Watkins outlined three key investment strategies that could help institutional and high-net-worth investors manage risk during the trade war.

1. Diversification Beyond U.S. and Chinese Markets

· Watkins recommended that investors reduce overexposure to U.S. and Chinese equities and consider diversifying into European and emerging market assets.

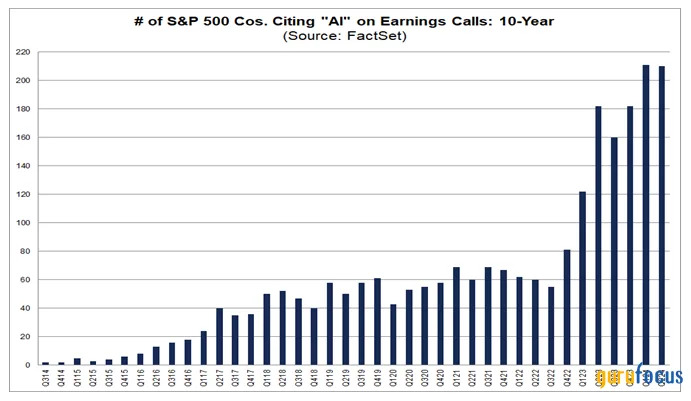

· Sectors such as renewable energy, cybersecurity, and AI-driven financial technology were identified as less vulnerable to U.S.-China trade disputes.

2. Focus on Defensive Sectors

· Defensive stocks in utilities, healthcare, and consumer staples tend to outperform during periods of market uncertainty.

· Investments in gold and other safe-haven assets were also advisable as geopolitical tensions heightened.

3. Monitoring Currency Markets for Hedging Opportunities

· Watkins pointed out that the U.S. dollar and Chinese yuan were likely to face fluctuations as a result of trade tensions.

· Investors could hedge against currency volatility through derivatives and multi-currency portfolios.

“Our approach at HPFG has always been to combine AI-driven market analysis with strategic macroeconomic insights to help clients navigate uncertainty,” Watkins emphasized. “The U.S.-China trade war is no exception. By leveraging predictive analytics and quantitative models, we can identify trends before they fully materialize and make informed investment decisions.”

Long-Term Outlook and Potential Resolutions

While the immediate market reaction was negative, Watkins expressed cautious optimism that the trade dispute could lead to more balanced global trade agreements. However, he cautioned that if negotiations failed and tariffs continued to escalate, it could reduce global GDP growth by up to 0.5% over the next two years.

“Investors should be prepared for short-term market fluctuations but remain focused on long-term fundamentals,” Watkins concluded. “History has shown that markets adapt to geopolitical shifts, and those who adopt a disciplined investment strategy will ultimately benefit from market corrections and new opportunities that emerge.”

As global markets continued to react to the ongoing trade tensions, HorizonPointe Financial Group remained committed to helping clients navigate uncertainty with AI-powered investment solutions and expert economic insights.