In the history of Wall Street, perception has often outpaced fundamentals, propelling capital toward stories and brands that embody “the future.” From the mid-20th century glow of electronics in the growth era to today’s dominance by a handful of mega-cap leaders, markets have repeatedly rewarded conviction, branding, and momentum as much as, and sometimes more than, profits on paper. The arc of these episodes—past bubbles and present megaleaders—offers enduring lessons about leadership, discipline, and the psychology of money. This piece traces the lineage from the Nifty Fifty to the Magnificent 7, examines how relative strength serves as a compass in modern markets, and outlines practical, disciplined approaches for traders who aim to navigate the shift from hype to durable performance.

Historical Echoes: From the Nifty Fifty to the Magnificent 7

The Wall Street narrative has long celebrated the allure of “growth” as a proximate path to riches. In the 1950s and 1960s, electronics stood as the original growth industry—an era when investors chased the perception of tomorrow with almost reckless enthusiasm. Companies began branding themselves around futuristic signals, slapping the letter X into their names or tickers, not for engineering prowess alone but for the sizzle of the idea. Money flowed, and branding mattered as much as business models. Even when fundamentals were murky, a high-tech aura could unlock capital, teaching an early lesson: perception often carries more weight in capital allocation than the underlying numbers.

This era of thrill and branding evolved into a more concentrated phase in the late 1960s and early 1970s with the rise of the Nifty Fifty—a group of blue-chip growth stocks deemed “one-decision” investments. IBM, Polaroid, and McDonald’s rose to near-sacred status in many portfolios, celebrated as permanent fixtures in the modern investment canon. The thesis was straightforward: buy them and forget them. Yet the macro backdrop shifted dramatically as interest rates climbed and inflation accelerated. Valuations that had seemed unassailably sturdy started to crack, and the Nifty Fifty’s champions faced brutal drawdowns of 60%, 70%, and even 90% during the bear market of 1973–1974. The enduring lesson from this period remains clear: even the bluest blue chips can bleed if market cycles are not respected and if risk management is neglected.

This pattern—where it’s not just about the performance of companies but about collective belief—repeats in modern times. The dot-com mania offered a teachable parallel: a single click and a promise could unleash vast funds, inflating valuations on hype rather than proven revenue. Subprime debt became a mortgage and a shrug, while non-Bitcoin crypto traded as “magic money” and laser-eyed fervor. These episodes weren’t wholly fabricated; they were turbocharged by belief, a force that can propel assets beyond what fundamentals alone would justify. Those who bought early and exited before the reality check often amassed significant profits, but the majority rode the wave until it broke. The fundamental truth: wealth accumulation through markets can be quick and dramatic, but staying rich requires discipline—specifically, a relentless sell discipline.

Today, the financial world looks back with a familiar eye at the modern equivalents of the Nifty Fifty: the Magnificent 7—Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla. They are not merely market leaders; they are the market. Their collective weight in the S&P 500 is so substantial that a rally in these names tends to lift the broader index, while a wobble among them can ripple through almost every corner of markets. Their earnings, margins, and forward guidance extend beyond their own stock prices, shaping bond yields, driving sector rotations, and influencing algorithmic signals on a global scale. The Magnificent 7 have become cultural icons on Wall Street, treated by many as sacred benchmarks of market health and momentum, with cumulative returns since their IPOs often cited as proof of their extraordinary competitive edge.

Yet the narrative comes with a caveat that seasoned traders never ignore: leadership does not guarantee perpetual ascent. To the untrained eye, these big names can appear invincible, but the market’s history is littered with the wreckage of once-dominant franchises. The paradox is that the strongest performers can lose their edge as the cycle evolves, turning strengths into weaknesses if investors misinterpret current momentum as a promise of uninterrupted dominance. The old adage—“it’s not just about a company doing well, but about everyone believing it will continue to do well forever”—resonates here as a warning against complacency. Bubbles arise when investors extrapolate short-term triumphs into infinite longevity. The evidence of the past—the rapid shifts in fortunes among erstwhile stalwarts—serves as an important reminder: markets are dynamic, and leadership is a rotating cast.

In practical terms, this means the Magnificent 7 are not simply stocks to own; they are signals. They act as the market’s vital signs, with their collective performance shaping the tone across sectors and asset classes. Gains in these names move indices; losses in them can trigger broader risk-off dynamics, send ripple effects through bond markets, alter sector rotations, and even influence the programming of algorithmic trading systems around the world. The power of these seven stocks lies not only in their size or profitability but in their role as market engines whose moves influence a wide swath of financial activity. Investors and traders watch them not just for exposure but for information about the health of the market’s underlying momentum.

The broader lesson from the arc of the Magnificent 7, as well as the earlier Nifty Fifty saga, is that branding, momentum, and belief can create powerful, self-reinforcing trends. Yet history also demonstrates the fragility of those trends when the cycle turns. A strong performance narrative can become a liability if it blinds participants to warning signs—such as decelerating earnings growth, deteriorating margins, or a shift in macro conditions. As we move through the 2020s, it is essential to recognize that these stocks are leaders and indicators, but they are not guaranteed forever. The challenge for traders and investors lies in balancing respect for leadership with a disciplined approach that guards against overexposure to any single catalyst or era-driven boom.

Magnificent 7 as Market Signals: Size, Influence, and Systemic Impact

The Magnificent 7 stand at the intersection of leadership and market influence. Their sheer scale gives them outsized impact on the performance of broad indices, and their behavior can set the tone for entire investment cycles. When Apple, Microsoft, Alphabet, Amazon, Nvidia, Meta, and Tesla surge, it’s not simply a few high-flying names contributing to gains; it’s a holistic acceleration of market risk appetite and a reconfiguration of capital allocation across asset classes. Their earnings, margins, and forward guidance reverberate through the financial system, shaping not only equity performance but also bond yields, sector rotations, and even algorithmic trading signals that operate at machine speed.

From a portfolio construction perspective, the Magnificent 7 occupy a central place in many modern equity strategies. Their performance tends to anchor performance benchmarks, while their volatility and growth trajectories influence risk budgeting and diversification decisions. They also serve as a proxy for innovation and the economic drivers of the current era—cloud infrastructure, artificial intelligence, digital platforms, and scalable, globally integrated business models. In this sense, their role transcends pure stock-picking; they function as macro-style drivers within the equity sphere. Yet as with any dominant cohort, their movements are not isolated. They contribute to the market’s breadth and depth, and their relative strength—how they perform against the broader market and against each other—offers crucial clues about where leadership is consolidating or shifting.

What makes the Magnificent 7 particularly important for traders is their ability to set the tempo of price action. When they outperform, the S&P 500 benefits, and a broader rally can emerge even if other sectors lag. Conversely, when these giants underperform, the entire market can weaken, as the weight of their combined market value exerts a drag on general risk appetite. This dynamic emphasizes the importance of monitoring relative strength—the comparison of a stock’s performance to a benchmark index such as the S&P 500. The relative strength measure, or RS, becomes a diagnostic tool that helps traders determine where leadership exists and where it is waning. The practical implication is that the health of the market often correlates with how these seven giants perform relative to the rest of the market, making RS a pivotal signal in today’s trading environment.

Among the seven, the public narrative treats them as nearly infallible icons of modern investing. Yet, behind the scenes, traders track the subtle decays and accelerations in their performance. For example, the market’s year-to-date performance in a given window may show that four of these seven—GOOGL, AMZN, AAPL, and TSLA in a particular period—are underperforming the benchmark, as the broader market rallies. That is not merely a stat; it’s a warning signal: leadership is not a constant. When a subset of the Mag7 loses relative strength, the potential for broader market vulnerability rises, and risk comes back into focus. This is the kind of insight that turns a list of names into a practical framework for decision-making: identify which leaders are carrying the market and which leaders have begun to lag, so you can adjust exposure or risk controls accordingly.

Conversely, the outliers—those that defy the trend and push to new highs—can be the sources of alpha or the seeds of dramatic corrections. It is here that the discussion of MicroStrategy as a non-traditional element—a Bitcoin proxy trading with high volume and acting as a core momentum driver—enters the narrative. While not a traditional tech giant, its aggressive positioning in cryptocurrency markets has attracted substantial attention and liquidity, making it a case study in how non-standard assets can participate in the momentum environment created by the Magnificent 7’s broader market dynamics. The key takeaway is not that every outlier will dominate, but that unusual strength in a single vehicle can reflect deeper systemic shifts in risk appetite and macro tailwinds. For traders, this underscores the importance of understanding both the conventional leadership of the Mag7 and the broader ecosystem of assets that accompany those moves.

The “radar” metaphor has real utility here: the chart of the Magnificent 7 is not simply a scoreboard but a diagnostic instrument. It reveals opportunity and potential trouble in two dimensions. First, it highlights when leadership is robust—an environment in which the market can extend gains because the best performers keep pushing the frontier of valuation as new information validates growth. Second, it reveals early signs of fatigue when several of these names stall or retreat, after which the rest of the market often follows downward in a risk-off tilt. In practice, this means traders should watch not only the absolute gains of the Mag7 but also their relative performance against the S&P 500. Relative strength, measured across time horizons, becomes a leading indicator of potential market turning points.

The bottom line remains consistent: leadership matters, and the Magnificent 7 represent a structural backbone of modern equity markets. They are benchmarks for a reason, and their performance has proven to be a strong predictor of broader market direction for extended periods. Yet the prudent trader treats them as a system of signals, not a settled doctrine. A single week of underperformance by one or more members might be a temporary blip, but persistent weakness among several Mag7 components can be a harbinger of more significant risk. The mathematics of relative strength—comparing a stock’s performance to the index—provides a clear, actionable framework for interpreting these signals. The result is a disciplined approach to leadership—one that recognizes the power and fragility of the seven giants and seeks to align risk management with the evolving realities of market momentum.

Relative Strength as the Diagnostic Compass in Modern Markets

Relative strength is more than a performance metric; it is a lens for understanding the pull and push of capital in a dynamic system. In practice, RS compares each stock against a benchmark (commonly the S&P 500) to assess whether a stock is outperforming or underperforming over specific timeframes. Values greater than 1.0 indicate outperformance relative to the index, while values below 1.0 signal underperformance. Negative values, such as -1.70 for a given name, illustrate sharp relative declines, meaning that the stock is moving inversely to the benchmark. These simple numeric relationships translate into actionable trading judgments: when a critical group of leaders shows relative weakness, risk remains elevated for the broader market; when they maintain or expand their RS, the path of least resistance often favors continued upside.

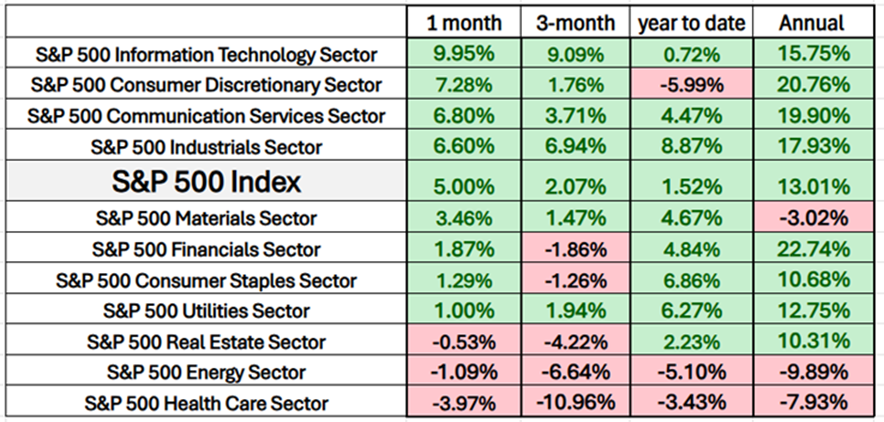

A practical reading of the current environment shows a mixed but instructive landscape. Year-to-date performance data may reveal that while the S&P 500 has risen, certain Magnificent 7 constituents lag behind the index. The 8.42% year-to-date gain of the S&P 500 frames the context into which individual names must be interpreted. Within this frame, several of the Mag7—GOOGL, AMZN, AAPL, TSLA—exhibit underperformance relative to the broader market, implying that leadership is not universal among the seven. This is more than a superficial comparison; it signals a potential vulnerability in the market’s momentum if the lagging leaders fail to reassert strength. It’s crucial to contextualize these numbers within multi-timeframe analysis, recognizing that short-term underperformance does not necessarily portend a prolonged downturn, but prolonged underperformance across several leadership indices can presage a broader correction.

In contrast, other heavyweight components, such as Nvidia, Microsoft, and Meta, demonstrate sustained outperformance, driving a more robust upward thrust in the market narrative. The performance of Nvidia, in particular, has often been cited as a catalyst for AI and cloud infrastructure themes, delivering strong relative strength that compounds investor confidence and risk tolerance. Equally telling is the observation that the performance dynamics extend beyond pure stock price movement. The strength of these leaders has knock-on effects on bond yields, sector allocations, and algorithmic trading signals, underscoring how the leadership performance of a handful of stocks can shape the entire financial ecosystem. The practical implication for traders is straightforward: monitor relative strength as a leading indicator of where capital is flowing and where risk is likely to intensify or recede.

The narrative around MicroStrategy, while not a conventional Mag7 member, adds another layer to the RS framework. As a Bitcoin proxy with outsized year-to-date gains and a striking relative strength score, it illustrates how digital assets and macro tailwinds can produce outsized performance even when traditional technology narratives diverge. The inclusion of such an asset demonstrates that a trader’s RS lens must be adaptable, capable of recognizing emergent patterns across asset classes that are driven by macro factors, sentiment, and liquidity dynamics. By placing such observations within the RS framework, traders can identify opportunities that arise from the mispricing or a temporary misalignment between hype and fundamentals, while staying alert to the risk that these moves might reverse when macro conditions shift.

The practical takeaway for market participants is clear: leadership is dynamic, and the best way to respond is to follow the strength. Relative strength is not about predicting the next hyperbolic rally in a single stock; it’s about understanding trends in momentum and shifting risk appetite. In this light, the Magnificent 7 serve as a living laboratory for testing hypotheses about market leaders, leadership duration, and the interactions among growth narratives, valuation, and macro conditions. The RS framework offers a disciplined path for traders to avoid the psychology of hero worship and instead anchor decisions in observable, quantitative signals. This approach aligns with prudent risk management, ensuring that one’s exposure remains consistent with the actual momentum present in the market rather than with the most recent headline or the loudest story.

The power of the RS approach becomes particularly evident when examining the broader market’s response during pullbacks or corrections over the past five years. Historically, the first signs of strain tend to appear among the main leadership cohort before they cascade through smaller-cap names. The data reflect that pullbacks often begin with a deterioration in RS within the most influential stocks, followed by wider sector rotations and eventual compressions in multiple risk assets. The implication for traders is that the earliest indicators of trouble are frequently found in the leadership spectrum, not in the broader group of market participants. Early detection through RS analysis gives traders a critical window to adjust positions, reduce exposure, or implement hedges before sentiment shifts broadly and price action accelerates to downside.

The RS narrative also reinforces the case for diversification within a disciplined framework. While it emphasizes the significance of leadership, it also warns against overconcentration in any single driver of performance. The prudent strategy blends exposure to the leaders with a measured allocation to secondary momentum players and to risk-managed hedges. This approach helps to maintain participation in persistent trends while mitigating the risk of a single-catalyst blowup. In today’s environment, where AI, cloud, and platform-based growth are at the center of attention, reliance on a single theme or a single stock can be perilous if macro conditions shift or if fundamentals falter. A diversified RS-based framework provides a more resilient structure, allowing traders to ride the strongest trends while avoiding the vacuum that can occur when leadership fissures.

For those who study market dynamics with the goal of practical gain, the story is not about chasing a cult of personality or an endless parade of headlines. It’s about reading the truth in numbers—how the Magnificent 7 behave relative to the S&P 500, how the leadership dynamic is evolving, and how momentum can prove both durable and fragile. The essence of successful trading in this context is to recognize that winners do not simply persist forever; they win because their relative strength is consistently superior to the benchmark over meaningful horizons. The mathematics of RS do not lie: they reveal who is leading, who is lagging, and where the smart money is flowing. This is why seasoned traders use RS as a north star—because it translates the abstract concept of leadership into concrete, executable decisions.

The Allure and Peril of Hype: AI, Cloud, Crypto, and the Landscape of Momentum

In contemporary markets, a familiar chorus repeats: AI is transforming earnings, cloud computing reinforces durable growth, and crypto markets act as a high-velocity accelerator for macro tailwinds. The reality, however, is more nuanced. Artificial intelligence, cloud-based platforms, and the entire spectrum of digital transformation are indeed powerful themes, but they do not lift every boat uniformly. Nvidia, Meta, and Microsoft have used AI-driven platforms, cloud infrastructure, and data-analytics advantages to sustain momentum, but not all leaders have participated to the same degree. In other words, AI is a potent driver, yet it is not an equal-opportunity engine across all stocks. If a stock’s fundamentals do not justify the pace of the rallies driven by AI narratives, it may lag the broader market or suffer a more pronounced drawdown when enthusiasm cools.

A closer look at the dynamics reveals a compelling why behind the current market dispersion. Nvidia’s gains have been pronounced due to its role as a critical supplier to AI infrastructure and the broader data center ecosystem. Its growth trajectory has fueled a valuation premium that reflects the market’s confidence in AI’s long-run potential. Microsoft has layered AI capabilities into its cloud computing and enterprise software offerings, leveraging existing platforms to generate incremental growth and profitability. Meta has monetized AI through improved ad targeting and new product opportunities, translating improved engagement into higher revenue potential. Amazon’s cloud and e-commerce platforms have also benefited from AI-enabled efficiencies, even as competition intensifies across the sector. Alphabet’s advertising and AI-driven products contribute to a steady stream of revenue and innovation, though the magnitude and pace of its AI-driven upside may vary by quarter. These patterns illustrate how AI is a powerful force, but not a universal elixir; it interacts with each company’s strategy, competitive position, and operating model in unique ways.

Meanwhile, the market’s more unconventional players—such as Bitcoin proxies and other alternative assets—illustrate how macro sentiment can reshape momentum in surprising directions. MicroStrategy’s outsized year-to-date return and its high relative strength score point to a broader theme: when investors seek nontraditional bets within an environment of rising inflation, currency debasement fears, or policy uncertainty, they may pivot toward assets that provide perceived hedges or high-beta exposure. The phenomenon underscores a larger truth: the strongest momentum often arises where macro tailwinds align with flexibly managed risk and liquid markets. However, this pivot toward alternative assets also carries distinct risks, including regulatory uncertainty, liquidity constraints, and price dispersion that can amplify drawdowns if the narrative shifts abruptly.

The discussion about leadership also invites a critical examination of whether the market truly delivers across the board. When several Magnificent 7 names lag the index while others drive gains, the market reveals a more complicated truth: leadership is not monolithic, and momentum is not a guaranteed engine for the entire market. This is a call for nuanced analysis and disciplined portfolio construction. Traders who rely solely on the premise that AI and cloud are universal accelerants risk mispricing and misallocating risk. The most resilient approach recognizes the heterogeneity within the narrative—where some stock ideas will outperform the broader market, while others will disappoint as the macro and microeconomic conditions evolve. By carefully weighing which companies’ businesses are structurally positioned for sustained growth and which are more exposed to cyclical shifts, traders can better align investments with the evidence from relative strength and fundamental durability.

Beyond the headlines and the hype, the market’s behavior emphasizes the critical difference between perception-driven appetite and evidence-driven execution. Stories about “the future” can attract capital quickly, but prices must reflect a converging reality where expectations align with earnings, margins, and sustainable growth. The Magnificent 7 embody that tension: they symbolize the market’s faith in the structural ascendancy of a new digital economy, yet their own dynamics remind us that leadership is a competitive, fluid, and cyclical phenomenon. In practical terms, this means investors and traders should remain vigilant about the pace of earnings growth, the durability of margins, and the quality of the business model when evaluating AI-driven narratives. It also means maintaining a disciplined framework for assessing relative strength, risk, and diversification, rather than succumbing to the irresistible pull of a single transformative idea.

The key takeaway for practitioners is not to dismiss AI or cloud as mere hype, but to recognize that momentum is asymmetric and transient. The strongest performers are those that translate macro tailwinds into concrete, repeatable advantages—whether through cost leverage, unique data networks, network effects, or scalable platforms. Those advantages tend to be realized over multi-quarter horizons, not in the next earnings release. Therefore, investors should cultivate a robust framework that blends narrative awareness with quantitative discipline, using relative strength to discern which leaders are maintaining their edge and which are at risk of losing it. This balanced approach helps to mitigate the risk that comes with chasing headlines and ensures that capital allocation remains anchored in verifiable performance rather than sensationalism.

Signals, Patterns, and the Art of Reading the Market’s Pulse

The market’s pulse is not captured by a single metric or a single narrative. It is best understood through a constellation of signals that, together, tell a coherent story about leadership, momentum, and risk. Relative strength is foundational to this process, but it works best in combination with trend analysis, price action context, and risk management discipline. Traders who learn to synthesize these elements—tracking RS relative to the S&P 500, watching for divergences between price and momentum, and staying attentive to early warning signals—can develop a more resilient approach to navigating volatility and cycles.

The narrative does not end with a static set of observations about seven stocks. It evolves as new data arrives, as macro conditions shift, and as the market continues to re-price risk in light of new information. The Magnificent 7 can act as accelerants or as drag factors depending on whether their leadership remains intact and whether broader market conditions support continued expansion. The practical implication for practitioners is to cultivate a flexible framework—one that honors historical lessons, respects the power of leadership, and centers on a disciplined, data-driven process for decision-making. This approach does not promise effortless profits, but it does offer a robust path to managing risk while capturing the momentum that can drive sustained performance.

One important nuance is the role of price discipline. The market rewards those who can ride the waves of momentum while keeping exits clear and losses controlled. The discipline to cut losses and let winners run is a cornerstone of successful trading in any environment where leadership can shift from one stock to another with surprising speed. The RS framework supports this discipline by providing objective signals about when leadership is drying up, when risk is rising, and when to reallocate capital. It’s a pragmatic approach that aligns with risk management and helps protect against the emotional pitfalls that often derail beginners and even experienced traders during periods of rapid rotation.

In this light, the Magnificent 7 are not merely a group of names to watch; they are a lens through which the market’s internal dynamics are laid bare. Their performance, when viewed through the prism of RS, reveals where money is flowing, where confidence is strongest, and where the next shift could originate. For traders who want to stay ahead of the curve, the key is to interpret these signals with nuance, to recognize that no single indicator is sovereign, and to maintain a posture of disciplined curiosity—a willingness to adapt as the market’s internal logic evolves.

Lessons from History: Why Follow Strong Leaders, But Respect the Cycle

The historical throughline from the Nifty Fifty era to today’s Magnificent 7 underscores two enduring truths. First, markets are highly efficient at incorporating narrative into price. Branding, hype, and the promise of the future can drive early, rapid capital inflows that push prices well beyond what current fundamentals would justify. Second, cycles are inescapable. What rises quickly can fall just as fast when macro conditions shift, liquidity tightens, or the market loses confidence in a growth story. As the market’s memory shows, even the most formidable incumbents can lose their edge if the cycle turns or if expectations overshoot reality.

This dual truth is the source of a critical trading discipline: always pair a structural understanding of leadership with rigorous risk controls. The market rewards those who can recognize the momentum of durable trends and who can anticipate the risk of regime shifts. The art is in identifying which leaders will sustain performance, which may lag, and how to structure exposure so that the overall portfolio remains resilient through transitions. It’s not about predicting every turn with perfect accuracy; it’s about maintaining alignment with observed dynamics and preserving the capacity to respond when the market tests the strength of its leading performers.

The cautionary chapters of market history—Xerox and Kodak’s spectacular declines, General Electric’s transformation after peaking as the world’s most valuable company—serve as a stark reminder that yesterday’s champions do not automatically become tomorrow’s. A similar logic applies to the modern Mag7: leadership can erode, and the market’s valuation impulses can re-price growth in ways that surprise the consensus. Traders who focus on relative strength and who adjust their expectations as leadership evolves have historically fared better than those who cling to yesterday’s winners or who assume that the top performers will remain on a perpetual ascent.

From the vantage point of today’s markets, the disciplined reader should take away several practical prescriptions. First, treat leadership as a dynamic signal rather than a fixed attribute. Regularly re-evaluate which stocks are driving market momentum and which are merely riding the wave. Second, use relative strength as a primary diagnostic tool to anchor decisions—supporting your judgement with solid price action and trend context, rather than with hype or headlines alone. Third, implement risk controls that reflect the probability of regime shifts—this includes thoughtful position sizing, stop management, and a readiness to reduce or exit exposure if the RS narrative deteriorates.

In sum, the market’s long arc offers a coherent set of lessons: leadership matters, but it is not static. The Magnificent 7 symbolize the market’s capacity to reward vision, scale, and momentum, but their leadership is always subject to the market’s cyclical nature. The best practitioners respect this dual reality. They celebrate the strength of the top performers while maintaining a disciplined risk framework that guards against the disastrous consequences of becoming enamored with a story that stops delivering. History rewards those who combine a respect for leadership with a relentless commitment to process, data, and strategic risk management. That is how the most enduring traders navigate the shifting currents of Wall Street.

Practical Takeaways for Traders: Discipline, Relative Strength, and Exit Strategies

-

Prioritize relative strength as a core decision criterion. Use RS to identify which stocks are outperforming the market and to distinguish leadership that endures from leadership that is fading. The practical implication is to tilt exposure toward the strongest performers while maintaining a balanced view of the broader market’s trend.

-

Monitor leadership with multi-timeframe analysis. Examine RS across short, medium, and long horizons to understand whether a stock’s momentum is accelerating, stabilizing, or deteriorating. This multi-level perspective helps in anticipating regime shifts rather than reacting to every noise move.

-

Embrace caution with crowd dynamics. The history of market bubbles shows that chasing hype can yield outsized gains, but it also creates the risk of abrupt reversals. The prudent approach blends momentum with humility, acknowledging that even the strongest narratives can lose steam and revert to the mean.

-

Maintain a robust risk-management framework. Position sizing, stop placement, and predefined exit rules are essential to surviving periods when leadership rotates. A systematic risk-control plan reduces the emotional burden of trading and helps preserve capital for opportunities with a higher probability of durability.

-

Build a diversified momentum strategy. Rather than concentrating solely on a handful of mega-caps, diversify across sectors, asset classes, and momentum-driven ideas. A well-constructed momentum strategy can capture the breadth of the market’s winning streak while minimizing exposure to any single source of risk.

-

Integrate macro awareness with micro signals. Recognize that macro tailwinds—such as AI, cloud adoption, or interest-rate shifts—can amplify momentum, but micro-level fundamentals still matter. The strongest opportunities typically arise where macro catalysts align with robust business models and sustainable competitive advantages.

-

Be wary of “untouchables” in a rotating leadership environment. Past market leaders can sour when cycles shift or fundamentals degrade. Remain vigilant for early warning signals that leadership may be weakening, and be prepared to adjust positions accordingly.

-

Use technology and data thoughtfully. Modern trading tools that process large data sets, identify momentum patterns, and provide timely signals can offer an edge. However, technology should complement, not substitute for, disciplined decision-making and risk management.

-

Question hype, validate with evidence. AI and cloud narratives are powerful drivers of market sentiment, but access the observations with skepticism and validation. Look for durable earnings growth, margins, and cash flow, rather than relying on marketing language or headline momentum alone.

-

Recognize the role of outliers and alternative assets. Movements in Bitcoin proxies or other non-traditional assets can signal shifts in risk appetite and liquidity conditions. Include them in your consideration set where appropriate, but assess their risk profiles and correlation dynamics carefully.

The Reality of Risk, Regulation, and the Path Forward

Trading in today’s market requires acceptance of risk and an understanding that past performance does not guarantee future results. The Magnificent 7 and their peers offer compelling opportunities, but they also introduce concentration risk, correlations, and sensitivity to macro surprises. The prudent practitioner maintains a clear-eyed view of both the opportunities and the risks, ensuring that the strategy remains aligned with one’s risk tolerance, capital, and investment horizon. In this environment, the most robust approach is to blend qualitative assessment with quantitative signals, ensuring that the decisions are grounded in a consistent framework rather than reaction to news or hype.

The market’s ongoing evolution—driven by technology, data, and the behavior of large pools of capital—demands adaptability. Yet, at its core, the discipline of trading remains constant: know your edge, manage your risk, and stay faithful to a process that emphasizes objective signals over subjective hope. Whether one’s focus is AI-driven leadership, cloud-enabled growth, or the ever-changing tides of momentum, the ability to interpret relative strength within the broader market context is a timeless skill. The Magnificent 7 will continue to be a focal point for investors and traders alike, not merely because of their size or fame, but because their performance offers insights into the health and direction of market cycles.

Conclusion

The tale of the Magnificent 7, tracing its lines back to the Nifty Fifty and beyond, is a story of leadership, momentum, and the psychology of money. It highlights how perception can drive capital as powerfully as fundamentals, how cycles eventually reassert balance, and how the best traders convert signals into disciplined actions. Relative strength emerges as a practical compass in this landscape, helping practitioners identify where capital is flowing and where risk is mounting. The market’s narrative is not a single thread but a complex weave of macro forces, company trajectories, and human behavior—one that rewards those who couple historical awareness with systematic analysis and robust risk controls. As technology redefines what is possible and as asset classes expand the spectrum of opportunities, the core principles endure: respect leadership, measure momentum, mitigate risk, and remain vigilant for the moment when the cycle suggests a shift. In this way, traders can navigate the evolving terrain with confidence, turning knowledge into practice and momentum into sustainable performance.